The European aerospace and defense industry acts as a major pillar in the European economy. According to the Aerospace and Defense Industries Association of Europe (ASD), the regional aerospace sector has significantly expanded registering a Y-o-Y sales growth of 5.2% in 2019. Positive net trade balance to the European economy generated by the European aerospace sector, technological transformation, and increase in demand for aircraft and aircraft components from the civil and military sector are driving the aircraft wheels and brakes market. The sector delivered strong economic performances with increased deliveries in the last few years and has witnessed a growth in civil and military aircraft demand, as well as stronger competition, which has resulted in significant efforts in the R&D and improvements in the manufacturing of wheels and brakes. Rise in innovation and technologies and sustainable and competitive products and services offered by the key market players are anticipated to boost the European aircraft wheels and brakes market. There is a growing demand for fiber-reinforced composites in the aviation industry in the EU, owing to their high specific stiffness and strength. Composite materials make up 22% of the large Airbus A380. Germany-based research institute Fraunhofer LBF is significantly focusing on the field of innovation by developing the first Carbon Fiber-Reinforced Plastics (CFRP) nose wheel for an A320. The commercialization of the CFRP nose wheel is expected to revolutionize the aircraft wheels industry, which is foreseen to boost the aircraft wheels and brakes market. Owing to the presence of prominent aircraft manufacturers such as Airbus, BAE Systems, Dassault Aviation, SAAB AB, and Ilyushin, and Tupolev, the production volume of various aircraft models (across commercial aircraft, general aviation aircraft, and military aircraft) is significant in the region. The production of aircraft is directly proportional to the demand for wheels and brakes, which is one of the key factors propelling the businesses of aircraft wheels and brakes market players. The aircraft manufacturing giant Airbus delivered 863 aircraft in 2019, while the number decreased to 566 units in 2020 as a result of COVID-19. However, according to a senior management official from Airbus, the company has been significantly ramping up its production volumes as the demand for aircraft fleet has been surging post lockdown. The aircraft manufacturers expect recovery to be led by the single-aisle segment. Hence, they are exploring opportunities to produce 75 A320 family aircraft per month by 2025 from an expected 45 by the end of 2021, registering around a 67% increase. Such statistics showcase a substantial rise in procurement of wheels and brakes, which is further expected to drive the aircraft wheels and brakes market. The region also houses several aircraft MRO companies such as AirFrance KLM Engineering and Maintenance, TAP Maintenance & Engineering, Lufthansa Technik AG, BAE Systems PLC, and Airbus SE, which is significantly enhancing the market growth. Various airlines in the region operate with MRO verticals to support their airline fleet. For instance, Germany-based Lufthansa Group offers a complete range of wheels and brakes overhaul services for all types of Boeing, Embraer, Bombardier, and Airbus aircraft models. The need for wheels and brake overhauling is consistently growing with the growth in the procurement of newer aircraft fleets. This is compelling the MRO service providers to maintain a substantial wheel, brakes, and braking systems inventory. This factor highlights the revenue generation in the European aircraft wheels and brakes market among the MRO facilities.

The air transport sector plays an important role in economic growth and employment in many European countries. With the COVID-19 outbreak, the production and sales of aircraft wheels and brake came to a sudden halt in the most part of Europe. The collapse of demand side severely impacted the EU aerospace sector and reduced international trade, thereby putting the economies in deep crisis. The European aerospace industry began to witness airspace inefficiencies, activity delays, and declining flight counts with the initial spread of COVID-19. The global passenger volume contracted by 60.5%, and total cost of infrastructure declined by 45.4% in 2020, increasing unit costs. This reduced demand has severely impacted the regional aircraft wheels and brake market. The EU aerospace industry is anticipated to recover gradually due to a slower economic recovery and the importance of international services. As per the IATA estimates, Europe faced net loss of ~US$ 26.9 billion in 2020. In 2021, net losses are estimated to lower down to US$ 11.9 billion.

Strategic insights for the Europe Aircraft Wheels and Brakes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

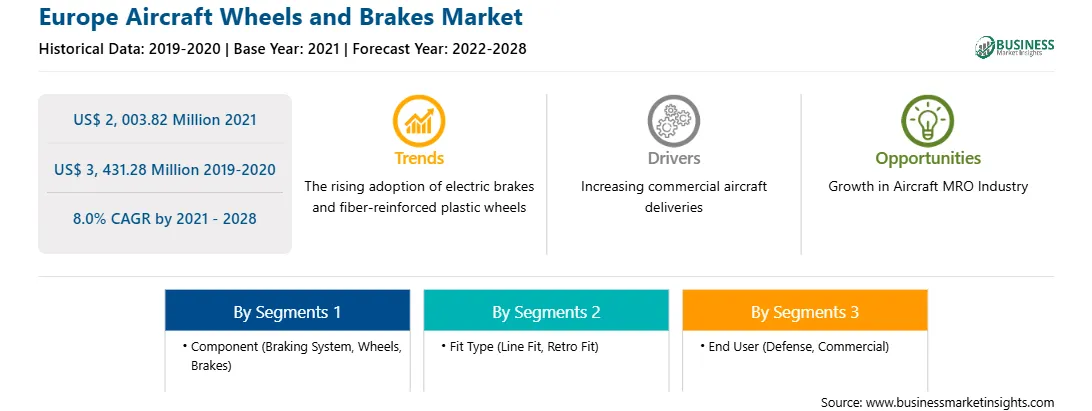

| Market size in 2021 | US$ 2, 003.82 Million |

| Market Size by 2028 | US$ 3, 431.28 Million |

| Global CAGR (2021 - 2028) | 8.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Aircraft Wheels and Brakes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft wheels and brakes market in Europe is expected to grow from US$ 2

Based on component, the market is segmented into braking systems, wheels, and brakes. In 2020, the brakes segment held the largest share Europe aircraft wheels and brakes market. Based on fit type the market is divided into line fit and retro fit. In 2020, the retro fit segment held the largest share Europe aircraft wheels and brakes market. Based on end user, the market is segmented into defense and commercial. In 2020, commercial segment held the largest share Europe aircraft wheels and brakes market.

A few major primary and secondary sources referred to for preparing this report on the aircraft wheels and brakes market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BERINGER AERO, Collins Aerospace, Crane Aerospace & Electronics, Honeywell International Inc., Meggitt PLC, Parker Hannifin Corporation, and Safran among others.

The Europe Aircraft Wheels and Brakes Market is valued at US$ 2, 003.82 Million in 2021, it is projected to reach US$ 3, 431.28 Million by 2028.

As per our report Europe Aircraft Wheels and Brakes Market, the market size is valued at US$ 2, 003.82 Million in 2021, projecting it to reach US$ 3, 431.28 Million by 2028. This translates to a CAGR of approximately 8.0% during the forecast period.

The Europe Aircraft Wheels and Brakes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Aircraft Wheels and Brakes Market report:

The Europe Aircraft Wheels and Brakes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Aircraft Wheels and Brakes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Aircraft Wheels and Brakes Market value chain can benefit from the information contained in a comprehensive market report.