The electronic mode of transportation is perceived to benefit the environment and reduce fuel consumption. Many governments across the region have embraced the Electric Vehicles Initiative (EVI), a multi-government policy forum coordinated by the International Energy Agency (IEA) to accelerate the introduction and adoption of electric vehicles worldwide. According to the IEA, 16 countries are the current participants of this program, including Finland, France, Germany, the Netherlands, Norway, Poland, Portugal, Sweden, and the UK. An electric battery is a core component of the electric mode of transportation. In these batteries, the output of the comparator is used to alert a microcontroller regarding their discharged or low power status. Also, the amplifier is used in EV battery management, and the isolated amplifier offset determines the initial precision of the current sense. Thus, the large-scale application of amplifiers in batteries required for electronic transportation would bolster the consumption of amplifiers and comparators in the future.

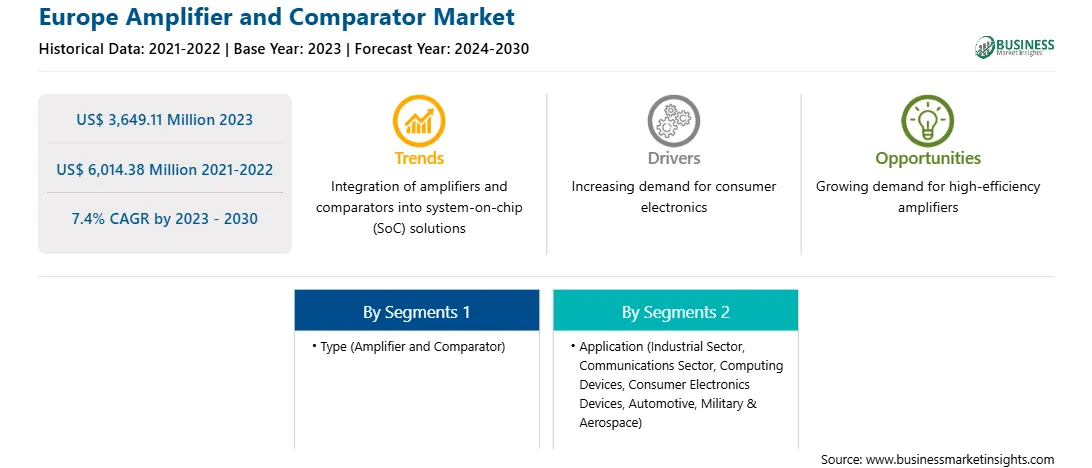

Europe Amplifier and Comparator Market Overview

The amplifier and comparator market in Europe is segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. Western Europe is a highly developed region and comprises different types of businesses. Europe has a well-established manufacturing industry using cutting-edge technologies, which include the Industrial Internet of Things, the Internet of Things, and Industry 4.0. The European market is extremely competitive, with the presence of both local and international players. Key companies involved in designing, manufacturing, and distributing amplifiers and comparators conduct business in the region. These companies often invest in research and development to remain the forerunners in technological advancements and meet evolving customer demands. Key players in the amplifier and comparator market focus on innovation, new product launches, partnerships, and collaborations to stay relevant in the competition. In March 2023, Marshall Amplification, one of the leading amp-makers, was acquired by the Swedish audio firm Zound Industries. With this acquisition, both companies decided to join forces with the launch of the Marshall Group. An amplifier improves audio quality, provides dynamic range, and enhances listening experiences. These strategic developments in the audio industry are expected to bolster the growth of the amplifier and comparator market.

Strategic insights for the Europe Amplifier and Comparator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Amplifier and Comparator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Amplifier and Comparator Strategic Insights

Europe Amplifier and Comparator Report Scope

Report Attribute

Details

Market size in 2023

US$ 3,649.11 Million

Market Size by 2030

US$ 6,014.38 Million

Global CAGR (2023 - 2030)

7.4%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Type

By Application

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Amplifier and Comparator Regional Insights

Europe Amplifier and Comparator Market Segmentation

The Europe amplifier and comparator market is segmented based on type, application, and country. Based on type, the Europe amplifier and comparator market is bifurcated into amplifier and comparator. The amplifier segment held a larger market share in 2023.

Based on application, the Europe amplifier and comparator market is segmented into industrial sector, communications sector, computing devices, consumer electronics devices, automotive, military & aerospace, and others. The industrial sector segment held the largest market share in 2023.

Based on country, the Europe amplifier and comparator market is segmented into Germany, the UK, France, Italy, Russia, and the Rest of Europe. Germany dominated the Europe amplifier and comparator market share in 2023.

ABLIC Inc; Analog Devices Inc; Broadcom Inc; Microchip Technology Inc; NXP Semiconductors; On Semiconductor; Renesas Electronics Corporation; Skyworks Solutions Inc; STMicroelectronics NV; and Texas Instruments Inc are the leading companies operating in the Europe amplifier and comparator market.

The Europe Amplifier and Comparator Market is valued at US$ 3,649.11 Million in 2023, it is projected to reach US$ 6,014.38 Million by 2030.

As per our report Europe Amplifier and Comparator Market, the market size is valued at US$ 3,649.11 Million in 2023, projecting it to reach US$ 6,014.38 Million by 2030. This translates to a CAGR of approximately 7.4% during the forecast period.

The Europe Amplifier and Comparator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Amplifier and Comparator Market report:

The Europe Amplifier and Comparator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Amplifier and Comparator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Amplifier and Comparator Market value chain can benefit from the information contained in a comprehensive market report.