Europe comprises economies such as Germany, France, the UK, and Italy. The western part of Europe is characterized for its high standards of living, with high GDP. The automotive industry, directly and indirectly, contributed ~7% to the GDP of the region. The automotive sector supports the growth of the economy by assisting the supply chain that results in the creation of a diversified array of business opportunities and services. Europe comprises major automotive manufacturing assembly and production plants. There are ~298 vehicle assembly plants across Europe. According to OICA in 2019 and 2020, the production of commercial and passenger vehicles was 4,371,499 and 3,581,851 units, respectively. Requirement of lightweight piston to improve performance is the major factor driving the growth of the Europe automotive piston market.

With the outbreak of COVID-19, the production and sales of motor vehicles came to a sudden halt in most of Europe. In April 2020, European markets witnessed the lowest new car registrations. Collapse of the demand side severely impacted the EU automotive sector, had put the economy in deep crisis and reduced international trade. The automotive sector plays an important role in economic growth and employment in many of the European countries which was strongly impacted by supply chain disruptions, and technological challenges. Automotive Production in Europe fell 21%, with UK, Spain and Germany witnessing the major declines ranging from 11% to almost 40%. Europe as a whole represented an almost 22% share of the global production in 2020. Players such as Volkswagen generated reduced production due to the disruption caused by the Covid pandemic. The supply shortage of certain raw materials and piston components also affected the regional production. The government is lifting restrictions in different parts of the regions which is anticipated to rebound the motor vehicle manufacturing industry in Europe. According to the European Automobile Manufacturers’ Association (ACEA), the automotive sales in Europe are anticipated to rise by about 10% in 2021 compared to 2020. Progress in vaccination programs and support measures to stimulate demand will help the market to recover.

Strategic insights for the Europe Automotive Piston provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

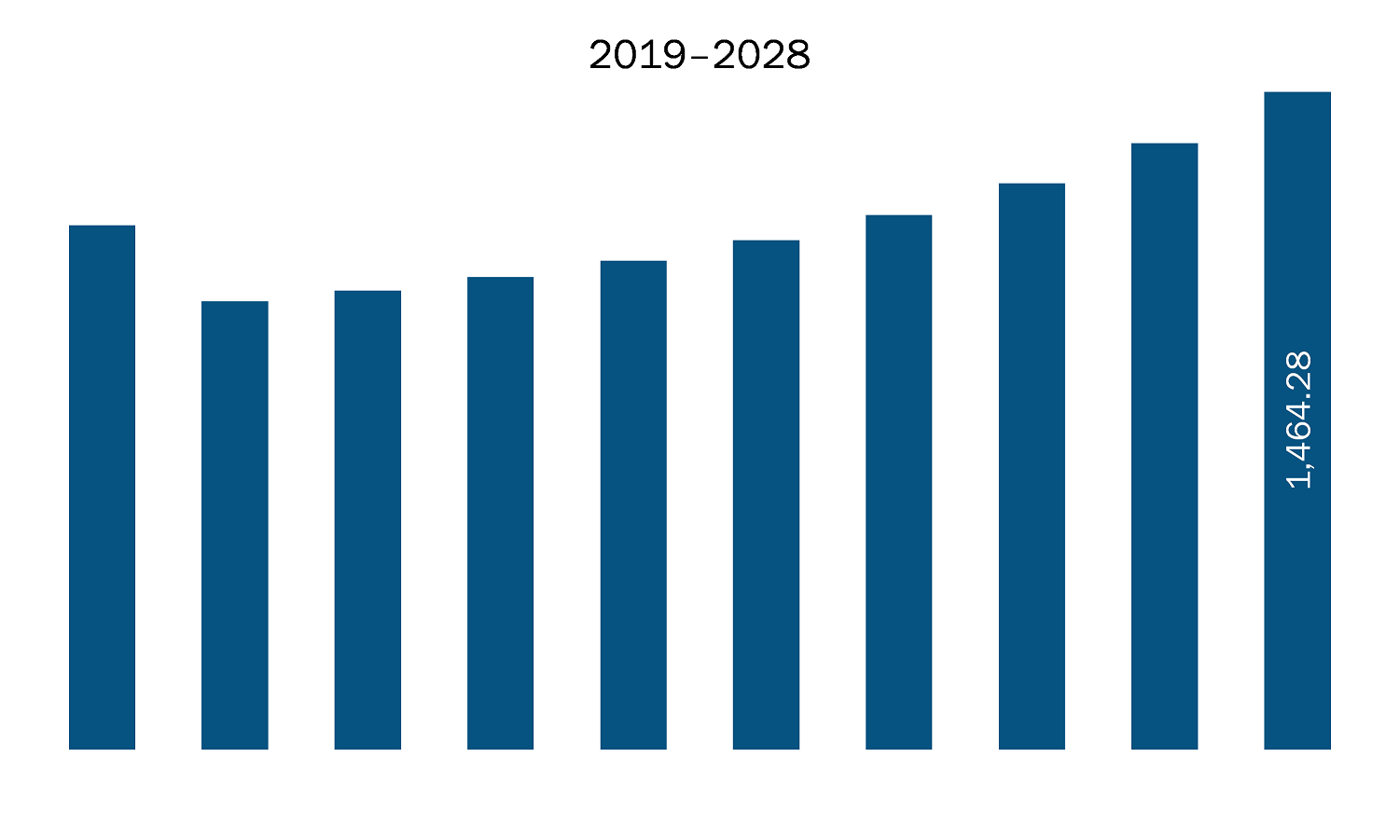

| Market size in 2021 | US$ 1022.47 Million |

| Market Size by 2028 | US$ 1464.28 Million |

| Global CAGR (2021 - 2028) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Automotive Piston refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The automotive piston market in Europe is expected to grow from US$ 1022.47 million in 2021 to US$ 1464.28 million by 2028; it is estimated to grow at a CAGR of 5.3% from 2021 to 2028. echnological innovations in ICEs such as intelligent combustion management systems as well as improvements in fuel efficiency to achieve power advantages and lower emission levels are emerging as new trends supporting the growth of the Europe automotive piston market. In 2019, Mazda Motor Corporation introduced its SkyActiv-X unit gasoline engine that merges gasoline and diesel technologies to harness the benefits of homogenous charge compression ignition (HCCI), wherein the engine’s air–fuel mixture is ignited by the piston’s compression stroke. The fuel-efficient gasoline engines capitalize on the piston’s full range of motion, allowing it to operate on a leaner fuel ratio than conventional petrol engines. These efforts would also help the Europe automotive piston market players to expand their product portfolio and business presence. Another emerging trend in the automotive piston market is hydrogen-fueled combustion engine technology. The hydrogen-fueled piston engines do not emit CO2 and allow users to achieve zero-emission targets. It also offers advantages over expensive battery-electric and hydrogen fuel cell solutions.

The Europe automotive piston market is segmented on the bases of material type, coating type, vehicle type, and piston type, and country. Based on material type, the market is segmented into steel and aluminum. The aluminum segment dominated the market in 2020 and steel segment is expected to be the fastest growing during the forecast period. On the basis of coating type, the automotive piston market is segmented into thermal barrier piston coating, dry film lubricant piston coating, and oil shedding piston coating. The thermal barrier piston coating segment dominated the market in 2020 and dry film piston coating segment is expected to be the fastest growing during the forecast period. On the basis of vehicle type, the automotive piston market, by vehicle type, is segmented into two wheelers, passenger vehicles, and commercial vehicles. The commercial vehicles segment dominated the market in is expected to be the fastest growing during the forecast period. On the basis of piston type, the automotive piston market is segmented into flat-top piston, dome piston, and dish piston. The flat-top piston segment dominated the market in 2020 and dome piston segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the automotive market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Arias Pistons; CAPRICORN AUTOMOTIVE LTD; Hitachi Astemo Americas, Inc.; MAHLE GmbH; QUFU JINHUANG PISTON CO., LTD; Rheinmetall Automotive AG; RIKEN CORPORATION; Shandong Binzhou Bohai Piston Co., Ltd; and Tenneco Inc. are among others.

The Europe Automotive Piston Market is valued at US$ 1022.47 Million in 2021, it is projected to reach US$ 1464.28 Million by 2028.

As per our report Europe Automotive Piston Market, the market size is valued at US$ 1022.47 Million in 2021, projecting it to reach US$ 1464.28 Million by 2028. This translates to a CAGR of approximately 5.3% during the forecast period.

The Europe Automotive Piston Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Automotive Piston Market report:

The Europe Automotive Piston Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Automotive Piston Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Automotive Piston Market value chain can benefit from the information contained in a comprehensive market report.