Airports possess multiple assets, including many ground support facilities used between flights to serve aircraft. A the number of players have been introducing different monitoring solutions for keeping track of these properties for several years, thus increasing the efficiency of ground-handling operations and maintenance activities. Airport properties are typically classified into motorised and non-motorized equipment. The Europe airport asset tracking market is witnessing high growth, and airports in the developing economies account for a major share of the overall demand for these tracking solutions. Considerable investments in the construction of new airports in these economies generate the need for technologically advanced airport asset tracking to achieve simplified operations. In addition to developing economies, several European countries, particularly the Nordic countries, are also seeing witnessing growth in the construction of new airports, boosting the demand for advanced asset tracking solutions. Also in order to achieve cost-competitiveness and reduce overall time, airlines are frequently spending in superior software, which is expected to boost the Europe airport asset tracking market growth in the coming years.

Furthermore, COVID-19 is having very bad impact over the Europe region. Due to the COVID-19 outbreak, Spain, Italy, Germany, UK, and France are some of the worst affected member states in the European region. Businesses in the region are facing severe economic difficulties as they had either to suspend their operations or reduce their activities in a substantial manner. Owing to business shutdown, the region is anticipated to an economic slowdown in 2020 and most likely in 2021 also. Air business is one of the important businesses in the European countries, and the outbreak of COVID-19 across the region has paralyzed the entire business. The revenue generated from airports contributes a significant share in the GDP of every European country. However, the airports in the region are witnessing continual stall in revenues, as operations had been suspended for regular passenger flights in last few months as well as halt of airport infrastructure development in several countries. Owing to the temporary termination of airport operations (except cargo business and repatriation), the revenue generation for end users has fallen drastically, which would take a longer time to normalize. However, it is expected that, with the start of construction projects, the demand for technologically advanced systems and the software will grow. Nonetheless, the airport asset tracking market in 2020 in Europe will remain sluggish.

Strategic insights for the Europe Airport Asset Tracking provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

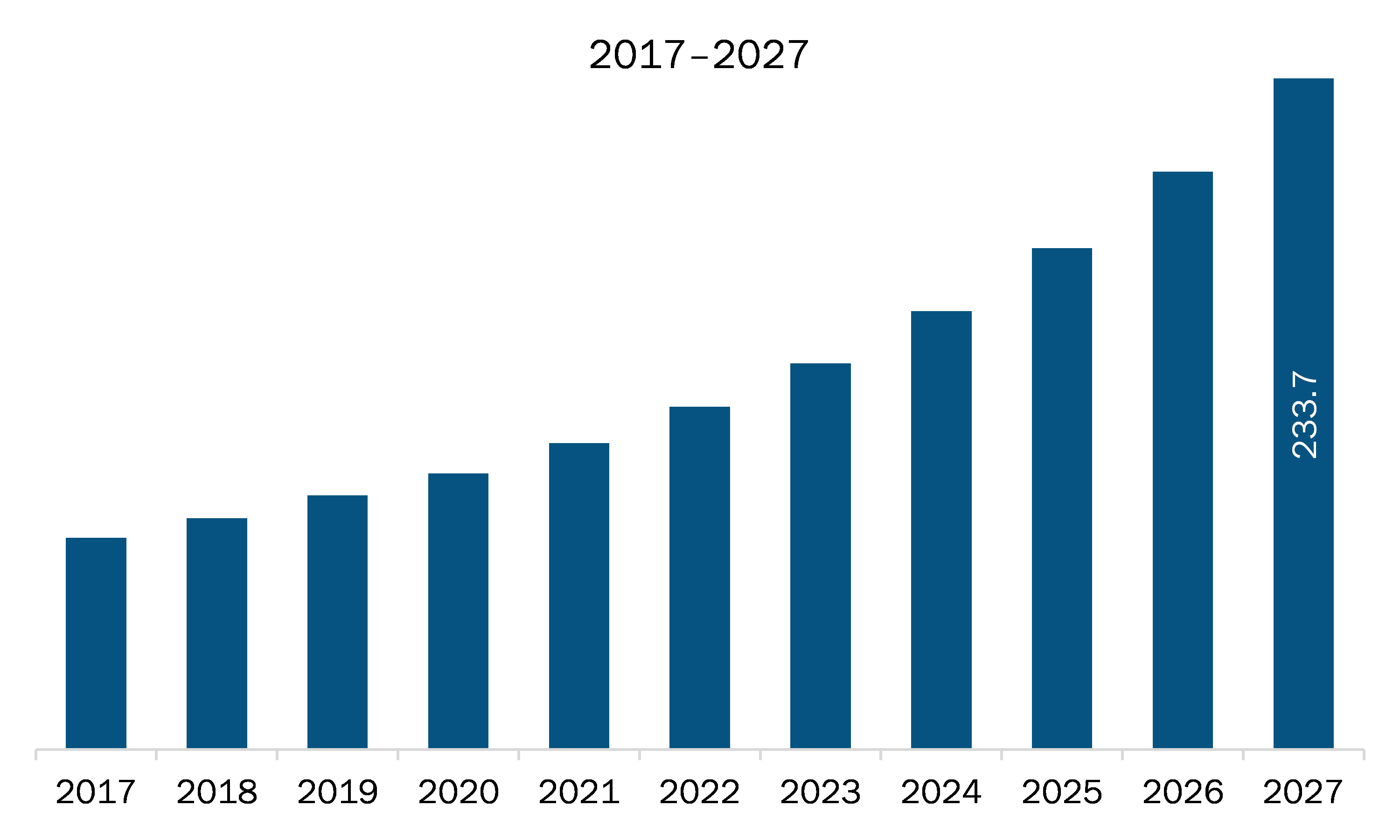

| Market size in 2019 | US$ 88.5 Million |

| Market Size by 2027 | US$ 233.7 Million |

| Global CAGR (2020 - 2027) | 13.5% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Airport Asset Tracking refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The airport asset tracking market in Europe is expected to grow from US$ 88.5 million in 2019 to US$ 233.7 million by 2027; it is estimated to grow at a CAGR of 13.5% from 2020 to 2027. Aviation is among the rapidly evolving industries, and various airport authorities, governments, and technology developers are empowering the industry to cope with a constant rise in the air traffic. The adoption of innovative technologies at airports is high in European countries due to favorable support and investments by governments and airport authorities. The surge in demand for technologically advanced solutions has resulted in the commercialization of the smart airport model. A few smart airports in Europe are Munich Airport (Germany), and London Heathrow Airport (UK). Several other airports are presently keen on adopting and embracing similar technologies to develop intelligent or smart airports. The smart airports demand premium technological solutions for the seamless management of various airport operations, ranging from passenger boarding to baggage and cargo handling. Thus, rise in the construction of smart airports is generating massive demand for robust solutions, which is projected to support the growth of the airport asset tracking market players during the forecast period.

In terms of offering, the hardware segment accounted for the largest share of the Europe airport asset tracking market in 2019. In terms of asset type, the mobile assets segment held a larger market share of the Europe airport asset tracking market in 2019.

A few major primary and secondary sources referred to for preparing this report on the airport asset tracking market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abeeway, Adveez; Asset Fusion Limited; Ctrack, Geotab Inc., indoo.rs GmbH, Steerpath Oy, Targa Telematics S.p.A., TracLogik, Undagrid, Unilode Aviation Solutions.

The Europe Airport Asset Tracking Market is valued at US$ 88.5 Million in 2019, it is projected to reach US$ 233.7 Million by 2027.

As per our report Europe Airport Asset Tracking Market, the market size is valued at US$ 88.5 Million in 2019, projecting it to reach US$ 233.7 Million by 2027. This translates to a CAGR of approximately 13.5% during the forecast period.

The Europe Airport Asset Tracking Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Airport Asset Tracking Market report:

The Europe Airport Asset Tracking Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Airport Asset Tracking Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Airport Asset Tracking Market value chain can benefit from the information contained in a comprehensive market report.