The demand for air travel in European companies is steadily increasing owing to surge in business and leisure travel. To meet the growing demand, both full-service and low-cost carriers are gradually launching flights to newer routes. In 2017, the “no frills” business model assisted many European economies in generating healthy revenues from their respective aviation industries. Increased passenger counts in the same year benefited the UK and Russian economies mainly. According to the Airports Council International (ACI) Europe, during 2019–2040, the region's aviation industry is projected to expand by more than 53% in terms of flight movements. This projected rise in fleet size in the area is expected to pique airport authorities' interest in investing significant sums in the modernization of existing airports. Moreover, a number of European countries are capitalizing on the building of newer airports to manage the increasing passenger traffic. In July 2019, Poland Airport Authorities announced the development of a new airport for better connectivity with the west. Similarly, Václav Havel Airport in the Czech Republic is scheduled to spend US$ 1.09 billion on the expansion of Terminal 2 and the building of a new runway parallel to the terminal. Growing demand for advanced robots and increasing construction of new airports and exigency for robust airport security are the major factor driving the growth of the Europe airport robots market.

In case of COVID-19, Europe is highly affected specially the UK. Additionally, countries such as Italy, Russia, and Spain witnessed a significant surge in cases, which led them to shut down business and manufacturing operations for a few months. However, numerous European countries witnessed swift recover from quarter 4 of 2020. Irrespective of the surge in number of COVID-19 cases and shutting down of business operations for months, manufacturers had to continue the production of essential products, resume it earlier than other businesses. However, since the travel activities were closed and airport development and expansion projects were halted, the global airport robots market was heavily impacted. Numerous airports were at a risk of bankruptcy in 2021 in Europe due to the crisis caused by the travel restrictions amid the COVID-19 pandemic. This severely impacted the number of businesses associated or involved in airport operations, including airport robots manufacturers. Further, since manufacturing facilities in the region were completely shut down for months, the manufacturers of airport robots faced several challenges related to procuring raw material and keeping up with the overall stock, among others. However, since the beginning of 2021, governments of various countries in Europe have expedited the vaccination process, and currently the number of COVID-19 cases in the region has drastically reduced. Seeing this, the government authority has now opened up the economy, and airports are now functional with more stringent sanitation guidelines. This has led to creation of demand of advance airport robots.

Strategic insights for the Europe Airport Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

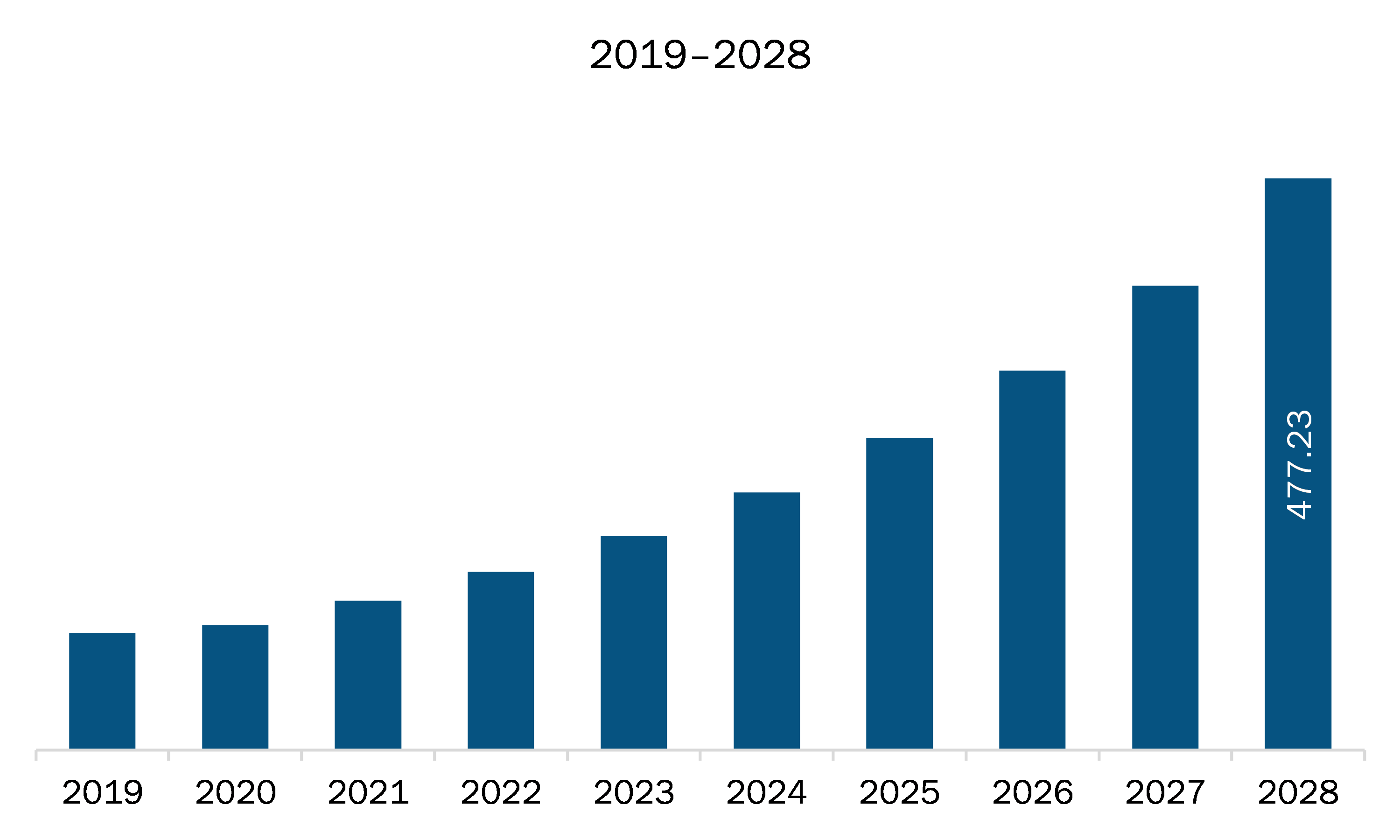

| Market size in 2021 | US$ 124.48 Million |

| Market Size by 2028 | US$ 477.23 Million |

| Global CAGR (2021 - 2028) | 21.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Airport Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe airport robots market is expected to grow from US$ 124.48 million in 2021 to US$ 477.23 million by 2028; it is estimated to grow at a CAGR of 21.2% from 2021 to 2028. Entire region is facing the COVID-19 pandemic crisis. The disease spreads primarily through droplets or microdroplets released by infected person via coughing, sneezing, of talking. Thus, sanitation, therefore, has become paramount importance at ports. With the gradual opening of economies and relaxation of travelling restrictions, airport authorities have accepted an additional responsibility of keeping the airports sanitized and clean for ensuring passenger safety and security. This has underlined the need of effective and comprehensive cleaning. As a result, airport authorities are investing significantly in cleanliness and sanitation. In late 2020, several countries across Europe region prepared a strategy for implementing multilayered cleaning processes to enhance the health and safety of travelers; the authority deployed autonomous cleaning robots that use ultraviolet (UV) light to kill microbes. So, the upgraded sanitation programs and procedures at airports across region is expected to fuel the Europe airport robots market in coming years.

In terms of application, the terminal segment accounted for the largest share of the Europe airport robots market in 2020. In terms of terminal, the airport security and cleaning segment held a larger market share of the Europe airport robots market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe airport robots market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ABB Ltd.; Avidbots Corp.; CYBERDYNE INC.; ECA Group; LG Electronics; SITA; SoftBank Robotics; Stanley Robotics SAS; UVD ROBOTS; and YUJIN ROBOT Co., Ltd.

The Europe Airport Robots Market is valued at US$ 124.48 Million in 2021, it is projected to reach US$ 477.23 Million by 2028.

As per our report Europe Airport Robots Market, the market size is valued at US$ 124.48 Million in 2021, projecting it to reach US$ 477.23 Million by 2028. This translates to a CAGR of approximately 21.2% during the forecast period.

The Europe Airport Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Airport Robots Market report:

The Europe Airport Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Airport Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Airport Robots Market value chain can benefit from the information contained in a comprehensive market report.