Gene banking is a popular way of managing human genetics and other organisms for research, development, and preservation of stem cells. Building a gene bank for animal genetics is expected to be a powerful tool for managing animal genetic resources for food and agriculture (AnGR). AnGr strategy was proposed in the 2000s under the Global Plan of Action for Animal Genetic Resources by the Food and Agriculture Organization of the United Nations (FAO). A substantial investment is required to cryopreserve genetic material so that it can be stored infinitely. Thus, the high investments have restricted the building of gene banks for animal genetics. Nevertheless, the advantages of gene banks and cryopreservation objectives, including supporting in vivo conservation, developing breeds, improving the management of not-at-risk breeds, have encouraged many countries to invest in the AnGr strategy. As a part of the Global Plan of Action for Animal Genetic Resources, many countries have initiated investments in national gene banks for the AnGr strategy. Also, there is an increase in demand for loans from farmers to manage their livestock, poultry, and fish. In addition, the goals of the AnGr strategy ensure to protect extinction breeds or catastrophic loss and support the in-situ populations across species and breeds, which have enabled increasing investments in gene banks. Similarly, private companies are investing to accelerate animal genetics and help advance genetics in livestock. Increased investments enable companies to expand their business and benefit farmers and researchers with their advanced tools useful in animal genetics. In April 2023, Vytelle raised US$ 20 million in Series B funding. With this investment, Vytelle aims to expand its global operations and accelerate genetics in cattle. Vyttelle has served its customers with its solutions, including Vytelle ADVANCE, an in vitro fertilization (IVF) technology; Vytelle SENSE, a capturing system for animal performance; and Vytelle INSIGHT, an artificial intelligence-based genetic analytics engine. Such innovative tools are increasing animal genetics efficiently. Thus, the above-mentioned factors are anticipated to foster the growth of the market during the forecast period.

The animal genetics market in Europe is sub segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. Europe is the second leading market for animal genetics in the world. The growth of the market in the region is ascribed to the growing livestock production; strategic collaborations between European companies, and international companies and organizations; and rising government support to enhance animal breeding and farming to stimulate local production, especially in rural areas.

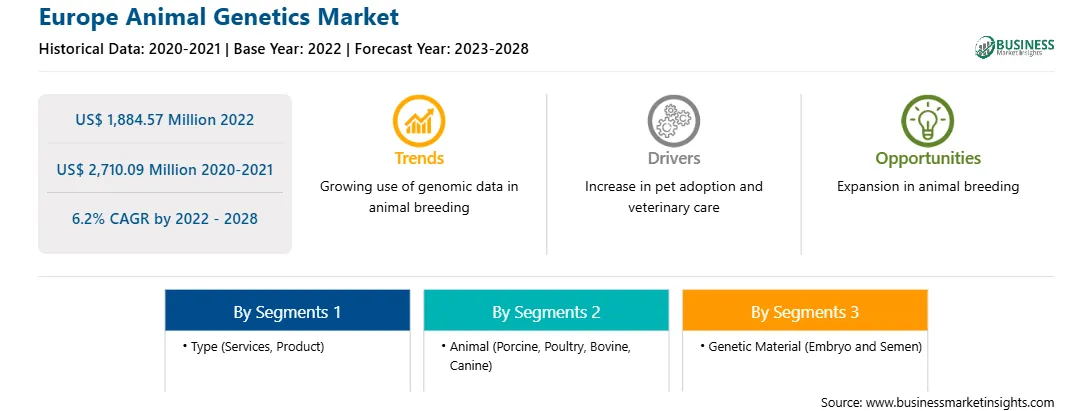

Strategic insights for the Europe Animal Genetics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Animal Genetics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Animal Genetics Strategic Insights

Europe Animal Genetics Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,884.57 Million

Market Size by 2028

US$ 2,710.09 Million

Global CAGR (2022 - 2028)

6.2%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Animal

By Genetic Material

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Animal Genetics Regional Insights

Europe Animal Genetics Market Segmentation

The Europe animal genetics market is segmented based on type, animal, genetic material, and country. Based on type, the Europe animal genetics market is bifurcated into services and product. The services segment held a larger market share in 2022.

Based on animal, the Europe animal genetics market is segmented into porcine, poultry, bovine, canine, and others. The porcine segment held the largest market share in 2022.

Based on genetic material, the Europe animal genetics market is bifurcated into embryo and semen. The embryo segment held a larger market share in 2022.

Based on country, the Europe animal genetics market is segmented into Germany, Italy, the UK, France, Spain, and the Rest of Europe. Germany dominated the Europe animal genetics market share in 2022.

Neogen Corp, Genus Plc, Topigs Norsvin Nederland B.V, Zoetis Inc, Hendrix Genetics B.V, Inotiv Inc, Animal Genetics Inc, Alta Genetics Inc, GROUPE GRIMAUD LA CORBIERE, and Charles River Laboratories International Inc are some of the leading companies operating in the Europe animal genetics market.

The Europe Animal Genetics Market is valued at US$ 1,884.57 Million in 2022, it is projected to reach US$ 2,710.09 Million by 2028.

As per our report Europe Animal Genetics Market, the market size is valued at US$ 1,884.57 Million in 2022, projecting it to reach US$ 2,710.09 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The Europe Animal Genetics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Animal Genetics Market report:

The Europe Animal Genetics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Animal Genetics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Animal Genetics Market value chain can benefit from the information contained in a comprehensive market report.