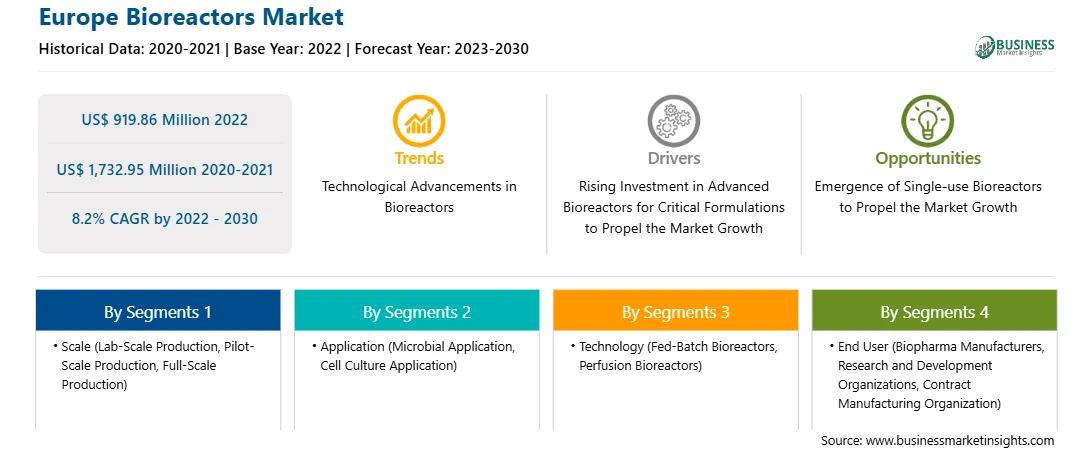

The Europe bioreactors market was valued at US$ 919.86 million in 2022 and is expected to reach US$ 1,732.95 million by 2030; it is estimated to grow at a CAGR of 8.2% from 2022 to 2030.

The transformation of the healthcare industry from one-size-fits-all to a targeted approach is expanding the demand for personalized medicine. Precision medicine is being considered as one of the most promising approaches to tackle diseases such as cancer, neurodegenerative diseases, and rare genetic conditions. Innovations in the production of personalized medicines are likely to impact the entire sector, and single-use technologies aimed at smaller-volume production have potential applications in protein bioproduction, particularly in downstream processes. Personalized and differentiated approaches to medicine are leading to a need for a wider range of products, many of them for a relatively small number of patients. A fundamentally different approach to the production and delivery of biological products may be required.

Precision medicine utilizes the genomic information of an individual to offer targeted treatment for a particular indication. The rising prevalence of a number of chronic diseases has increased the demand for biologics, drugs for orphan diseases, and personalized medicines. For instance, in 2019, the FDA approved 12 personalized medications to address the root causes of disease and further integrate precision medicine with clinical care.

In Germany, new product development, extensive research & development activities in pharmaceutical and biotechnology companies, and the growth of biologics and life sciences drive the market growth. In August 2023, Sartorius, one of the leading suppliers for the biopharmaceutical industry, collaborated with global technology and software leader Emerson to integrate Sartorius's Biostat STR Generation 3 family of bioreactors with Emerson's DeltaVTM distributed control system (DCS). The biotechnology sector in Germany exhibits tremendous growth owing to the presence of numerous biotechnology companies, high-tech research labs, and massive funding for research and development. Moreover, the cutting-edge and high-quality research in the country and the presence of an established market for bioreactors creates lucrative opportunities. The growth of research and development in biopharmaceuticals and biologics is majorly driven by the adoption of various organic strategies by companies in the healthcare industry. For instance, in June 2021, Rentschler Biopharma expanded its production capacity with a 2,000-liter bioreactor to address the increasing demand for complex antibodies, a class of biopharmaceutical drugs with continued high potential. The pharmaceutical sector in the country is growing due to increasing R&D expenditure by pharmaceutical companies. Thus, collaborative research efforts by pharmaceutical and biotechnology companies in the country influence the market.

Strategic insights for the Europe Bioreactors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 919.86 Million |

| Market Size by 2030 | US$ 1,732.95 Million |

| Global CAGR (2022 - 2030) | 8.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Scale

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Bioreactors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe bioreactors market is segmented based on scale, application, technology, end user, and country. Based on scale, the Europe bioreactors market is segmented into lab-scale production, pilot-scale production, and full-scale production. The pilot-scale production segment held the largest market share in 2022.

In terms of application, the Europe bioreactors market is categorized into microbial application, cell culture application, and others. The cell culture application segment held the largest market share in 2022.

By technology, the Europe bioreactors market is bifurcated into fed-batch bioreactors and perfusion bioreactors. The fed-batch bioreactors segment held a larger market share in 2022.

Based on end user, the Europe bioreactors market is categorized into biopharma manufacturers, research and development organizations, and contract manufacturing organization. The research and development organizations segment held the largest market share in 2022.

Based on country, the Europe bioreactors market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. Germany dominated the Europe bioreactors market share in 2022.

Applikon Biotechnology BV, bbi-biotech GmbH, Cellexus International Ltd, General Electric Co, Merck KGaA, Pall Corp, PBS Biotech Inc, Sartorius AG, Solaris Biotechnology SRL, and Thermo Fisher Scientific Inc are some of the leading players operating in the Europe bioreactors market.

The Europe Bioreactors Market is valued at US$ 919.86 Million in 2022, it is projected to reach US$ 1,732.95 Million by 2030.

As per our report Europe Bioreactors Market, the market size is valued at US$ 919.86 Million in 2022, projecting it to reach US$ 1,732.95 Million by 2030. This translates to a CAGR of approximately 8.2% during the forecast period.

The Europe Bioreactors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Bioreactors Market report:

The Europe Bioreactors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Bioreactors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Bioreactors Market value chain can benefit from the information contained in a comprehensive market report.