The European continent has many emerging economies, including Germany, France, the UK, and Italy. 2019 showed promising results for tech investments in Europe, as European tech continues to break records despite the UK and European Union (EU) economic slowdowns. Over the past five years, capital invested in European technology has grown by 124%, with a 39% increase between 2018 and 2019 alone, reaching US$ 34.3 billion in capital investment for 2019. This compares with reductions in investment in both the US and Asian capital between 2018 and 2019. Western Europe is renowned for its improved living conditions, with higher income levels among residents. It is one of the continent's wealthiest regions, with more GDP per capita than the rest. The automotive sector supports the growth of the economy by assisting the supply chain that results in the creation of a diversified array of business opportunities and services. The automotive manufacturers have 304 vehicle assembly plants and production plants in 27 countries across Europe. In 2019, the production of 4,371,499 units of commercial and passenger vehicles was reported. Growing production of commercial and passenger vehicles is likely to surge the demand for integration of braking resistors. Also, high demand for braking resistor owing to inclination towards EVs is expected to create a significant demand for braking resistors in the coming years, which is further anticipated to drive the Europe braking resistors market.

Countries in Europe, especially Italy and Spain, are adversely affected by the COVID-19 pandemic. Russia is witnessing an economic hit due to a lack of revenue from various industries, as it recorded the highest number of confirmed cases across Europe. Other member states have implemented drastic measures and travel restrictions, and partially closed their borders to control the spread of the virus. Europe is one of the key regions for the growth of braking resistors market with the presence of many developed countries such as Germany, the UK, France, Italy, Norway, and Sweden. Oil & gas, energy & power, automotive, and manufacturing are among the significant industries that are heavily impacted due to the pandemic. The crisis is also disrupting the supply of electronic components. This scenario is hindering the growth of the Europe braking resistors market.

Strategic insights for the Europe Braking Resistors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

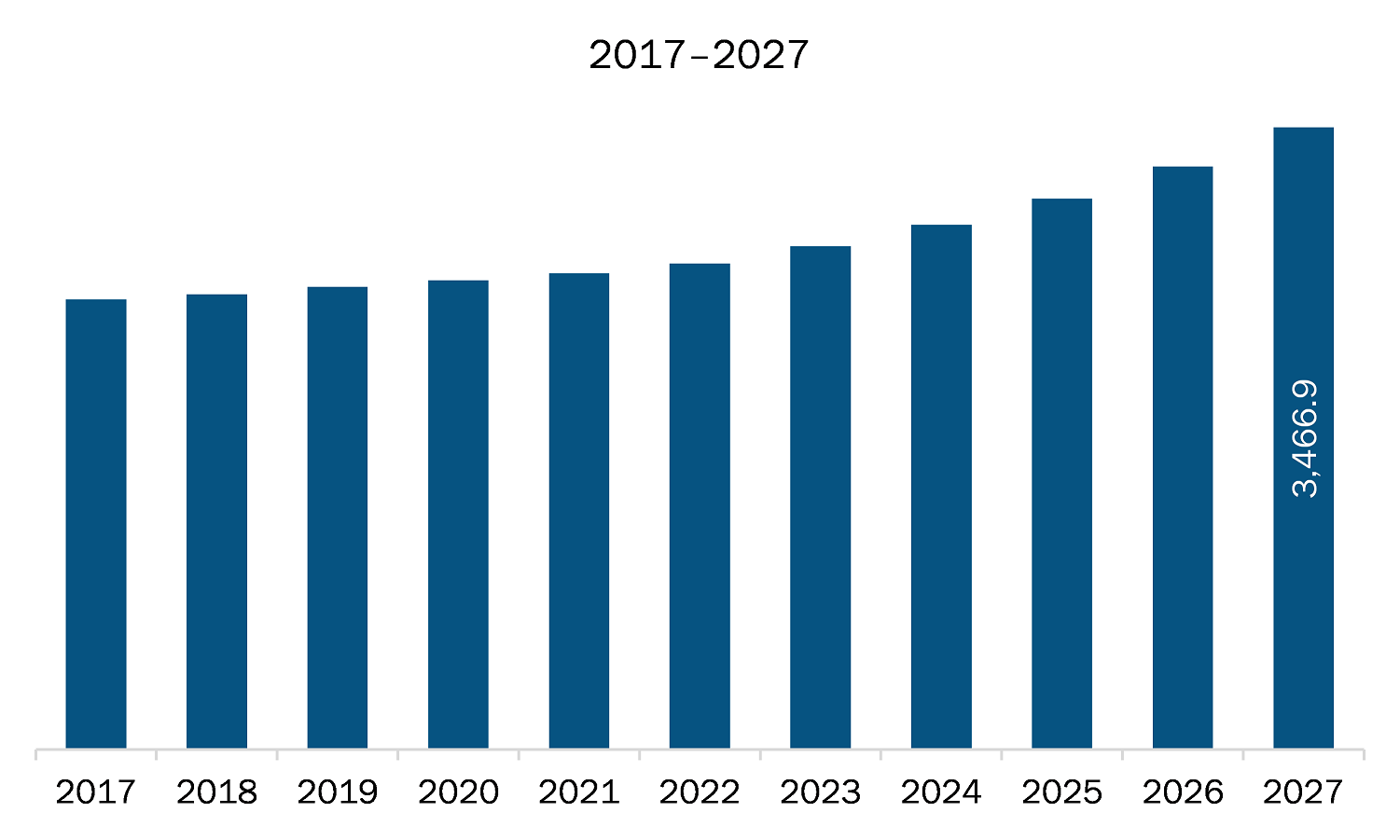

| Market size in 2019 | US$ 2,577.1 Million |

| Market Size by 2027 | US$ 3,466.9 Million |

| Global CAGR (2020 - 2027) | 4.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Resistor Element Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Braking Resistors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The braking resistors market in Europe is expected to grow from US$ 2,577.1 million in 2019 to US$ 3,466.9 million by 2027; it is estimated to grow at a CAGR of 4.1% from 2020 to 2027. The smart grid has become the most significant technological revolution in the past years. Compared to the conventional grid, the smart grid is an automated, technology-driven, highly integrated, and modernized grid due to such power electronics. The smart grid is expected to play a significant role in transforming the electrical networks and electricity generation during the forecast period. Smart grids facilitate the quicker restoration of electricity after power disturbances and help reduce management and operational costs of utilities; this ultimately lowers power costs for consumers. Moreover, various initiatives advancing the energy sector's technological landscape are also likely to drive market growth during the forecast period. With the constant augmentation in the penetration of renewable energy sources, high dynamic processes have to be resisted. Thus, to cope with these requirements, the integration of braking resistor-based out-of-step protection system for a smart-grid. A smart grid can reduce carbon footprints by integrating renewable energy sources, energy storage, and plug-in hybrid electric vehicles with the primary grid. Thus, the implementation of smart grids results in the increasing use of braking resistors, which in turn is propelling the growth of the Europe market.

In terms of resistor element type, the wire-wound segment accounted for the largest share of the Europe braking resistors market in 2019. Further, the automobile and railways segment held a substantial share of the Europe braking resistors market based on end user in 2019.

A few major primary and secondary sources referred to for preparing this report on the braking resistors market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ABB; CRESSALL RESISTORS LTD.; REO AG; Sandvik AB; Schneider Electric; Toshiba International Corporation; Vishay Intertechnology, Inc.; Yaskawa Electric Corporation.

The Europe Braking Resistors Market is valued at US$ 2,577.1 Million in 2019, it is projected to reach US$ 3,466.9 Million by 2027.

As per our report Europe Braking Resistors Market, the market size is valued at US$ 2,577.1 Million in 2019, projecting it to reach US$ 3,466.9 Million by 2027. This translates to a CAGR of approximately 4.1% during the forecast period.

The Europe Braking Resistors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Braking Resistors Market report:

The Europe Braking Resistors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Braking Resistors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Braking Resistors Market value chain can benefit from the information contained in a comprehensive market report.