Bearings are a vital component of automotive parts and are commonly used in engines, generators, motors, wheels, gearboxes, transmission shafts, steering shafts, and steering gears, among others. Its load-carrying characteristics and ability to facilitate the transfer of torque improve the overall performance of rotating parts in an automotive system. The performance of bearings can be enhanced by the correct selection of bearing steel, technology, and lubrication while manufacturing, based on their specific applications. Carbon steel and stainless steel, among others, are widely used for the manufacturing of bearings. Moreover, manufacturers are utilizing new raw materials such as lightweight steel alloys to fulfill the demand for lightweight materials from automotive companies. The use of lightweight materials also allows them to keep up with the changing emission norms. According to a report published by the European Automobile Manufacturers’ Association (ACEA), global motor vehicle production rose by 1.3% from 2020 to 2021; a total of 79.1 million motor vehicles, including 61.6 million passenger cars, were produced across the world in 2021. According to a report by Germany Trade & Invest, Germany is a major automotive market in Europe, and the market in this country registered a foreign market revenue of US$ 289.0 billion (a 10% rise from 2020) from passenger car and light commercial vehicle original equipment manufacturers in 2021. Governments of a few other European countries, such as the Netherlands, have introduced incentives to stimulate the sale of electric automobiles. The International Energy Agency (IEA) estimates that 80% of the total cars sold in the world will be hybrid or electric cars by 2050. Therefore, the growing demand for bearings from the automotive industry, coupled with a rise in the sales of electric vehicles, drives the Europe bearing steel market.

According to the European Construction Industry Federation, in 2020, the European Union (EU) invested US$ 1.4 trillion in the construction industry, and the investment increased by 4.2% in 2021. Germany, France, the UK, Italy, and Spain were the major countries that accounted for more than 70% of the EU’s total investments in the construction of buildings and other structures. As a result, the utilization of bearing steel is increasing in excavators, loaders, dozers, dump trucks, graders, cranes, forklifts, and other bearing applications in the construction sector. Moreover, automotive is one of the major industries in Europe as it contributes significantly to the GDPs of many European countries, including Germany, Italy, and the UK. According to the report by European Commission, turnover generated by the automotive industry in Europe represents 7% of the region’s total GDP. As per a report by the International Energy Agency in 2022, 2.3 million electric vehicles were sold in Europe in 2021, a rise from 1.4 million in 2020. Thus, the surge in investments by governments of various countries in Europe and private companies in infrastructure building & construction projects is anticipated to fuel the Europe bearing steel market growth in Europe during the forecast period.

Strategic insights for the Europe Bearing Steel provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

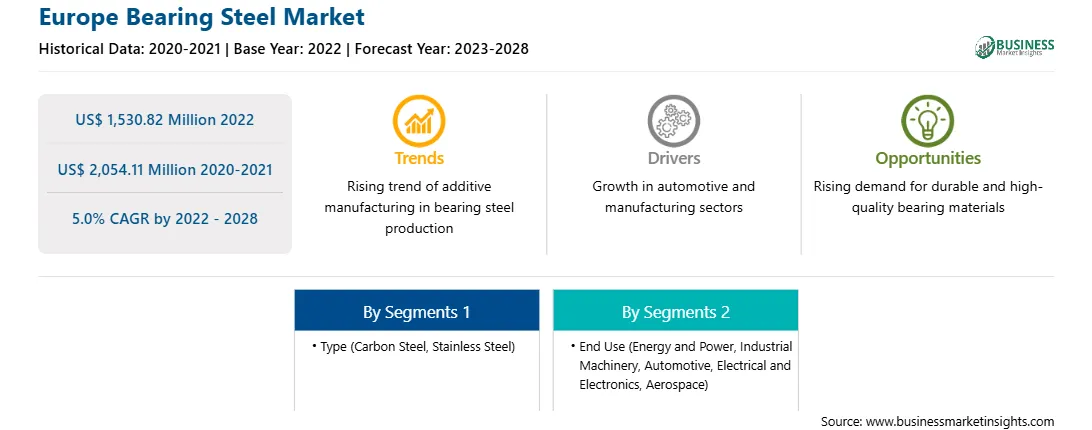

| Market size in 2022 | US$ 1,530.82 Million |

| Market Size by 2028 | US$ 2,054.11 Million |

| Global CAGR (2022 - 2028) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Bearing Steel refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe bearing steel market is segmented into type, end use, and country.

Based on type, the Europe bearing steel market is segmented into carbon steel, stainless steel, and others. In 2022, the carbon steel segment registered a largest share in the Europe bearing steel market.

Based on end use, the Europe bearing steel market is segmented into energy and power, industrial machinery, automotive, electrical and electronics, aerospace, and others. In 2022, the automotive segment registered a largest share in the Europe bearing steel market.

Based on country, the Europe bearing steel market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. In 2022, Russia segment registered a largest share in the Europe bearing steel market.

Baosteel Group Corp; Benxi Iron and Steel Group Co Ltd; Dongbei Special Steel Group Co Ltd; EZM Edelstahlzieherei Mark GmbH; Fushun Special Steel Co Ltd; HBIS Group Co Ltd; Kobe Steel Ltd; Ovako AB; Saarstahl AG; and Sanyo Special Steel Co Ltd are the leading companies operating in the Europe bearing steel market.

The Europe Bearing Steel Market is valued at US$ 1,530.82 Million in 2022, it is projected to reach US$ 2,054.11 Million by 2028.

As per our report Europe Bearing Steel Market, the market size is valued at US$ 1,530.82 Million in 2022, projecting it to reach US$ 2,054.11 Million by 2028. This translates to a CAGR of approximately 5.0% during the forecast period.

The Europe Bearing Steel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Bearing Steel Market report:

The Europe Bearing Steel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Bearing Steel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Bearing Steel Market value chain can benefit from the information contained in a comprehensive market report.