Benelux Automotive Composites Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031215 | Category: Chemicals and Materials

No. of Pages: 150 | Report Code: BMIRE00031215 | Category: Chemicals and Materials

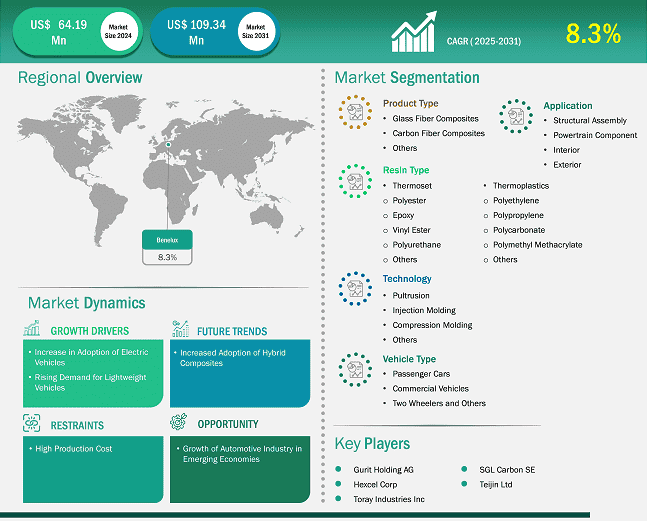

The Automotive Composites Market size is expected to reach US$ 109.34 million by 2031 from US$ 64.19 million in 2024. The market is estimated to record a CAGR of 8.3% from 2025 to 2031.

The demand for automotive composites in Belgium, the Netherlands, and Luxembourg is growing steadily, driven by advancements in the automotive industry. The region's strong industrial base is in the automotive manufacturing sector. This leads to an increased need for automotive composites. Thus, the region attracts several automotive companies to commence their operations. For instance, in January 2024, KW automotive GmbH expanded its business operations by launching its manufacturing facility in Benelux to strengthen its position in the market in Europe.

Key segments that contributed to the derivation of the automotive composites market analysis are product type, resin type, technology, vehicle type, and application.

There is an increased shift towards electric vehicles (EVs) in the region due to increased environmental regulation. For instance, the electric vehicle (EV) industry in Belgium presents numerous opportunities for US companies anticipating to grow or enter the market in Belgium. In the upcoming years, the nation's EV market is expected to increase significantly due to supportive government regulations, reduced battery prices, and rising customer awareness. There are opportunities in the manufacture, innovation, retrofitting, and recycling of batteries, EV charging infrastructure, advanced vehicle components and inputs, and other technology transition-related fields. Such growth in the automotive sector and increased adoption of EVs in the region is expected to propel the demand for automotive composites over the forecast period.

Based on region, the Benelux automotive composites market is further segmented into Belgium, the Netherlands, and Luxembourg. Belgium held the largest share in 2024.

The automotive composites market in Belgium is witnessing significant growth attributed to favorable government policies and initiatives. The Belgian government is prioritizing the automotive sector as a critical revenue generator by encouraging foreign direct investments (FDIs) in the automotive industry, which boosts local production capabilities and infrastructure development. For instance, according to the International Organization of Motor Vehicle Manufacturers, automotive production in the country accounted for 3,32,103 units of vehicles in 2023, which grew by 27% from 2021 to 2023. Belgium's overall economic outlook is improving, with rising household purchasing power expected to lead to increased automobile sales, supporting higher production levels. The increasing automotive production propels the demand for automotive composites in the country.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 64.19 Million |

| Market Size by 2031 | US$ 109.34 Million |

| Global CAGR (2025 - 2031) | 8.3% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered | Benelux

|

| Market leaders and key company profiles |

Gurit Holding AG, Hexcel Corp, Mitsubishi Chemical Group Corp, SGL Carbon SE, Solvay SA, Teijin Ltd, DuPont de Nemours Inc, Toray Industries Inc, Atlas Fibre, and Elaghmore Advisor LLP are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Benelux Automotive Composites Market is valued at US$ 64.19 Million in 2024, it is projected to reach US$ 109.34 Million by 2031.

As per our report Benelux Automotive Composites Market, the market size is valued at US$ 64.19 Million in 2024, projecting it to reach US$ 109.34 Million by 2031. This translates to a CAGR of approximately 8.3% during the forecast period.

The Benelux Automotive Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Benelux Automotive Composites Market report:

The Benelux Automotive Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Benelux Automotive Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Benelux Automotive Composites Market value chain can benefit from the information contained in a comprehensive market report.