The automobile industry is critical to Europe's economic development. The EU is one of the world's largest producers of automobiles, and the automotive industry is the largest private investor in research and development (R&D), responsible for 29% of total spending. The European Commission promotes global technical harmonization and offers funds for R&D to improve the productivity of the EU automotive industry and maintain its global technological leadership. One of the main drivers for the automotive lead-acid battery market in Europe is the rising automotive industry. Estimates say that there are more than 260 million passenger vehicles, 4 million trucks, and 30 million buses on European roads in October 2019. Every year, about 15 million new cars and 200,000-220,000 new trucks are introduced, and the lead-acid battery that powers starting, lighting, and ignition is essential to all of them. European automobiles are recognized around the world for their advanced architecture and higher-than-average electronics content. This necessitates the use of a large battery, which can range in size from 40Ah in regular A segment cars to 100Ah in Premium C& D segment cars. As a result, the market for lead-acid batteries is increasing. Furthermore, in 2019, the European electric vehicle industry expanded at a faster rate than other international markets, owing to favorable government policies and changing consumer preferences. As a result, these factors would drive the demand for lead-acid batteries in the region.

In Europe, Russia is the hardest-hit country by the COVID-19 outbreak, and it has reported ~4.49 million cases as of March 2021. European countries have implemented drastic measures and travel restrictions, including partially closing their borders. Vehicle production has declined due to the shutdown of factories. The region experienced the production loss of 3.6 million vehicles worth Euro 100 billion in the first half of 2020 owing to the infection spread and the related restrictions imposed by the respective governments. This is led to the hindered growth of the automotive lead acid batteries market in Europe in 2020.

Strategic insights for the Europe Automotive Lead Acid Battery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

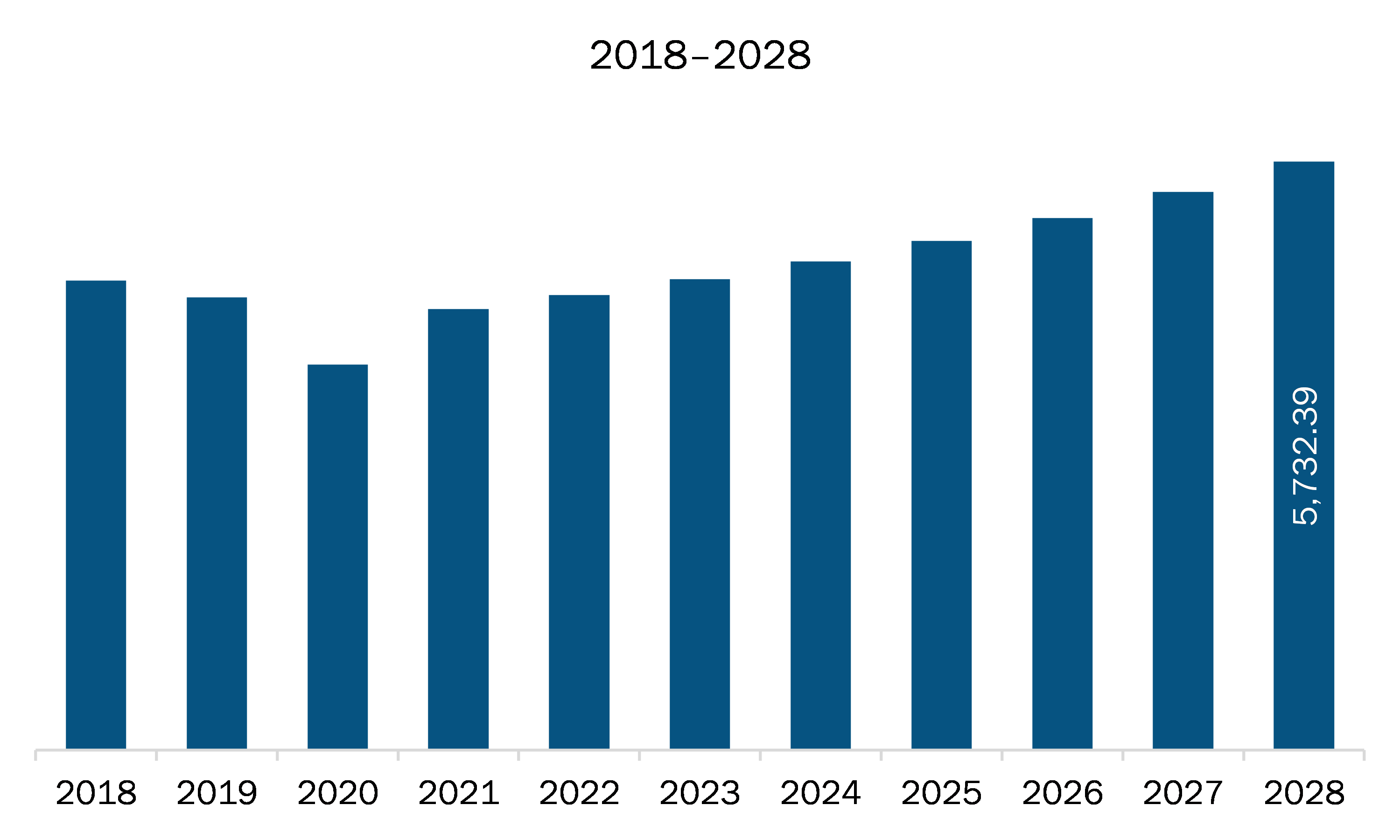

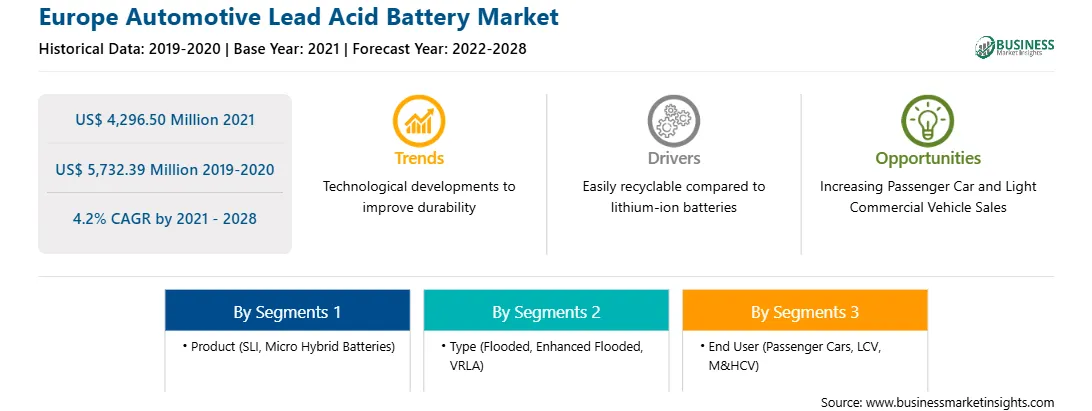

| Market size in 2021 | US$ 4,296.50 Million |

| Market Size by 2028 | US$ 5,732.39 Million |

| Global CAGR (2021 - 2028) | 4.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Automotive Lead Acid Battery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The automotive lead acid battery market in Europe is expected to grow from US$ 4,296.50 million in 2021 to US$ 5,732.39 million by 2028; it is estimated to grow at a CAGR of 4.2% from 2021 to 2028. The automotive sector is undergoing through tremendous technological advancements which is expected to generate development opportunity for automotive related components including batteries. For instance, in India, the Government authority has mandated that all automotive manufacturers including four-wheeler and two-wheelers can produce, sell, and register BSVI-compliant vehicles solely. This rule has been effective from April,1 2020 and is also marked as a landmark in the past of automotive sector. Additionally, with the formation of stringent regulations regarding vehicle emissions, it is anticipated that automotive manufacturers would make a shift into micro hybrid engine architecture which is further projected to result into higher demand for complex & advanced car batteries.

The Europe automotive lead acid battery market is segmented based on product, type, and end user. Based on product, the Europe automotive lead acid battery market is segmented into SLI, micro hybrid batteries. The SLI segment held the largest market share in 2020 Based on type, Europe automotive lead acid battery market is segmented into flooded, enhanced flooded, and VRLA. The enhanced flooded segment dominated the market. Based on end user, the market is segmented into passenger cars, LCV, M&HCV. The passenger cars segment dominated the end user segment in the market.

A few major primary and secondary sources referred to for preparing this report on the automotive lead acid battery market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Clarios; CSB Energy Technology Co., Ltd.; East Penn Manufacturing Company; EnerSys; Exide Industries Limited; GS Yuasa International Ltd.; Johnson Controls, Inc.; leoch International Technology Limited Inc; and Panasonic Corporation.

The Europe Automotive Lead Acid Battery Market is valued at US$ 4,296.50 Million in 2021, it is projected to reach US$ 5,732.39 Million by 2028.

As per our report Europe Automotive Lead Acid Battery Market, the market size is valued at US$ 4,296.50 Million in 2021, projecting it to reach US$ 5,732.39 Million by 2028. This translates to a CAGR of approximately 4.2% during the forecast period.

The Europe Automotive Lead Acid Battery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Automotive Lead Acid Battery Market report:

The Europe Automotive Lead Acid Battery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Automotive Lead Acid Battery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Automotive Lead Acid Battery Market value chain can benefit from the information contained in a comprehensive market report.