Market Introduction

The Europe blood brain barrier technologies consists of Germany, UK, France, Italy, Spain, and the rest of Europe. In 2021, Germany held the largest share in the market. Germany is much ahead in terms of the healthcare industry. It has the presence of market leaders from across the world. Also, there are well-established players across the country that is contributing to the overall healthcare industry, including diagnostics and treatment of neurological diseases. The blood brain barrier technologies industry is a lucrative one in Germany which is driven by the factors such as the growing prevalence of neurological diseases such as meningitis, multiple sclerosis, Parkinson’s disease, and encephalitis. For instance, according to Globocan, in 2020, the number of new cases of brain, central nervous system cancer was 7697. Similarly, according to a data published in NCBI in 2017, the prevalence of brain associated aneurysm in Germany was around 11.3 per 100,000 persons in 2011. Additionally, in 2013, the prevalence reached to 22.1 per 100,000 persons. Such increasing prevalence of brain aneurysm is projected to drive the Germany brain aneurysm market during 2020-2027. In addition, according to Alzheimer Europe, in 2019, total 1585166 patients of Alzheimer were present in Germany and the overall numbers of people with dementia will rise from 1,585,166 in 2018 to 2,748,178 in 2050. Similarly, as a percentage of the overall population, people with dementia will represent 3.43% in 2050 compared to 1.91% in 2018.

The European economy is severely affected due to the exponential growth of COVID-19 cases in the region. Spain, Italy, Germany, France, and the UK are among the most affected European countries. In addition, new evidence has backed up a year-old theory that the Covid-19 infection causes neurological problems. This viewpoint initially developed in the summer of last year, during the pandemic's first wave. According to a preliminary (yet to be peer-reviewed) research by four Imperial College London academics, it is now considerably proven. Jiabin Tang, Shivani Patel, Steve Gentleman, and Paul M Matthew wrote the preprint, which indicates a "potential route" for the virus to enter the nervous system. The blood-brain barrier is a semi-permeable membrane of endothelial cells that protects the brain from the rest of the body. Monocytes, a kind of white blood cell, are activated as part of the body's defense mechanism when SARS-CoV-2 enters the bloodstream. To allow monocytes to cross the BBB, a complicated mechanism is activated. According to the article, "this facilitates the entry of infected and activated monocytes into the central nervous system, allowing the SARS-CoV-2 virus to pass through the loosened BBB.

Strategic insights for the Europe Blood Brain Barrier Technologies provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Blood Brain Barrier Technologies refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Blood Brain Barrier Technologies Strategic Insights

Europe Blood Brain Barrier Technologies Report Scope

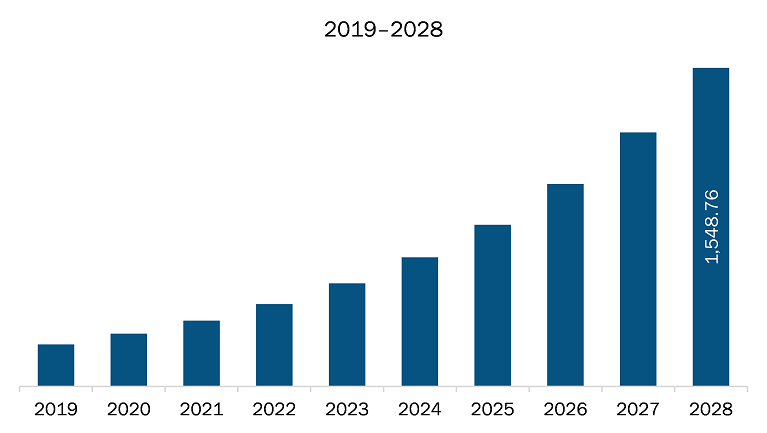

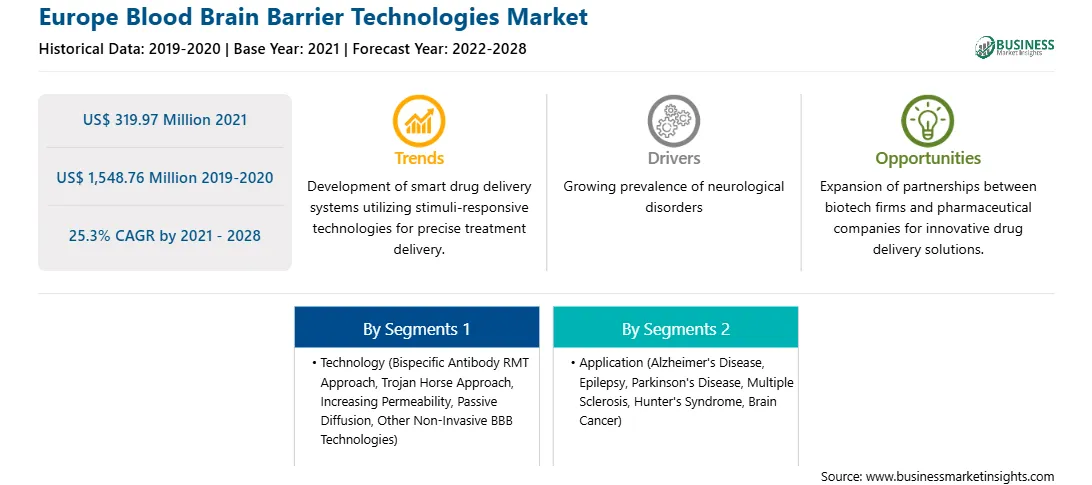

Report Attribute

Details

Market size in 2021

US$ 319.97 Million

Market Size by 2028

US$ 1,548.76 Million

Global CAGR (2021 - 2028)

25.3%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Technology

By Application

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Blood Brain Barrier Technologies Regional Insights

Market Overview and Dynamics

The blood brain barrier technologies market in Europe is expected to grow from US$ 319.97 million in 2021 to US$ 1,548.76 million by 2028; it is estimated to grow at a CAGR of 25.3% from 2021 to 2028. Nanomedicine is a rapidly developing field with nanoparticles or nanostructures for medical applications, particularly in the underdeveloped area of drug delivery to the brain. Great expectations are placed on the ability of multifunctional nanoparticles (NPs) to cross the blood-brain barrier. Recent advances in nanotechnology allow otherwise poorly distributed drugs in the brain to be packaged into nanoparticles with brain-targeting properties. These targeted carrier systems enhance the delivery of drugs by entrapping or encapsulating the drug in the particle with a targeting peptide/ligand on its surface that results in BBB targeting. These carrier systems cross the BBB using transcellular pathways such as receptor-mediated endocytosis. A significant advantage of solid lipid nanoparticles is that their high lipid solubility physically stabilizes the nanoparticles, which increases the carrying capacity of the drug and results in a controlled release rate of the drug. Although lipid-based nanoparticles and formulations have a prolonged systemic circulation time and increased tumor retention due to increased permeation and retention, their most important limiting factor is rapid clearance from the bloodstream through the reticuloendothelial system. Several groups are working to improve targeting to the brain by mounting nanoparticles with ligands, which are substrates for BBB uptake transporters, facilitating transit to the brain. As this technology advances, this system can effectively deliver a variety of therapeutic agents with a favorable toxicity profile. Thus, the use of nanoparticles for brain drug delivery is expected to be the trend during the forecast period

Key Market Segments

In terms of technology, the increasing permeability segment accounted for the largest share of the Europe blood brain barrier technologies market in 2021. In terms of application, the parkinson’s disease segment accounted for the largest share of the Europe blood brain barrier technologies market in 2021.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the blood brain barrier technologies market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Teva Pharmaceutical Industries Ltd.; F. Hoffmann-La Roche Ltd.; Eli Lilly and Company; Bristol-Myers Squibb Company; Pfizer, Inc.; Johnson & Johnson Services, Inc.; Fabre-Kramer Pharmaceuticals, Inc.; Abliva AB.; and Bioasis Technologies, Inc. among others.

Reasons to buy report

Europe Blood Brain Barrier Technologies Market Segmentation

Europe Blood Brain Barrier Technologies Market – By Technology

Europe Blood Brain Barrier Technologies Market – By

Application

Europe Blood Brain Barrier Technologies Market – By Country

Europe Blood Brain Barrier Technologies Market – Companies Mentioned

The Europe Blood Brain Barrier Technologies Market is valued at US$ 319.97 Million in 2021, it is projected to reach US$ 1,548.76 Million by 2028.

As per our report Europe Blood Brain Barrier Technologies Market, the market size is valued at US$ 319.97 Million in 2021, projecting it to reach US$ 1,548.76 Million by 2028. This translates to a CAGR of approximately 25.3% during the forecast period.

The Europe Blood Brain Barrier Technologies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Blood Brain Barrier Technologies Market report:

The Europe Blood Brain Barrier Technologies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Blood Brain Barrier Technologies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Blood Brain Barrier Technologies Market value chain can benefit from the information contained in a comprehensive market report.