Germany, France, Russia, the UK, and Italy are among the major countries in Europe. In Europe, NATO (North Atlantic Treaty Organization) members such as France are aiming to increase their defense spending as the US continually encourages NATO countries to upsurge military spending to 2.0% of GDP. From military aviation and soldier-worn technology to military ground vehicles and submarine-launched missile systems, the region is emphasizing on adopting solutions that are designed to ensure success in critical missions in the air, on land, and at sea. European countries are further strengthening their defense and military systems with advanced technologies to face uncertain challenges. Strong economic conditions increase in technological advancements in laser technologies, and numerous initiatives taken by the European governments to strengthen their weapon systems are the major factors propelling the market growth in the region. In the marine industry, the radar and laser system are installed in unmanned surface vehicles (USVs) for coastal water patrolling and obstacle detection. A USV, which travels along a pre-planned path, is usually adopted for perimeter surveillance. The USV manufacturers are positively integrating long range obstacle detection systems to detect any obstacle at a long-range distance and avoid collision. Rising demand for maritime security and water quality monitoring are the significant factors boosting the adoption of USVs in the region, which, in turn leads to increasing interest of numerous manufacturers toward investing in the border security systems.

Owing to the lockdown during the year 2020 because of COVID-19, several defense companies across Europe implemented a wide range of measures like halting or reducing production. The outbreak of the virus has distrusted the supply chain in various countries in this region. The member states of Europe such as Italy, Spain and Germany have implemented drastic measures and travel restrictions to limit the spread of coronavirus among its citizens. Moreover, the spread of COVID-19 at an alarming rate could shift governments’ priorities away from defense and towards healthcare and crisis contingency. For instance, there have already been announcements of spending cuts to EU programs. Most notably, the European Defense Fund (EDF) was originally set to receive US$ 16.32 billion for the next EU Multiannual Financial Network for 2021-27 which was cut to US$ 9.74 billion in May 2020. Thus, the spread of newly mutated strain of COVID-19 is anticipated to affect the Border Security market till first two quarters of 2021.

Strategic insights for the Europe Border Security provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

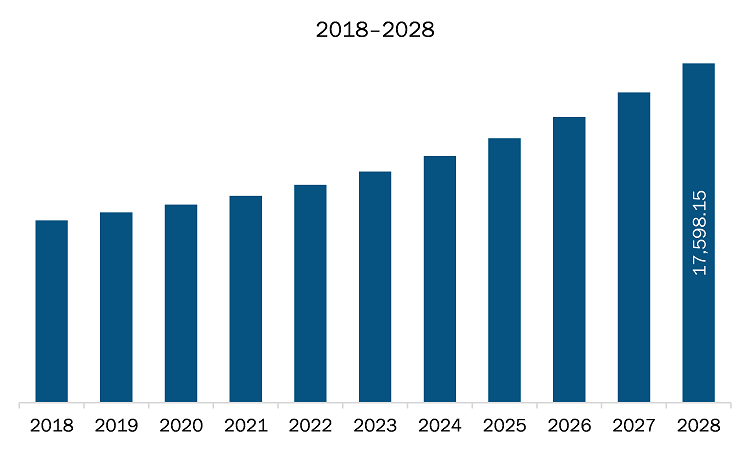

| Market size in 2021 | US$ 10721.69 Million |

| Market Size by 2028 | US$ 17598.15 Million |

| Global CAGR (2021 - 2028) | 7.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Environment

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Border Security refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The border security market in Europe is expected to grow from US$ 10721.69 million in 2021 to US$ 17598.15 million by 2028; it is estimated to grow at a CAGR of 7.3% from 2021 to 2028. Rising Adoption of intelligent surveillance system; The growing adoption of intelligent surveillance system (ISS) is gaining attention of the military forces, owing to the mounting demand for enhanced border security and safety. This system is capable of automatically analyzing the video, image, audio, or other type of surveillance data without or with restricted human intervention. The increasing developments of advanced electronic devices such as computer vision, sensor, artificial intelligence, and machine learning plays a significant role in empowering these intelligent systems. The intelligent surveillance system consists of probable sensor modalities and their fusion developments for designing advanced security system such as infrared camera, visible camera (CCTV), thermal camera and radar system. In intelligent surveillance system (ISSs), several technologies such as pattern recognition, computer vision, and artificial intelligence technologies integrated to detect abnormal behavior’s in audio, images, and videos. These systems represent the development of real-time behaviors-based intelligent surveillance systems and thus, trigger alarms to alert military forces about the potential threats. This is bolstering the growth of the border security market

In terms of environment type, the ground segment accounted for the largest share of the Europe border security market in 2020. In terms of system type, the unmanned vehicles segment held a larger market share of the border security market in 2020.

A few major primary and secondary sources referred to for preparing this report on the border security market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE Systems plc

The Europe Border Security Market is valued at US$ 10721.69 Million in 2021, it is projected to reach US$ 17598.15 Million by 2028.

As per our report Europe Border Security Market, the market size is valued at US$ 10721.69 Million in 2021, projecting it to reach US$ 17598.15 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The Europe Border Security Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Border Security Market report:

The Europe Border Security Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Border Security Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Border Security Market value chain can benefit from the information contained in a comprehensive market report.