Europe and South America Mobile Wallet and Payment Market

No. of Pages: 128 | Report Code: BMIRE00030585 | Category: Banking, Financial Services, and Insurance

No. of Pages: 128 | Report Code: BMIRE00030585 | Category: Banking, Financial Services, and Insurance

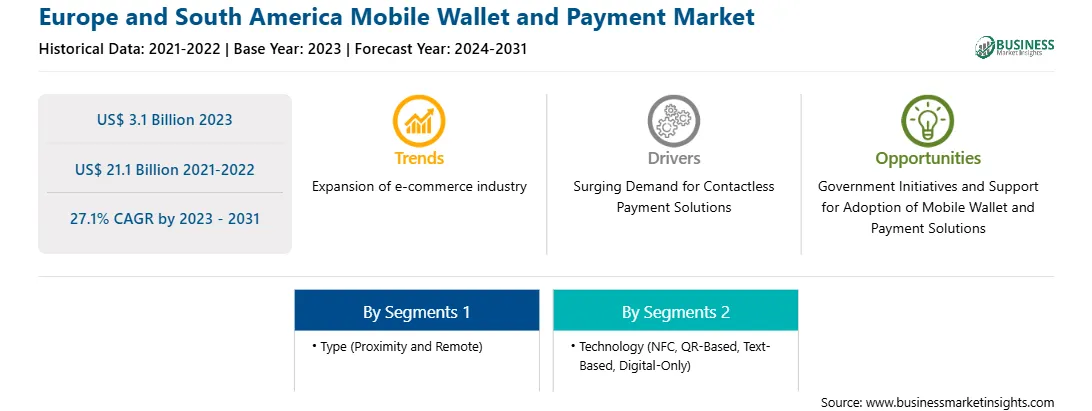

The Europe and South America Mobile Wallet and Payment market size was valued at US$ 3.1 billion in 2023 and is expected to reach US$ 21.1 billion by 2031. The Europe and South America Mobile Wallet and Payment market is estimated to record a CAGR of 27.1% from 2023 to 2031.

The Europe and South America Mobile Wallet and Payment market in Europe is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. Mobile wallets are the second most favored online payment option among consumers in France. Global companies such as Google Pay, Apple Pay, and PayPal operate alongside France-based service providers such as Lyf, Lydia, and PayLib. PayLib is one of the most popular digital wallets in the country because of its integration with Cartes Bancaires. According to Pay.com, approximately 38% of online purchases made in France were paid for using a digital gadget in 2023. Various options available for French consumers for making payments using phones and watches include Amazon Pay, digital wallet brands such as Lyf, bank-specific apps, and mobile-only payment solutions such as Revolut and Monese.

In 2023, Italy recorded a significant surge in in-store mobile payments, with Nexi recording an 88% increase in the value of in-store mobile payment transactions via smartphones and smartwatches. According to data released by the Innovative Payments Observatory of the School of Management of the Polytechnic of Milan, mobile-based payments increased by 78% overall in Italy last year (2022), reaching a value of EUR 29 billion. Specifically, the number of payments processed by Nexi via smartphones and wearables spiked by 103% during 2023. Furthermore, the number of Nexi cards registered on apps that virtualize the card on the smartphone—such as Google Pay, Samsung Pay, and Apple Pay—grew by 41% in the same period. These stats highlight the burgeoning popularity and adoption of mobile wallet payments in Italy.

On the basis of technology, the market is divided into near field communication, QR code, text-based, and others. The QR-based segment held the largest share in the Europe and South America mobile wallet and payment market in 2023. Quick response (QR) codes are two-dimensional barcodes that include information such as payment information, website links, and contact details. Customers need to scan QR codes with their smartphones to make payments on the spot. These codes allow businesses to handle payments without investing in additional hardware. Individuals and businesses can set up QR codes on their smartphones to execute seamless financial transactions. QR codes also enable users to create and pay invoices and share critical information within seconds. Apple’s active QR code scanners installed in smartphone cameras allow users to transmit information and make online payments with efficiency. QR code has been one of the fastest-growing payment options in Europe and South America.

Apple Inc, Alphabet Inc, AT&T Inc, Paypal Holdings Inc, Samsung Electronics Co Ltd, Mastercard Inc, Fitbit LLC, American Express, Visa Inc, and ACI Worldwide Inc are among the prominent players profiled in the Europe and South America mobile wallet and payment market report. This report focuses on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

The overall Europe and South America Mobile Wallet and Payment market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Europe and South America Mobile Wallet and Payment market size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Europe and South America Mobile Wallet and Payment market.

Strategic insights for the Europe and South America Mobile Wallet and Payment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.1 Billion |

| Market Size by 2031 | US$ 21.1 Billion |

| Global CAGR (2023 - 2031) | 27.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe and South America Mobile Wallet and Payment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe and South America Mobile Wallet and Payment Market is valued at US$ 3.1 Billion in 2023, it is projected to reach US$ 21.1 Billion by 2031.

As per our report Europe and South America Mobile Wallet and Payment Market, the market size is valued at US$ 3.1 Billion in 2023, projecting it to reach US$ 21.1 Billion by 2031. This translates to a CAGR of approximately 27.1% during the forecast period.

The Europe and South America Mobile Wallet and Payment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe and South America Mobile Wallet and Payment Market report:

The Europe and South America Mobile Wallet and Payment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe and South America Mobile Wallet and Payment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe and South America Mobile Wallet and Payment Market value chain can benefit from the information contained in a comprehensive market report.