Germany, France, the UK, and Italy are among the key countries contributing to the European automotive radar market growth. In 2019, the region witnessed promising results of tech investments despite the economic slowdowns in the UK and EU. Over the past 5 years, capital investments in the European technology sector has grown by 124%, with a 39% increase in 2018–2019 alone; in 2019, the investments reached US$ 34.3 billion. Western Europe is characterized by the high standards of living, and it is one of the richest regions on the continent. The automotive manufacturers have 304 vehicle assembly plants and production plants in 27 countries in Europe. In 2019, more than 3 million units of commercial and passenger vehicles were produced at these sites. Thus, the growing production of commercial and passenger vehicles is boosting the demand for radar systems. A disciplined approach by EU through the reinforcement of measures for halving the total road accidents and deaths is another factor escalating the adoption of automotive radar systems in the region. Short-range radar systems are being extensively used in luxury cars that are on road in the region. Additionally, the EU is now promoting 76–79 GHz radar frequency, thereby creating extended growth opportunities for OEM manufacturers. As per spectrum regulations and standards developed by the ETSI and the FCC, c the UWB band of 24 GHz frequency range would be phased out of Europe by the beginning of 2022. Also, rising demand of passenger cars is going to bolster the demand for automotive radar in the coming years, which is further anticipated to drive the Europe automotive radar market.

Europe has been severely affected by the ongoing COVID-19 outbreak. Spain, Italy, Germany, the UK, and France are some of the worst affected member states in the European region. Businesses in the region are facing severe economic difficulties as they had to either suspend their operations or reduce their activities in a substantial manner. Owing to business shutdown, the region is anticipated to face an economic slowdown in 2020 and most likely in 2021 as well. Air business is one of the important businesses in the European countries, and the outbreak of COVID-19 across the region has paralyzed the entire business. The European region witnessed a varying pandemic impact across its economically diverse countries following the COVID-19 virus outbreak. For instance, countries such as Germany, UK, Netherlands, France, and selected other developed countries imposed stringent government restrictions and closed their borders to curb the virus spread hence plummeting the demand as well as the availability of various automotive components, including radar systems. Whereas, selected other countries such as Italy, Russia, and Spain witnessed a significant surge in cases, which notably impacted the demand for passenger vehicle sales during the April and July period. However, numerous European countries did recover swiftly in recent months. They witnessed a reliable surge in demand for automotive sales and its associated components among the OEMs and aftermarket sales. Further, countries in the region, including Germany, UK, France, and Belgium, have witnessed a second wave of the virus and have announced lockdown for the second time in November 2020. The situation amid the COVID-19 pandemic is extraordinary, which is anticipated to hamper the growth of the market.

Strategic insights for the Europe Automotive Radar provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

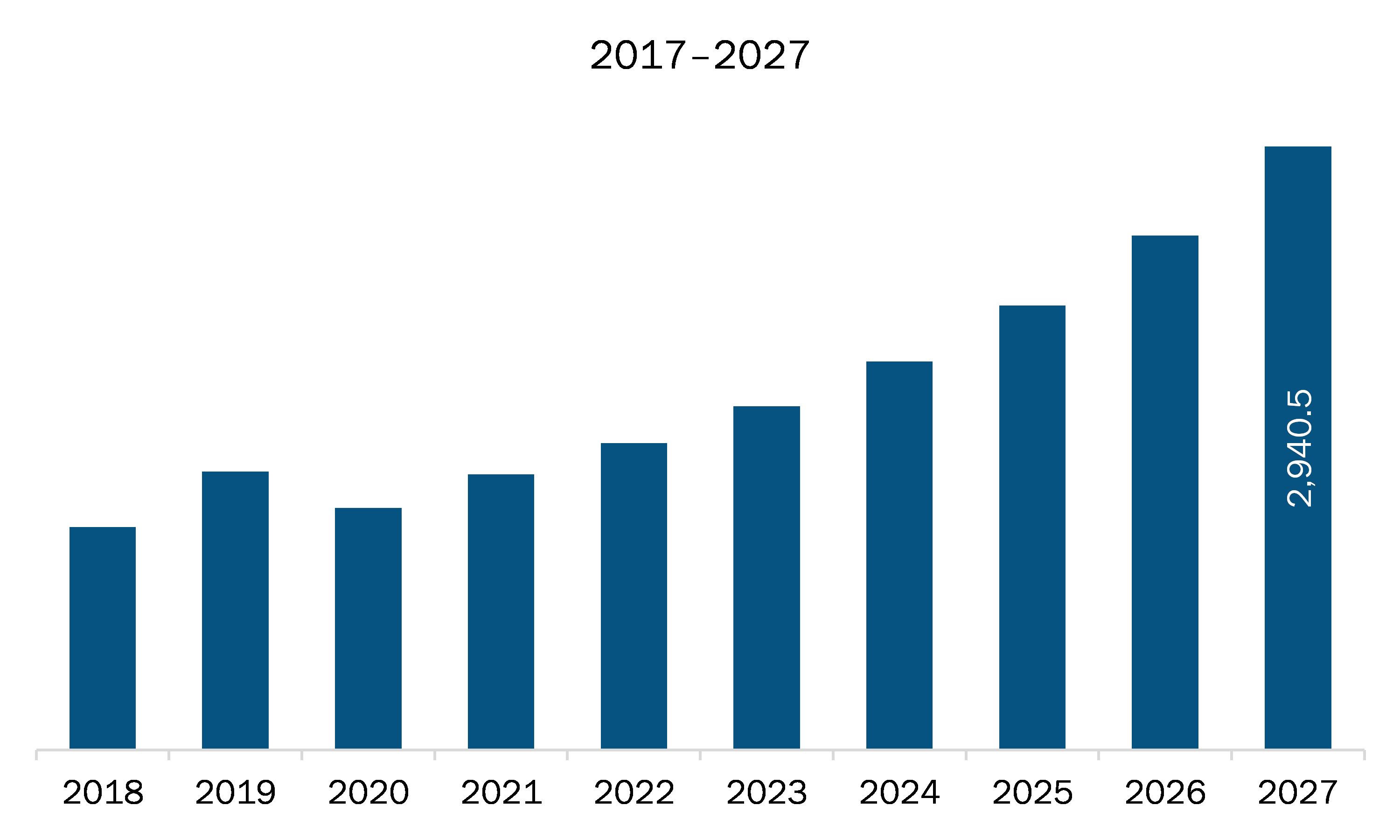

| Market size in 2019 | US$ 1,355.8 Million |

| Market Size by 2027 | US$ 2,940.5 Million |

| Global CAGR (2020 - 2027) | 14.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Range

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Automotive Radar refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The automotive radar market in Europe is expected to grow from US$ 1,355.8 million in 2019 to US$ 2,940.5 million by 2027; it is estimated to grow at a CAGR of 14.0% from 2020 to 2027. The radar technology is used in automobiles to operate and enable various ADAS functions. There is a significant shift toward smaller node complementary metal-oxide semiconductor (CMOS) or silicon-on-insulator (SOI) chips, which enable higher monolithic functions. The operational frequency of the radar technology is increasing with enhanced velocity and angular resolution. Moreover, the range resolution of the technology is increasing with the improvement in its overall bandwidth. There are number of startups that are in the forefront of some of these trends. For instance, Arbe, an Israel-based company, has designed its own chip and developed its own algorithm for radar signal processing. Furthermore, Uhnder Inc., US, has collaborated with Magna International for the supply of its high-resolution radar systems to a wider clientele.

Based on range, the short range radar segment is expected to lead the market throughout the forecast period. By frequency, 24 GHz is expected to dominate the market in 2019; however, the 77 GHz is anticipated to attain the highest market share by frequency by 2027. By Application, the adaptive cruise control segment is anticipated to dominate the market by 2027. The passenger cars segment is expected to hold over 70% of the market share based on vehicle type from 2019 to 2027.

A few major primary and secondary sources referred to for preparing this report on the automotive radar market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Europe automotive radar market. Aptiv Plc; Continental AG; Denso Corporation; HELLA KGaA Hueck & Co.; Nidec Corporation; Robert Bosch GmbH; Valeo; Veoneer Inc; ZF Friedrichshafen AG.

The Europe Automotive Radar Market is valued at US$ 1,355.8 Million in 2019, it is projected to reach US$ 2,940.5 Million by 2027.

As per our report Europe Automotive Radar Market, the market size is valued at US$ 1,355.8 Million in 2019, projecting it to reach US$ 2,940.5 Million by 2027. This translates to a CAGR of approximately 14.0% during the forecast period.

The Europe Automotive Radar Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Automotive Radar Market report:

The Europe Automotive Radar Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Automotive Radar Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Automotive Radar Market value chain can benefit from the information contained in a comprehensive market report.