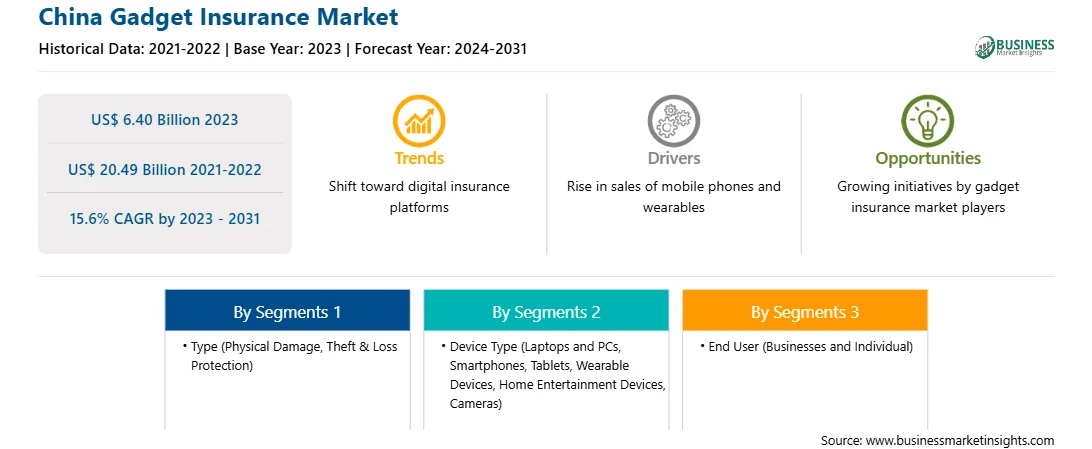

The China gadget insurance market size was valued US$ 6.40 billion in 2023 and is expected to reach US$ 20.49 billion by 2031; it is estimated to record a CAGR of 15.6% from 2023 to 2031.

The China gadget insurance market is experiencing significant growth, driven by the increasing demand for customized policies tailored to specific devices. As the digital landscape evolves and consumer electronics proliferate, insurers are improving their offerings to meet the unique needs of individual gadgets, enhancing customer satisfaction and expanding market reach. With consumers being increasingly reliant on technology for everyday tasks, the financial implications of gadget damage or loss have become more pronounced.

Customized insurance policies provide peace of mind by offering targeted protection that aligns with the value and usage of each device, making them an attractive choice for tech-savvy consumers. Key players operating in the region offer protection and insurance plans to cover the consumers' devices against damages. For instance, Samsung offers Samsung Care+, which brings together a range of benefits that are meant to safeguard users' devices against any accidental, physical, or liquid damage or technical or mechanical failure. Additionally, Samsung Care+ covers a select range of Samsung smartphones, tablets, laptops, and wearables. Similarly, Apple provides AppleCare+, an insurance policy covering the policy period for repairs or replacement of covered Apple devices such as Apple Watch, HomePod, iPad (including Apple Pencil), iPhone, iPod, or Headphones in case of accidental damage or battery depletion. It gives priority access to telephone technical support from Apple. Such offerings by the companies provide consumers with customized policies for a specific gadget, driving market growth.

Based on sales channel, the market is segmented into retail and online. The retail segment held the largest China Gadget Insurance market share in 2023 China gadget insurance market share in 2023. Based on end user, the market is segmented into businesses and individuals. The individual segment held the largest share in the China gadget insurance market share in 2023.

The retail insurance sales channel plays a crucial role in the promising gadget insurance market in China, which has seen significant growth due to the increasing penetration of electronic devices among consumers. As the demand for gadgets such as smartphones, laptops, and cameras rises, the need for insurance products that protect these investments from risks like theft, accidental damage, and mechanical failure increases. In China, the gadget insurance market is characterized by a diverse range of products tailored to various device types, including mobile phones, tablets, laptops, and home entertainment systems. Retailers are strategically positioned to offer these insurance products at the point of sale, providing consumers with immediate options to safeguard their purchases.

AT&T, Apple Inc., ASSURANT, INC., AmTrust Financial, HDFC ERGO General Insurance Company Limited, Chubb, ICICI Group, AXA, Zurich General Insurance Company (China) Limited, Samsung, and HUAWEI Care are among the prominent players profiled in the China gadget insurance market report. The China gadget insurance market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases.

The overall China gadget insurance market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the China gadget insurance market analysis. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the market.

Strategic insights for the China Gadget Insurance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.40 Billion |

| Market Size by 2031 | US$ 20.49 Billion |

| Global CAGR (2023 - 2031) | 15.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | China

|

| Market leaders and key company profiles |

The geographic scope of the China Gadget Insurance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The China Gadget Insurance Market is valued at US$ 6.40 Billion in 2023, it is projected to reach US$ 20.49 Billion by 2031.

As per our report China Gadget Insurance Market, the market size is valued at US$ 6.40 Billion in 2023, projecting it to reach US$ 20.49 Billion by 2031. This translates to a CAGR of approximately 15.6% during the forecast period.

The China Gadget Insurance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the China Gadget Insurance Market report:

The China Gadget Insurance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The China Gadget Insurance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the China Gadget Insurance Market value chain can benefit from the information contained in a comprehensive market report.