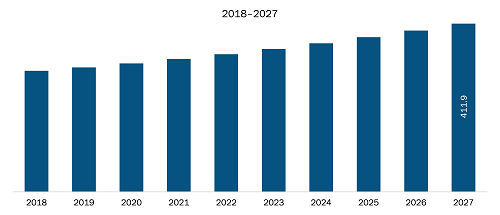

Europe's aircraft landing gear market is expected to grow from US$ 3.42 Bn in 2018 to US$ 5.88 Bn by the year 2027. This represents a CAGR of 6.4% from the year 2018 to 2027.

The inclining curve of air travel is continuously climbing across geographies, which is leading to the increased production of aircraft from manufacturers such as Airbus and Boeing. The commercial airplanes are anticipated to maintain continuous growth over the coming years, regardless of various challenges faced by commercial airlines such as uncertain fuel prices and other regulatory changes in multiple countries. In addition to this, the increasing investments in defense equipment across countries due to unpredictable geopolitical tensions are expected to drive the demand for military aircraft during the forecast period of 2019 to 2027. All these factors and trends are anticipated to fuel the demand for aircraft landing gear and offer future growth opportunities for market players operating in the aircraft landing gear market. The landing gear is one of the crucial subsystems of an aircraft that supports the entire weight of a plane during landing, take-off, and other ground operations. The type and design of a landing gear system depend on the aircraft type and its potential use. A typical landing gear system consists of various components such as brakes, controls, shock absorbers, retraction systems, and warning devices, among many others.

Currently, France is dominating the aircraft landing gear market in terms of installation, which in turn boosts the demand for aircraft landing gear market. The aerospace manufacturing sector of France is one of the most important sectors for the economy of the country, which is the world's sixth-largest economy. The aerospace sector generated revenues amounting to US$ 55.10 Bn in 2018, backed by the presence of some of the world's largest airplane manufacturers. Airbus, Dassault Aviation, ATR, and Daher are the largest aerospace manufacturers present in the France market. The Safran Group, which is one of the leading manufacturers and providers of aircraft landing gear systems, has bagged several contracts with the Airbus Group. Liebherr Group is another major manufacturer of landing gear systems having a noteworthy presence in France. The defense expenditure of the country amounted to US$ 63.8 Bn in 2018, out of which close to 50% of the budget share was allocated for equipment manufacturing. France is the second-largest exporter of aerospace equipment globally after the US. All these factors put together bring ample opportunities for aircraft landing gear in the region. The figure is given below highlights the revenue share of Rest of Europe in the Europe aircraft landing gear market in the forecast period:

Strategic insights for the Europe Aircraft Landing Gear provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 3.42 Billion |

| Market Size by 2027 | US$ 5.88 Billion |

| Global CAGR (2018 - 2027) | 6.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Aircraft Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Aircraft Landing Gear refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

EUROPE AIRCRAFT LANDING GEAR MARKET - SEGMENTATION

Europe Aircraft Landing Gear Market by Type

Europe Aircraft Landing Gear Market by Aircraft Type

Europe Aircraft Landing Gear Market by End-User

Europe Aircraft Landing Gear Market by Gear Arrangement

Europe Aircraft Landing Gear Market by Country

Companies Mentioned

The List of Companies - Europe Aircraft Landing Gear Market

The Europe Aircraft Landing Gear Market is valued at US$ 3.42 Billion in 2018, it is projected to reach US$ 5.88 Billion by 2027.

As per our report Europe Aircraft Landing Gear Market, the market size is valued at US$ 3.42 Billion in 2018, projecting it to reach US$ 5.88 Billion by 2027. This translates to a CAGR of approximately 6.4% during the forecast period.

The Europe Aircraft Landing Gear Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Aircraft Landing Gear Market report:

The Europe Aircraft Landing Gear Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Aircraft Landing Gear Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Aircraft Landing Gear Market value chain can benefit from the information contained in a comprehensive market report.