Unmanned aerial vehicles (UAV) have been designed and developed for military and civilian applications. . At present, the defense industry is considered a prime market for UAVs and is expected to be a major industry for the adoption of UAVs in coming days. These vehicles are widely used for fighter combat, surveillance, aircraft carrier operations, stealth missions, and military communications applications. The drone technology is interdisciplinary with the integration of aerospace structures, telemetry, electronics, and other components. The production of UAVs requires a substantial number of electronic components for data recording and transmission applications, and also for avionic functions. Similarly, the adoption of automated guided vehicle (AGVs) across warehouses to automate the overall operation and reduce the manpower is boosting the integration of autonomous navigation. Moreover, marine sector in Europe is also investing robustly for procuring unmanned underwater vehicles (UUV), which is used for seafloor mapping, digital cameras, ultrasonic imaging, bathymetry, and magnetic sensors. All these factors are anticipated to propel the adoption of autonomous navigation technology across military, transportation & logistics, and marine sector. These factors are further anticipated to drive the Europe autonomous navigation market.

The ongoing COVID-19 pandemic has severely impact the European countries. Spain, Italy, Germany, the UK, and France are among the worst-affected member states in Europe. Businesses in the region are facing severe financial difficulties as they either had to suspend their operations or reduce their activities in a substantial manner. Due to business lockdowns, travel bans, and supply chain disruptions, the region has seen an economic slowdown in 2020 and is most likely to witness in 2021. The entire region is heavily hit by the COVID-19 outbreak, which has resulted in temporary closure of tech giants and many industrial sectors. This closure has obstructed the investment decision of several companies on different software. The region is a major manufacturing and industrial hub for various industries such as machinery equipment, manufacturing, and logistics. However, due to business lockdowns, travel bans, and supply chain disruptions, the region has witnessed decline in activities in aforementioned industries, resulting in lesser development of autonomous technologies and systems.

Strategic insights for the Europe Autonomous Navigation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

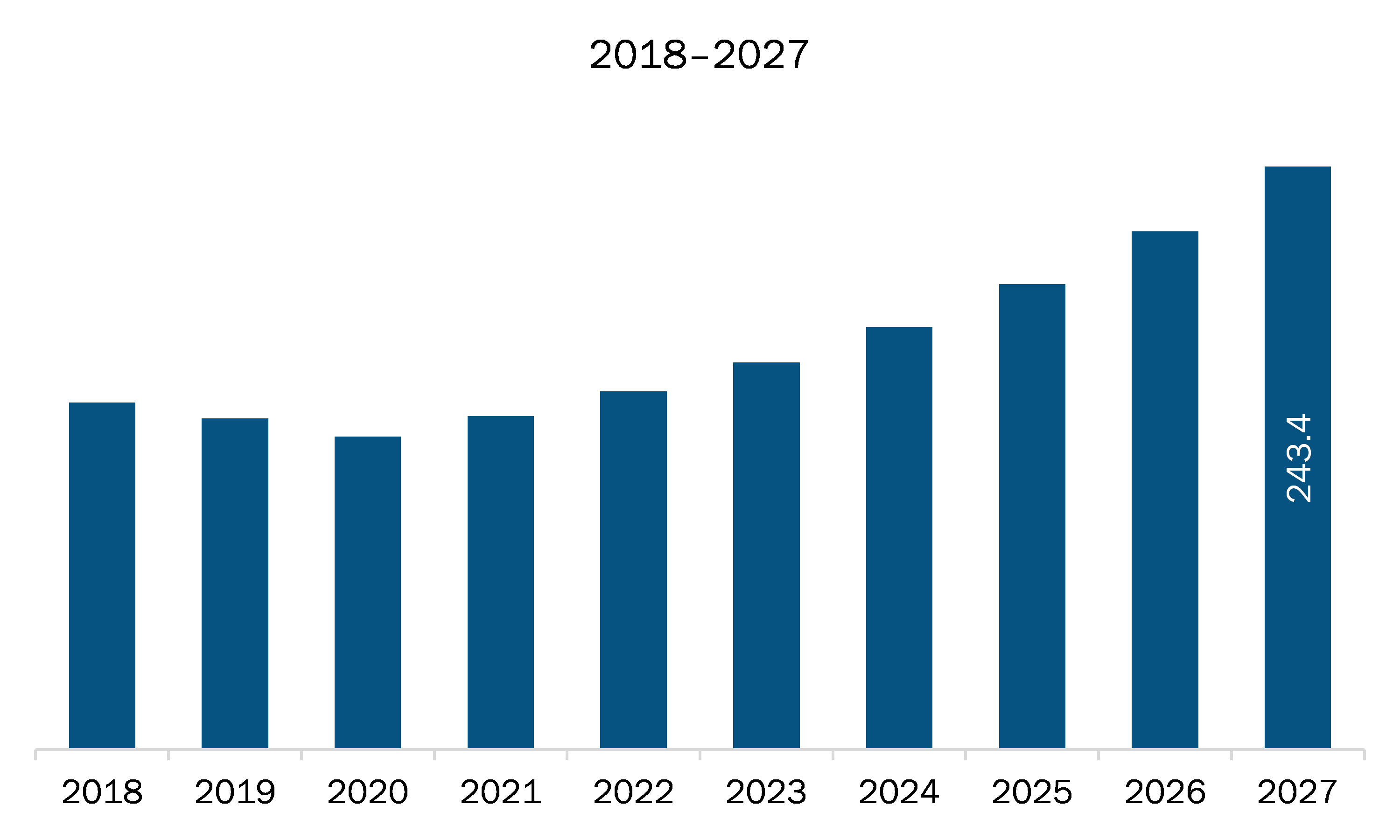

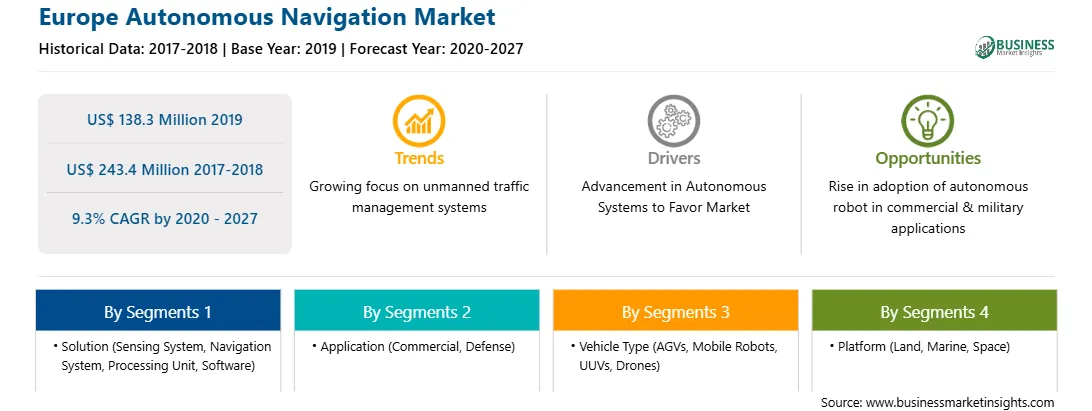

| Market size in 2019 | US$ 138.3 Million |

| Market Size by 2027 | US$ 243.4 Million |

| Global CAGR (2020 - 2027) | 9.3% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Autonomous Navigation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The autonomous navigation market in Europe is expected to grow from US$ 138.3 million in 2019 to US$ 243.4 million by 2027; it is estimated to grow at a CAGR of 9.3% from 2020 to 2027. In the new era of fueling technologies, the emergence of big data would prove to be a game-changer for shipping, logistics, military, and other end users of autonomous navigation. The scope of autonomous systems, such as self-driving cars and drones, is anticipated to positively impact individuals' daily lives. Assured navigation is anticipated to be a key enabler for emerging applications of autonomous systems such as cars and drones. Various initiatives have been taken to develop assured AI-based navigation solution for UAVs that enables reliable operation in safety-critical missions in case satellite navigation such as GNSS and GPS are not available. Moreover, autonomous navigation systems offer resilience during pandemics and disasters.

In terms of solution, the sensing system segment accounted for the largest share of the Europe autonomous navigation market in 2019. In terms of application, the commercial segment held a larger market share of the Europe autonomous navigation market in 2019. Further, AGVs segment held a larger share of the market based on vehicle type in 2019. Also, on the basis of platform, land segment held largest market share in 2019.

A few major primary and secondary sources referred to for preparing this report on the autonomous navigation market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BlueBotics SA; Brain Corporation; Collins Aerospace, a Raytheon Technologies Corporation Company; FURUNO ELECTRIC CO., LTD.; KINEXON; Kollmorgen; KONGSBERG; Trimble Inc.

Some of the leading companies are:

The Europe Autonomous Navigation Market is valued at US$ 138.3 Million in 2019, it is projected to reach US$ 243.4 Million by 2027.

As per our report Europe Autonomous Navigation Market, the market size is valued at US$ 138.3 Million in 2019, projecting it to reach US$ 243.4 Million by 2027. This translates to a CAGR of approximately 9.3% during the forecast period.

The Europe Autonomous Navigation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Autonomous Navigation Market report:

The Europe Autonomous Navigation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Autonomous Navigation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Autonomous Navigation Market value chain can benefit from the information contained in a comprehensive market report.