The mounting adoption of digital label printing solutions is expected to boost the European barcode software market growth during the forecast period. The barcode software products allow users to automatically scan the labels with the help of scanners, followed by collecting relevant details of the products at once. Besides, digital printing technology offers features such as real-time proofing, flexibility, improved color characteristics, and variable data printing. The demand for product variations and label customization has propelled the adoption of digital printing technology among leading vendors, thus boosting barcode software deployment. The retail, and transportation and logistics sectors are boosting, owing to the increased awareness about sustainability among consumers, as it has an excellent record of environmental and social performance. This distinguishes European manufacturers from low-cost competitors operating in regions others than the EU. Moreover, the rising demand for labeled and packaged food & beverages in Europe, and the increasing disposable income of consumers in the developing countries in the region are boosting the adoption of barcode software. Also, growing usage of barcodes in logistics & transportation and healthcare sectors is a major factor driving the Europe barcode software market.

Europe is another important region for the growth of barcode software market due to presence of many developed countries such as Germany, the UK, France, Italy, Norway, and Sweden, wherein industry spending on advanced and effective technology solutions is high. Manufacturing, healthcare, and retail are the key verticals in this region, which contribute significantly to the growth of the barcode software market in Europe. Currently, Russia, the UK, France, Italy, Germany, etc., are the major countries affected by the COVID-19 outbreak. To manage the outbreak, the governments in various European countries have imposed lockdowns and movement restrictions multiple times in the past 10 months. The recent second wave of COVID outbreak led to a month-long lockdown in several European countries, such as France and UK, Germany, Spain among others. Despite the negative impact of the COVID 19 outbreak on economies, the demand for barcode software solutions is minimally affected as many crucial businesses were operational. In fact, the pandemic has created new digitization opportunities to reduce human involvement in various processes in small and medium enterprises. To effectively manage the supply chain, enterprises are replacing outdated manual processes with automated data collection, mobile barcoding, and various mobile barcode apps.

Strategic insights for the Europe Barcode Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

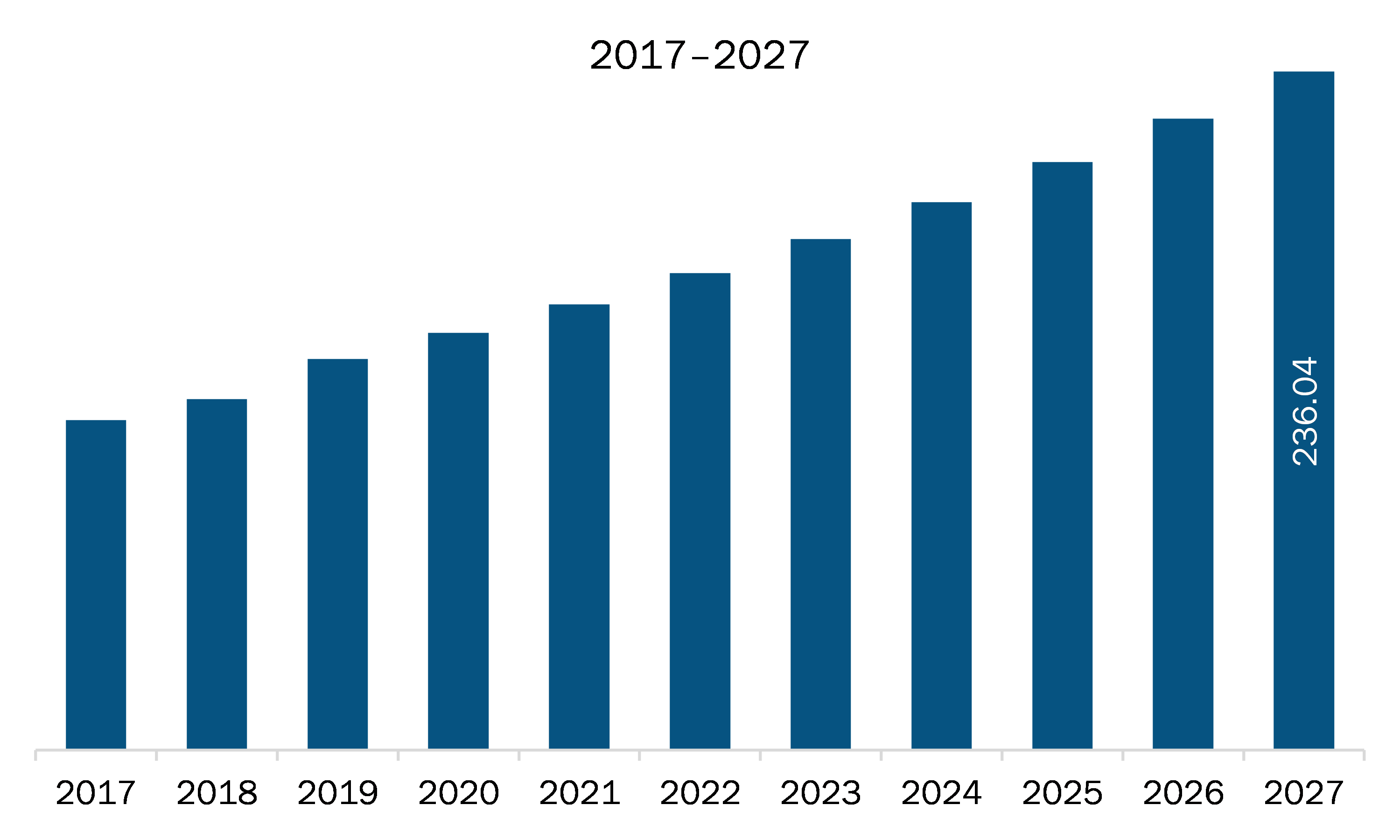

| Market size in 2019 | US$ 136.12 Million |

| Market Size by 2027 | US$ 236.04 Million |

| Global CAGR (2020 - 2027) | 7.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Barcode Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The barcode software market in Europe is expected to grow from US$ 136.12 million in 2019 to US$ 236.04 million by 2027; it is estimated to grow at a CAGR of 7.2% from 2020 to 2027. Various enterprises are offering software development kits (SDKs) that are highly efficient and advanced. The SDKs offered by the providers in the market helps in transforming smartphones, tablets and other wearable devices into enterprise-grade scanners. A few of the common capability features of such SDKs include barcode scanning, augmented reality, text recognition, and ID scanning. For instance, Scandit offers SDKs on native mobile apps, featuring capabilities such as high-performance barcode scanning, text recognition, and augmented reality (AR). It provides accurate barcode scanning software that supports ~20,000 mobile device types and all key barcode types. Since the processing happens on the device rather than on cloud, it increases the overall speed and data security. Similarly, Zebra Technologies Corporation offers Scanner SDKs that help in easy creation of fully featured application. The SDKs offered by these vendors’ capture and optimized images and control the entire process of data collection. SDKs are compatible with all type of operating system (OS), including Windows, iOS, Android, and Linux.

The Europe barcode software market is segmented based on application and end-user. Based on application, the market is segmented into asset management, package tracking, employee attendance and time tracking, and others. The asset management segment accounted for the largest revenue share in 2019. Based on end-user, the market is segmented into manufacturing, transportation and logistics, retail, healthcare, and others. The manufacturing segment accounted for the largest revenue share in 2019.

A few major primary and secondary sources referred to for preparing this report on the barcode software market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bluebird Inc., CVISION Technologies, Datalogic S.P.A., DENSO ADC, Honeywell International, Inc., NCR Corporation, and Zebra Technologies Corporation.

The Europe Barcode Software Market is valued at US$ 136.12 Million in 2019, it is projected to reach US$ 236.04 Million by 2027.

As per our report Europe Barcode Software Market, the market size is valued at US$ 136.12 Million in 2019, projecting it to reach US$ 236.04 Million by 2027. This translates to a CAGR of approximately 7.2% during the forecast period.

The Europe Barcode Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Barcode Software Market report:

The Europe Barcode Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Barcode Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Barcode Software Market value chain can benefit from the information contained in a comprehensive market report.