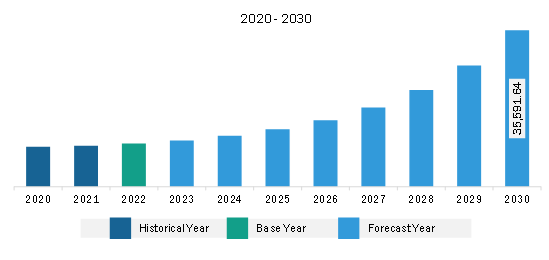

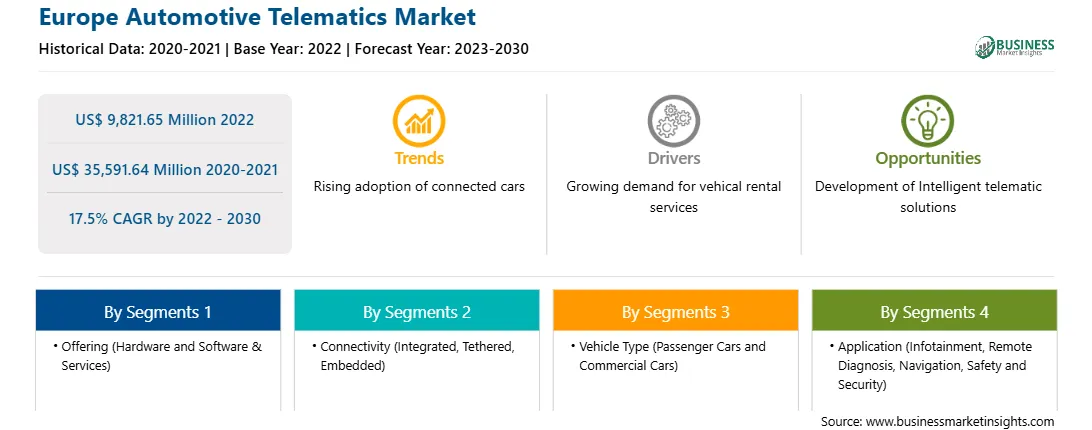

The Europe automotive telematics market was valued at US$ 9,821.65 million in 2022 and is expected to reach US$ 35,591.64 million by 2030; it is estimated to register a CAGR of 17.5% from 2022 to 2030.

Increasing Adoption of Intelligent Telematic Solutions Drives Europe Automotive Telematics Market

Intelligent telematics gateways are the next-generation neural processing chips with AI integration that help track vehicle locations in real-time. This chip tracks and communicates with the fleet owners and offers data processing and storage solutions. Several key players in the market are developing and launching intelligent telematics gateway solutions in order to meet the growing demand for connected vehicles. For instance,

According to The Insight Partners, the IoT-based intelligent telematics gateways market was valued at ~US$ 509 million in 2022 and is growing rapidly. Increasing AI and IoT technologies have surged the demand for intelligent automotive telematics gateway products. The intelligent telematics gateway products include Eurotech's DynaGATE 10-14, released in 2022. It is a 5G embedded telematics gateway with integrated AI, processing IP, and video feeds from vehicle cameras.

The rise in AI in the transition to intelligent telematics gateways and 5G technologies is expected to create ample opportunity for the growth of the Europe automotive . These gateways are embedded with advanced, powerful processors, such as multi-core CPUs, and can handle high volumes of data using AI.

AI and Intelligent telematics gateway integration offers the following benefits to fleet managers and commercial vehicle owners:

Europe Automotive Telematics Market Overview

The European Automobile Manufacturers' Association, or ACEA, stated that vehicle production in Europe was 16.24 million units in 2022. According to the same organization, more than 10.9 million passenger cars were produced across the European Union in 2022, an increase of 8.3% compared to 2021. The Europe automotive industry accounted for ~20% of global production in 2022. The adoption of connected vehicles is gaining momentum across the region. The connected vehicles comprise automotive telematics systems such as software, hardware, and other solutions. The adoption is driven by consumer preferences, regulatory measures and safety standards, and an increase in implementation of advanced driver assistance systems (ADAS) and vehicle-to-everything (V2X) communication. European governments are actively supporting the deployment of connected vehicles to enhance road safety and reduce emissions. Cooperative Intelligent Transport Systems (C-ITS) is one of the EU's connected vehicle projects. Successful implementation of this system will enable information exchange between vehicles and the road infrastructure. The C-ROADS Platform, which enables the uniform deployment of C-ITS operations throughout Europe, is being developed in close collaboration with road authorities and operators. Many notable European countries, such as Germany, Spain, France, and the UK, are investing heavily to develop suitable infrastructure for connected mobility. For instance, Spain is building its first intelligent highways. In this project, Kapsch TrafficCom's technology and software will enable the digitalization of a 60-kilometer section of the A8 motorway near Bilbao by 2024. Hence, increasing adoption of connected vehicles and rising automotive production across European countries drive the Europe automotive telematics market.

Europe Automotive Telematics Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Europe Automotive Telematics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 9,821.65 Million |

| Market Size by 2030 | US$ 35,591.64 Million |

| Global CAGR (2022 - 2030) | 17.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Automotive Telematics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Verizon Communications Inc

2. Geotab Inc.

3. Omnitracs LLC

4. Samsara Inc

5. ORBCOMM Inc

6. Trimble Inc

7. Valeo SE

8. TomTom NV

9. Denso Corp

10. Luxoft Switzerland AG

11. Harman International Industries Inc

The Europe Automotive Telematics Market is valued at US$ 9,821.65 Million in 2022, it is projected to reach US$ 35,591.64 Million by 2030.

As per our report Europe Automotive Telematics Market, the market size is valued at US$ 9,821.65 Million in 2022, projecting it to reach US$ 35,591.64 Million by 2030. This translates to a CAGR of approximately 17.5% during the forecast period.

The Europe Automotive Telematics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Automotive Telematics Market report:

The Europe Automotive Telematics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Automotive Telematics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Automotive Telematics Market value chain can benefit from the information contained in a comprehensive market report.