The European broaching tools market is further segmented into France, Germany, Russia, Italy, the UK, and the Rest of Europe. Europe is a diverse market with a group of more than 40 countries in it. In Europe, the automotive sector is crucial for the region’s prosperity. The region has significantly upgraded its industrial solutions and is labeled as Industry 4.0. To reinforce the competitiveness of its automotive industry and continue its global technological leadership, the European Commission is focusing on R&D funding. The region is the leading producer of passenger cars and several commercial vehicle manufacturers, such as Ford of Europe, Hyundai Motor Europe, Iveco, and Volkswagen exist in the region. In 2020, 16,921,311 units of commercial and passenger vehicles were produced in the region. Germany is one of the largest automotive markets in the region with the presence of well-known automobile manufacturers such as Daimler AG, BMW, VW, Opel, and Audi. Thus, the growing automobile production in Germany and other parts of Europe is driving the growth of broaching tools market. Escalating automotive production and growing manufacturing sector are the major factor driving the growth of the Europe broaching tools market

In case of COVID-19, France is the hardest-hit country by the outbreak in Europe, followed by Russia, the UK, and Italy. The outbreak has created significant disruptions in primary industries such as manufacturing, healthcare, energy & power, electronics & semiconductor, aerospace & defense, and construction. A significant decline in the growth of mentioned industrial activities is impacting the performance of the Europe broaching tools market. The reimplementation’s of containments measures such travel restrictions, trade bans, and workforce limitation at workplaces has impacted manufacturing, supply, and sales of various businesses, including industrial equipment such as broaching tools. Majority of European countries are expected to suffer an economic hit due to a lack of revenue from various industries. Due to business shutdown, travel bans, and supply chain disruption, the region is anticipated to face an economic slowdown in 2021 as well. European countries contribute a significant share to the broaching tools market owing to presence of huge automotive and aerospace & defense sectors. However, the supply chain disruptions have led to a decline in revenues of market players operating in the European region.

Strategic insights for the Europe Broaching Tools provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 34.77 Million |

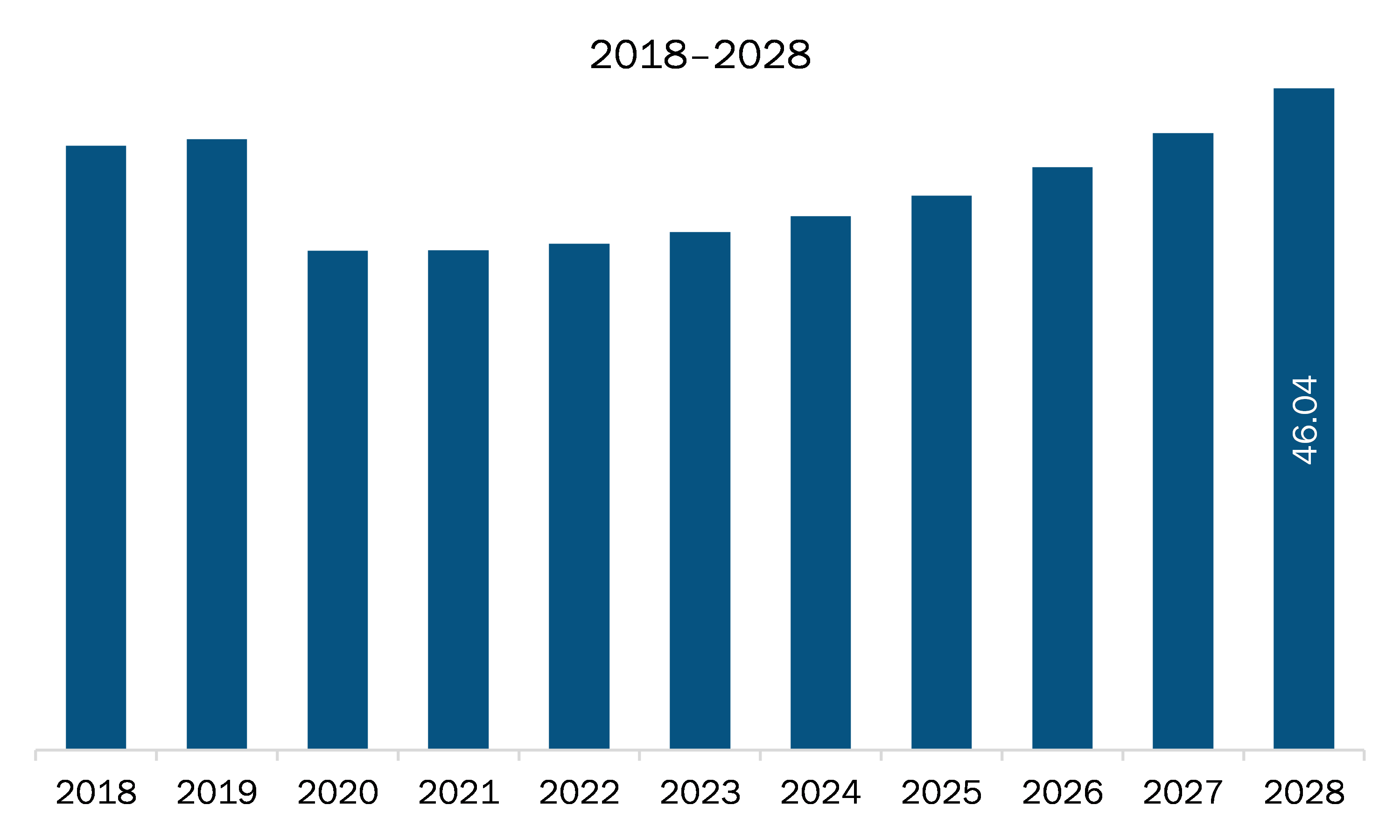

| Market Size by 2028 | US$ 46.04 Million |

| Global CAGR (2021 - 2028) | 4.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Broaching Tools refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe broaching tools market is expected to grow from US$ 34.77 million in 2021 to US$ 46.04 million by 2028; it is estimated to grow at a CAGR of 4.1% from 2021 to 2028. Advent of industrial automation is expected to fuel the Europe broaching tools market. Owing to the growing need for optimization of resources, manufacturers are exploring various options to streamline their manufacturing and distribution operations. Manufacturers are getting inclined toward the adoption of automation solutions for the optimization of business resources. Industrial automation uses various robots and advanced information technologies to carry out various manufacturing and distribution processes. High productivity, output quality, flexibility, information accuracy, and safety are among the major advantages of industrial automation. The rise of industrial automation coupled with the advent of new technologies such as computer numerical control (CNC), computer-aided manufacturing (CAM), automation using servo drive technology, and rapid prototyping is subsequently fueling the adoption of broaching tools. Also, with the increasing deployment of automation solution in the manufacturing sector, the adoption of broaching tools is projected to increase during the forecast period across Europe region.

In terms of type, the internal broaches segment accounted for the largest share of the Europe broaching tools market in 2020. In terms of end user, the automotive segment held a larger market share of the Europe broaching tools market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe broaching tools market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are American Broach & Machine Company; Arthur Klink Gmbh; Blohm Jung Gmbh; Ekin S. Coop; Messer Räumtechnik Gmbh & Co. KG; Mitsubishi Heavy Industries Machine Tool Co., Ltd.; and Nachi-Fujikoshi Corp

The Europe Broaching Tools Market is valued at US$ 34.77 Million in 2021, it is projected to reach US$ 46.04 Million by 2028.

As per our report Europe Broaching Tools Market, the market size is valued at US$ 34.77 Million in 2021, projecting it to reach US$ 46.04 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The Europe Broaching Tools Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Broaching Tools Market report:

The Europe Broaching Tools Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Broaching Tools Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Broaching Tools Market value chain can benefit from the information contained in a comprehensive market report.