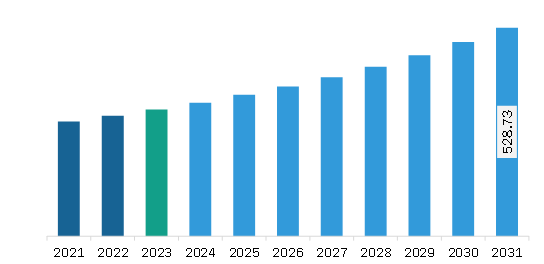

The Europe aerial firefighting market was valued at US$ 321.05 million in 2023 and is expected to reach US$ 528.73 million by 2031; it is estimated to register a CAGR of 6.4% from 2023 to 2031.

Aerial firefighting focuses on fire suppression as well as emphasizes the importance of forest protection. By proactively managing forests and ensuring their overall health, aerial firefighting service providers can prevent the rapid spread of wildfires and reduce their intensity. Aerial photography can identify areas at risk of fire outbreaks. These assessments enable proactive measures to reduce fuel loads and create fire-resilient landscapes. Qualified pilots play a critical role in effectively managing forests and minimizing the impact of wildfires on natural habitats and surrounding communities. By using firefighting techniques and harnessing the power of aerial firefighting, aerial firefighting service providers can protect our forests and communities from the devastating effects of wildfires. In addition, governments of various countries are playing a key role in investment or funding toward forest preservation from wildfires. For instance, the European Council extended the utilization of funding for firefighting planes and helicopters in November 2023. This will allow EU member states to avail benefit from the European Union financing for leasing aerial firefighting solutions. Thus, a rise in awareness and government initiatives toward forest conservation from fire boosts the Europe aerial firefighting market growth.

Europe accounted for a 30.8% share of the global aerial firefighting market in 2023 and is expected to maintain its dominance during the forecast period. Various countries such as Italy, the UK, Spain, and Germany held the majority share in Europe owing to the increasing number of wildfires, government initiatives toward forest preservation, and the presence of key players in the countries. According to the data from the European Forest Fire Information System (EFFIS), 2022 was the second worst season of forest fires in the European Union since 2000. In 45 countries observed by the European Union, 16,941 wildfire instances affected 1,624,381 hectares of land in 2022.

Strategic insights for the Europe Aerial Firefighting provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 321.05 Million |

| Market Size by 2031 | US$ 528.73 Million |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Aerial Firefighting refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe aerial firefighting market is categorized into end use, aircraft type, and country.

By end use, the Europe aerial firefighting market is segmented into forest firefighting, urban firefighting, and others. The forest firefighting segment held the largest share of the Europe aerial firefighting market share in 2023.

In terms of aircraft type, the Europe aerial firefighting market is segmented into fixed wing and rotary wing. The rotary wing segment held a larger share of the Europe aerial firefighting market share in 2023.

Based on country, the Europe aerial firefighting market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. The UK segment held the largest share of Europe aerial firefighting market in 2023.

Avincis Aviation Group, Babcock International Group Plc, Conair Group Inc., and Erickson Inc are the among leading companies operating in the Europe aerial firefighting market.

The Europe Aerial Firefighting Market is valued at US$ 321.05 Million in 2023, it is projected to reach US$ 528.73 Million by 2031.

As per our report Europe Aerial Firefighting Market, the market size is valued at US$ 321.05 Million in 2023, projecting it to reach US$ 528.73 Million by 2031. This translates to a CAGR of approximately 6.4% during the forecast period.

The Europe Aerial Firefighting Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Aerial Firefighting Market report:

The Europe Aerial Firefighting Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Aerial Firefighting Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Aerial Firefighting Market value chain can benefit from the information contained in a comprehensive market report.