Online retailing attracts prospective customers than brick and mortar based competitors due to the scale of the internet. In addition, e-commerce market players opt from a variety of logistics options such as the surface transport and air transport, to deliver packages to their customers. Therefore, as the e-commerce market is heating up, varying buying patterns and trends have been observed in different countries. Majority of the purchase is influenced by the demographics of the country such as the percentage of youth population indulging in e-commerce activity, the economy of the country, age group interested in e-commerce, and the level of awareness in the country. Thus, e-commerce is a future growth driver for the air cargo industry, as online shopping boosts the demand for parcel delivery services. Air cargo is well-positioned to serve their needs and deliver their goods with speed, efficiency, and reliability. The fast-growing cross-border e-commerce market remains a key driver in addition to rising domestic volumes sent by large and small e-retailers. Air cargo is an important for the e-commerce ecosystem to manage the transportation of goods. Air cargo service providers deliver upgraded technology, flexibility & scalability, and efficiency & specialization in the e-commerce business. There are numerous benefits pertaining to the e-commerce and they can get fulfilled if the company delivers to customers on time. Thus, several organizations are engaged in improving air cargo services owing to the growing adoption of e-commerce. Online shoppers are now purchasing frequently, and cross-border e-commerce volumes are growing. Customers’ expectations are similar for domestic and cross border e-commerce. Moreover, many passenger aircraft had been operating as cargo planes during the pandemic when the passenger traffic witnessed a steep decline which has also boosted the adoption of air cargo services during the years 2020 to 2022. Such factors are boosting the adoption of air cargo services for e-commerce applications as cross-border online sales are also rising.

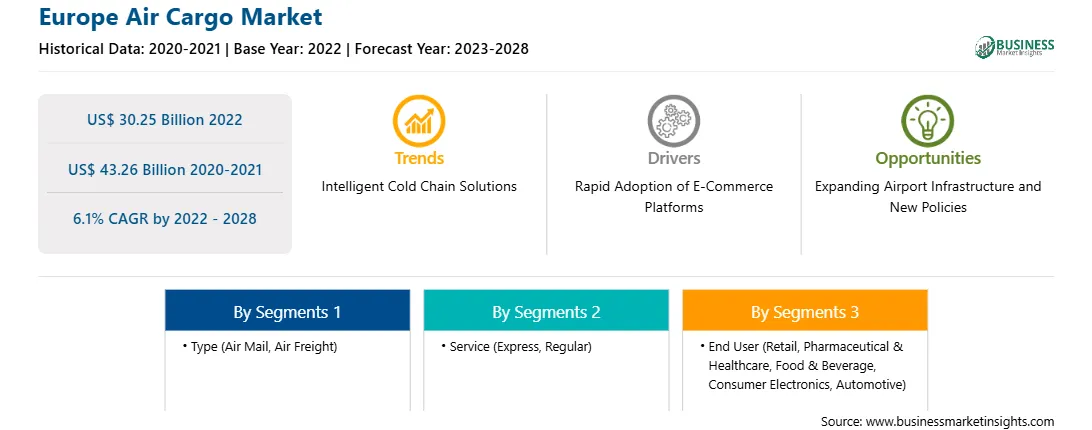

Europe is the third-largest regional market for air cargo. The UK, France, Germany, Italy, and Spain are the key contributors to the market in the region. The region has the presence of several major manufacturing industries. The automotive sector contributes significantly to the GDP of various European countries as well as employs billions of people in the region. Germany does not have large-scale consumer electronics production factories, but the presence of massive automobile manufacturing firms has fueled the trade, transportation, and logistics operations between Germany and other countries in the world. On the other hand, economically strong countries such as Italy, the UK, and Spain are generating huge demand for air cargo products and services for the optimization of supply chains of the pharmaceuticals, e-commerce, and food & beverages processing industries, among others. Further, advancements in Industry 4.0 revolution, and integration of machine learning and deep learning with automation is expected to provide significant opportunities for the efficient integrations of air cargo in the supply chain operations. Moreover, the growth of the e-commerce sector and consumer electronics industry as well as surge in demand and sale of temperature-sensitive products are propelling the growth of the Air Cargo Market in Europe.

Strategic insights for the Europe Air Cargo provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Air Cargo refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Air Cargo Strategic Insights

Europe Air Cargo Report Scope

Report Attribute

Details

Market size in 2022

US$ 30.25 Billion

Market Size by 2028

US$ 43.26 Billion

Global CAGR (2022 - 2028)

6.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Service

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Air Cargo Regional Insights

The Europe air cargo market is segmented based on type, service, end user, and country.

Based on type, the Europe air cargo market is segmented into air mail and air freight. The air freight segment held a larger Europe air cargo market share in 2022.

Based on service, the Europe air cargo market is segmented into express and regular. The regular segment held a larger Europe air cargo market share in 2022.

Based on end user, the Europe air cargo market is segmented into retail, pharmaceutical & healthcare, food & beverage, consumer electronics, automotive, and others. The others segment held the largest Europe air cargo market share in 2022.

Based on country, the Europe air cargo market has been categorized into the UK, Germany, France, Italy, Russia, and the Rest of Europe. Our regional analysis states that France dominated the Europe air cargo market in 2022.

ANA Cargo; Cargolux; Cathay Pacific Airways Limited; DHL International GmbH (Deutsche Post DHL Group); Emirates SkyCargo; Etihad Cargo; FedEx Corporation; Lufthansa Cargo AG; United Parcel Service of America, Inc.; and Zela Aviation The Air Charter Company are the leading companies operating in the Europe air cargo market.

The Europe Air Cargo Market is valued at US$ 30.25 Billion in 2022, it is projected to reach US$ 43.26 Billion by 2028.

As per our report Europe Air Cargo Market, the market size is valued at US$ 30.25 Billion in 2022, projecting it to reach US$ 43.26 Billion by 2028. This translates to a CAGR of approximately 6.1% during the forecast period.

The Europe Air Cargo Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Air Cargo Market report:

The Europe Air Cargo Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Air Cargo Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Air Cargo Market value chain can benefit from the information contained in a comprehensive market report.