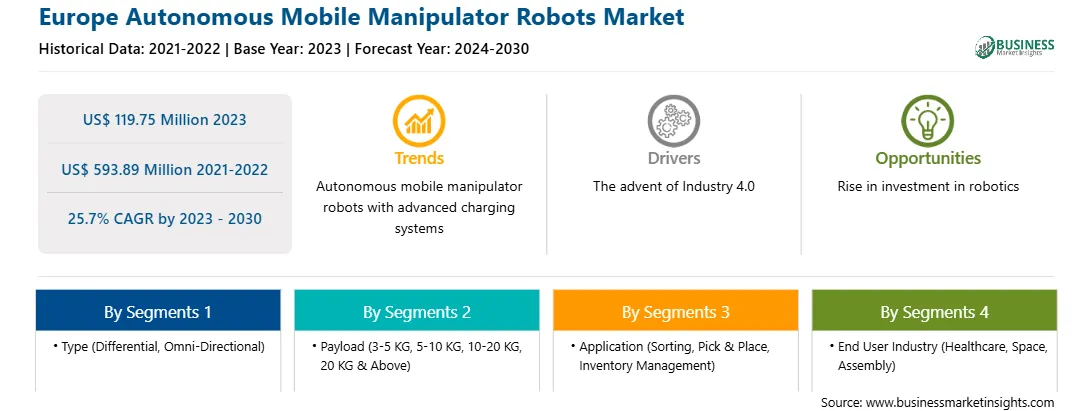

Industry 4.0 is transforming the way companies manufacture, process and distribute their products. They are incorporating new technologies such as the Internet of Things (IoT), robotics, analytics, AI, and machine learning into their facilities to boost operational and production efficiency. Factory automation plays a crucial role in automating the manufacturing process to increase the production output in minimal time and reduce labor costs. In addition, it helps to improve the quality of the products by minimizing the risk of human error These factors are leading to a rise in the adoption of factory automation in several industries such as healthcare, automotive, and aerospace. Thus, to cater to the growing demand for automation, the market players are launching new solutions. For instance, in April 2023, Comau S.p.A., an Italy-based company, developed a mobile manipulator mounted on an autonomous mobile platform. This system was built for three different European Union (EU) projects. DIMOFAC, the first project that was an initiative to help factories implement a smart factory architecture in Europe, where the system can be used for the pick-and-place operation and other warehouse automation tasks. PeneloPe project was the second project in the region, where the mobile manipulator will be used for glue dispensing and quality inspection in the public transport domain. The third application of the system is for the ODIN project; it supports the management of mechanical parts in automotive applications. Therefore, the growing demand for automation in various industries is propelling the Europe autonomous mobile manipulator robots market growth.

The Europe autonomous mobile manipulator robots market is further segmented into Germany, France, Italy, the UK, Russia, Sweden, Belgium, the Netherlands, and the Rest of Europe. Western European countries are more advanced than the NORDIC and other East European countries. Therefore, there are more developments and advancements in the field of automation in the western part of Europe. The NORDIC countries of Europe consist of many Small and Medium Enterprises (SMEs) that do not demand much for automated storage warehouses. However, economically strong countries such as Germany, Italy, the UK, and Spain have witnessed significant growth in implementing automation solutions. The pharmaceutical, e-commerce, healthcare, automobile, and food & beverage processing industries are among the biggest end-users of AMMR solutions. Technological advancements in autonomous mobile manipulator robots (AMMR) will boost market growth during the forecast period as the industry players are rapidly expanding their reach to increase revenue generation. KUKA AG signed a deal with German car manufacturer Daimler automotive group in April 2021. The order by Daimler encompasses four-figure robots, linear units, and other products such as controllers and software. Therefore, strategic business partnerships for AMMR solutions propel the Europe autonomous mobile manipulator robots market growth.

Strategic insights for the Europe Autonomous Mobile Manipulator Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Autonomous Mobile Manipulator Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Autonomous Mobile Manipulator Robots Strategic Insights

Europe Autonomous Mobile Manipulator Robots Report Scope

Report Attribute

Details

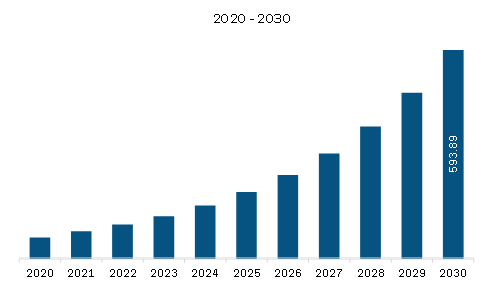

Market size in 2023

US$ 119.75 Million

Market Size by 2030

US$ 593.89 Million

Global CAGR (2023 - 2030)

25.7%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Type

By Payload

By Application

By End User Industry

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Autonomous Mobile Manipulator Robots Regional Insights

Europe Autonomous Mobile Manipulator Robots Market Segmentation

The Europe autonomous mobile manipulator robots market is segmented into type, payload, application, end user industry, and country.

Based on type, the Europe autonomous mobile manipulator robots market is bifurcated into differential and omni-directional. In 2023, the differential segment registered a larger share in the Europe autonomous mobile manipulator robots market.

Based on payload, the Europe autonomous mobile manipulator robots market is segmented into -5 kg, 5-10 kg, 10-20 kg, and 20 kg & Above. In 2023, the 10-20 kg segment registered the largest share in the Europe autonomous mobile manipulator robots market.

Based on application, the Europe autonomous mobile manipulator robots market is segmented into sorting, pick & place, inventory management, and others. In 2023, the pick & place segment registered the largest share in the Europe autonomous mobile manipulator robots market.

Based on end user industry, the Europe autonomous mobile manipulator robots market is segmented into healthcare, space, assembly, and others. In 2023, the others segment registered the largest share in the Europe autonomous mobile manipulator robots market.

Based on country, the Europe autonomous mobile manipulator robots market is segmented into France, Germany, the UK, Italy, Russia, Sweden, Belgium, the Netherlands, and the Rest of Europe. In 2023, Germany segment registered the largest share in the Europe autonomous mobile manipulator robots market.

Boston Dynamics Inc, Enabled Robotics ApS, Hans Laser Technology Co Ltd, JAG Jakob AG, Kuka AG, Neobotix GmbH, OMRON Corp, PAL Robotics SL, and Robotnik Automation SL are some of the leading companies operating in the Europe autonomous mobile manipulator robots market.

The Europe Autonomous Mobile Manipulator Robots Market is valued at US$ 119.75 Million in 2023, it is projected to reach US$ 593.89 Million by 2030.

As per our report Europe Autonomous Mobile Manipulator Robots Market, the market size is valued at US$ 119.75 Million in 2023, projecting it to reach US$ 593.89 Million by 2030. This translates to a CAGR of approximately 25.7% during the forecast period.

The Europe Autonomous Mobile Manipulator Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Autonomous Mobile Manipulator Robots Market report:

The Europe Autonomous Mobile Manipulator Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Autonomous Mobile Manipulator Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Autonomous Mobile Manipulator Robots Market value chain can benefit from the information contained in a comprehensive market report.