Benelux 3D and 4D Technology Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031274 | Category: Technology, Media and Telecommunications

No. of Pages: 150 | Report Code: BMIRE00031274 | Category: Technology, Media and Telecommunications

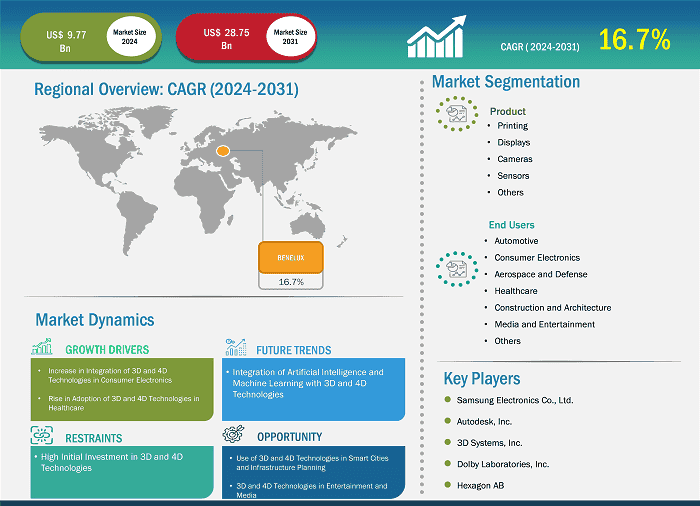

The Benelux 3D and 4D Technology Market size is expected to reach US$ 28.75 billion by 2031 from US$ 9.77 billion in 2024. The market is estimated to record a CAGR of 16.7% from 2024 to 2031.

The Benelux region—comprising Belgium, the Netherlands, and Luxembourg—is a hotspot for cutting-edge technological advancements, particularly in the realms of 3D and 4D technologies. These innovations are reshaping several key industries, including manufacturing, healthcare, architecture, and entertainment, driving significant economic growth and boosting productivity. The region's commitment to innovation and technological development, supported by its strong research and development initiatives, positions it as a global leader in 3D and 4D technological applications. The 3D technology market in the Benelux region is thriving, encompassing various applications that span 3D printing, 3D modeling, and visualization. The Benelux region is a prominent hub for additive manufacturing, and 3D printing has made significant strides across industries. Leading the way is Materialise, a Belgian company recognized for its sophisticated 3D printing solutions, particularly in aerospace, healthcare, and automotive industries. Materialise's offerings include prototyping, customized parts, and even medical implants, showcasing the versatility of 3D printing in diverse sectors. The Netherlands is also home to Ultimaker, a company that focuses on desktop 3D printers. Ultimaker has made 3D printing more accessible for small businesses, startups, and hobbyists by providing affordable and user-friendly solutions that allow users to create everything from simple prototypes to intricate mechanical components. Furthermore, Building Information Modeling (BIM), supported by 3D technologies, has become essential in the architecture and construction sectors, facilitating real-time data sharing and enhanced collaboration between architects, contractors, and engineers.

Key segments that contributed to the derivation of the 3D and 4D technology market analysis are product and end users.

While 3D technology has been a game-changer in many industries, the integration of 4D technology—which adds the dimension of time to 3D environments—is opening new frontiers for simulation, interactivity, and dynamic experiences. One of the most visible applications of 4D technology in the Benelux region is in the entertainment industry, particularly through 4D cinema experiences. Venues like Kinepolis in Belgium offer immersive movie experiences where the audience engages not only with 3D visuals but also with physical effects that are synchronized with the film's action. These physical effects include movement, vibrations, water sprays, scent diffusion, and wind effects, creating a fully immersive environment for the viewer. The integration of 4D in cinema has made film-watching more engaging and interactive, providing an emotional and physical connection that traditional cinema cannot achieve. The rise of 4D theaters in Belgium, the Netherlands, and Luxembourg has helped attract a new audience for experiential entertainment, contributing to the region's growing tourism and leisure sectors. Manufacturers in the Benelux are also exploring the potential of 4D technology for interactive prototyping and product development. In these cases, time-based simulations can show how products will behave and evolve under various conditions over time. In sectors such as automotive and aerospace, 4D simulations help engineers visualize the wear-and-tear of parts or how a material behaves under stress or temperature fluctuations. This helps reduce the development cycle, improves testing and validation, and leads to better products with enhanced durability and performance.

Based on Geography, the Benelux 3D and 4D technology market comprises of Belgium, the Netherlands, and Luxembourg. The Netherlands held the largest share in 2024.

The Benelux countries have a strong tradition of government support for research and development. This will continue to drive advancements in 3D and 4D technologies, especially in areas such as material science, new printing techniques, and interactive design tools. Investment in sustainable technologies will be a key priority, encouraging companies to explore ways to use renewable resources, recycled materials, and eco-friendly manufacturing methods in the production of 3D-printed goods. As sustainability becomes a central theme in the Benelux region, the focus on eco-friendly 3D printing materials and reduced waste in production will increase. Companies will adopt more efficient 3D printing techniques that minimize material usage and enhance the circular economy, further reducing their environmental footprint. This push for sustainability is supported by policies from the European Union, which encourages the development of green technologies and sustainable production methods, fostering innovation and adoption of 3D and 4D solutions that prioritize eco-friendly practices. 3D printing is expected to see further growth in the aerospace and automotive industries, where companies are exploring the use of additive manufacturing for lightweight parts and functional prototypes. This trend will reduce production costs, improve performance, and allow for the customization of components at a reduced cost.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 9.77 Billion |

| Market Size by 2031 | US$ 28.75 Billion |

| Global CAGR (2025 - 2031) | 16.7% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Benelux

|

Some of the key players operating in the market includes 3D Systems Corp, Autodesk Inc, Dassault Systemes SE, Dolby Laboratories Inc, Panasonic Holdings Corp, Materialise NV, Hexagon AB, BASLER AG, Samsung Electronics Co Ltd, and Stratasys Ltd among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisition to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conduct a significant number of primary interviews each year with industry stakeholders and experts to validate its data, analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Benelux 3D and 4D Technology Market Country and Regional Insights

Benelux 3D and 4D Technology Key Sources Referred:

The Benelux 3D and 4D Technology Market is valued at US$ 9.77 Billion in 2024, it is projected to reach US$ 28.75 Billion by 2031.

As per our report Benelux 3D and 4D Technology Market, the market size is valued at US$ 9.77 Billion in 2024, projecting it to reach US$ 28.75 Billion by 2031. This translates to a CAGR of approximately 16.7% during the forecast period.

The Benelux 3D and 4D Technology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Benelux 3D and 4D Technology Market report:

The Benelux 3D and 4D Technology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Benelux 3D and 4D Technology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Benelux 3D and 4D Technology Market value chain can benefit from the information contained in a comprehensive market report.