Market Introduction

The European region comprises several economies such as Germany, France, the UK, and Italy. The western part of Europe is known for its better standards of living and greater income levels of people. In 2020, the automotive industry contributed 7% to the average GDP of the region. A strong automotive sector ensures the availability of necessary vehicle categories to support supply chains, which further creates a diversified array of business opportunities and services. The automotive manufacturers have production plants in 27 European countries and 304 vehicle assembly plants across the region. The growing production of commercial and passenger vehicles is likely to surge the demand for automotive ECUs. European Union (EU) is ensuring co-operation among the autonomous vehicle industry stakeholders at a regional level to create a favorable environment for the development of autonomous vehicles. In 2016, the Vienna Convention was updated for explicitly allowing driverless technology and attracting developments related to autonomous vehicles in the region. Recently, the EU adopted a plan to promote the deployment of driverless trucks in cities. This will lead to reduced cost of transit and fuel, further boosting the automotive ECU market growth. The European Green Deal announced its plan of focusing on net-zero emissions across different economies to reduce the transport emissions to 90% by 2050. European Commission (EC) is now reconsidering its sectoral plans and policies to successfully attain emission reduction targets, including the post-2021 CO2 standards for vans and cars in mid-2021, and buses and trucks in 2022. Similarly, as per the International Council on Clean Transportation (ICCT), at the end of 2019, Europe accounted for more than 560,000 EV registrations and 1.8 million aggregated registrations. The EU and European Free Trade Association member countries constitute the second-largest market for electric vehicles across the world. Additionally, among the total EV sales in Europe, total 1,367,138 passenger plug-in electric cars were registered in 2020. Thus, huge volumes of automotive ECUs are being integrated in EVs in Europe.

In case of COVID-19, Europe is highly affected specially France. The COVID-19 pandemic has distrusted the supply chains in various European countries. Italy, Spain and Germany, among others, have implemented drastic measures and travel restrictions to limit the spread of the disease. European countries represent a major share in the automotive ECU market as this region has the highest road safety standards in world. However, disruptions in the supply chain of automotive ECU hardware components has significantly affected the deployment of automotive ECUs. Moreover, the manufacturing of various consumer electronics devices and production of automobiles in European countries exhibited a sharp decline in 2020, and the enterprises would need time to stabilize their businesses. Furthermore, the recurrent imposition of containment measure owing to the spread of mutated strains further hampers the market growth in Europe.

Strategic insights for the Europe Automotive ECU provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Automotive ECU refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Automotive ECU Strategic Insights

Europe Automotive ECU Report Scope

Report Attribute

Details

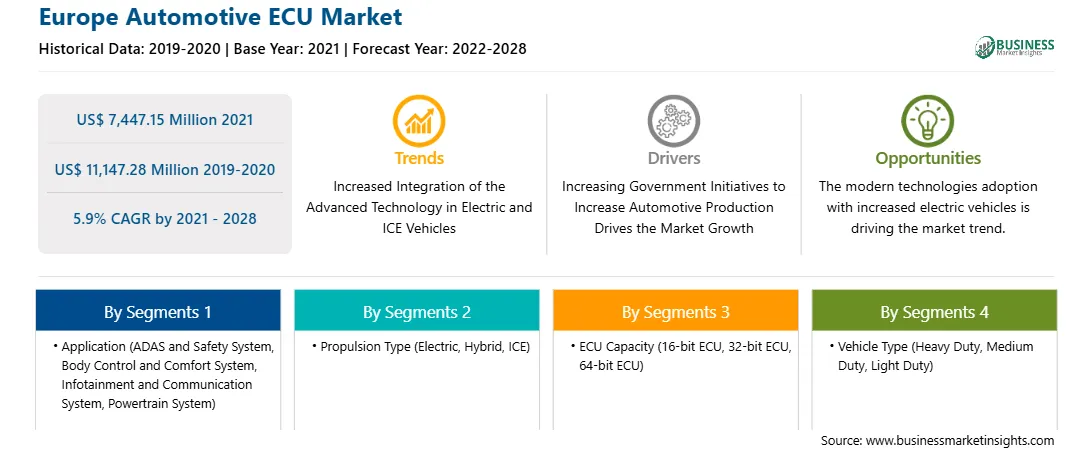

Market size in 2021

US$ 7,447.15 Million

Market Size by 2028

US$ 11,147.28 Million

Global CAGR (2021 - 2028)

5.9%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Application

By Propulsion Type

By ECU Capacity

By Vehicle Type

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Automotive ECU Regional Insights

Market Overview and Dynamics

The Europe automotive ECU market is expected to grow from US$ 7,447.15 million in 2021 to US$ 11,147.28 million by 2028; it is estimated to grow at a CAGR of 5.9% from 2021 to 2028. Several countries across the region are the largest producer as well as consumer of cars. Although the overall car sales fell by ~2.4 by October 2021, the demand for new energy vehicles (NEV) grew by 135% in that month to reach 383,000 units. All significant OEMs of luxury vehicles in several countries, including BMW, Mercedes-Benz, and Audi, have reported positive sales figures. In the earlier generations, consumers used to purchase premium vehicles mainly to exhibit their social status. However, the progressively sophisticated new generation of consumers prefers buying premium automobiles for luxury experience and smart technologies. According to a study conducted by the Association of Automobile Manufacturers, women play a significant role in the premium car market. This survey stated that while opting for a vehicle model, women value safety features, comfort, and exterior styling over the other qualities that are favored by their male counterparts, such as powertrain technology, social premium brand recognition, and model size. Thus, with the growing sales of premium cars, are driving the demand for the integration of automotive ECU in sedans and SUVs Europe across region.

Key Market Segments

In terms of application, the ADAS and Safety System segment accounted for the largest share of the Europe automotive ECU market in 2020. In terms of propulsion type, the ICE segment held a larger market share of the Europe automotive ECU market in 2020. In terms of ECU capacity, the 32-bit ECU segment held a larger market share of the Europe automotive ECU market in 2020. Further, the light duty segment held a larger share of the Europe automotive ECU market based on vehicle type in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the Europe automotive ECU market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aptiv PLC; Continental AG; Denso Corporation; Hitachi, Ltd.; Mitsubishi Electric Corporation; Pektron; Robert Bosch GmbH; Veoneer Inc; and ZF Friedrichshafen AG among others.

Reasons to buy report

Europe Automotive ECU Market Segmentation

Europe Automotive ECU Market - By Application

Europe Automotive ECU Market -

By Propulsion Type

Europe Automotive ECU Market -

By ECU Capacity

Europe Automotive ECU Market -

By Vehicle Type

Europe Automotive ECU Market - By Country

Europe Automotive ECU Market - Company Profiles

The Europe Automotive ECU Market is valued at US$ 7,447.15 Million in 2021, it is projected to reach US$ 11,147.28 Million by 2028.

As per our report Europe Automotive ECU Market, the market size is valued at US$ 7,447.15 Million in 2021, projecting it to reach US$ 11,147.28 Million by 2028. This translates to a CAGR of approximately 5.9% during the forecast period.

The Europe Automotive ECU Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Automotive ECU Market report:

The Europe Automotive ECU Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Automotive ECU Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Automotive ECU Market value chain can benefit from the information contained in a comprehensive market report.