Automotive Composites Market Report (2021–2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031136 | Category: Chemicals and Materials

No. of Pages: 150 | Report Code: BMIRE00031136 | Category: Chemicals and Materials

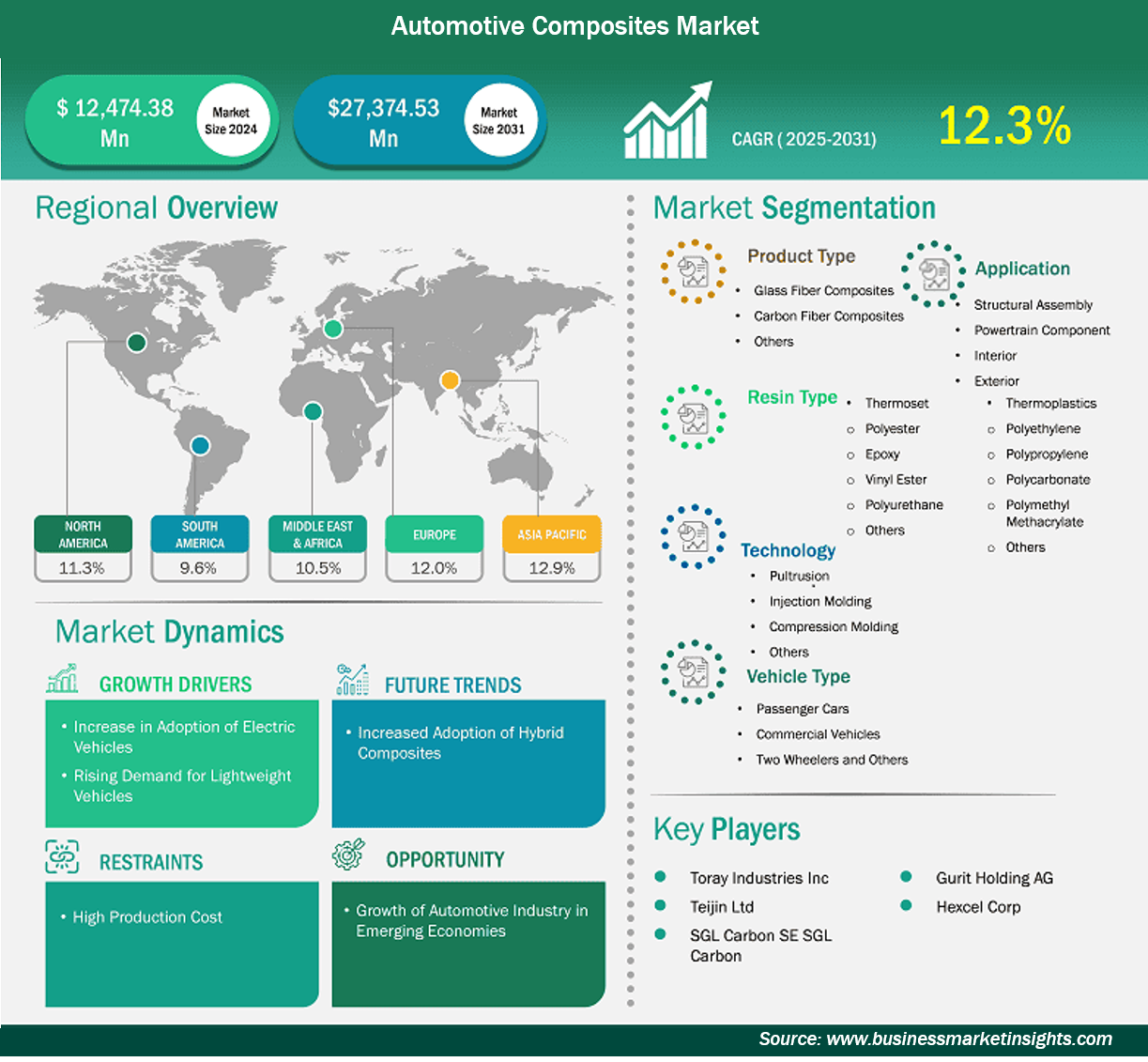

The Automotive Composites Market size is expected to reach US$ 27,374.53 million by 2031 from US$ 12,474.38 million in 2024. The market is estimated to record a CAGR of 12.3% from 2025 to 2031.

Automotive composites are lightweight materials made from a combination of fibers and resins used in vehicle manufacturing to reduce weight, enhance fuel efficiency, and improve performance. These composites help meet stringent environmental regulations and support the automotive industry's shift toward sustainability. The global automotive composites market is experiencing significant growth, driven by increasing demand for lightweight materials in autmotive industry to enhance fuel efficiency and meet stringent environmental regulations.

Governments worldwide are implementing stricter emission standards and fuel efficiency requirements. Automotive composites help reduce vehicle weight, which improves fuel efficiency and lowers CO2 emissions, helping manufacturers meet these regulations.

Key segments that contributed to the derivation of the automotive composites market analysis are type and application.

Increase in Adoption of Electric Vehicles

The rise in fuel prices and the environmental impact of conventional gasoline vehicles have paved the way for alternative fuel vehicles across the globe. Buyers are gradually getting inclined to use battery-powered or hybrid automobiles, which is anticipated to boost the demand for electric vehicles. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and the number is projected to grow by 35% in 2023 to reach 14 million. As the automotive industry witnesses a transformative shift toward electric vehicles (EVs), the role of composites has become more crucial. To promote the sale of EVs, governments are providing attractive laws and incentives. Reduced selling costs, no registration fees or minimal registration fees, and free EV infrastructure charging at various charging points are a few of these incentives. Furthermore, many countries worldwide exclude import, purchase, and road taxes due to multiple subsidies. These auto industry incentives have led to a rise in the manufacture of electric vehicles. Governments have also created beneficial policies and invested heavily in infrastructure. For example, the US government plans to spend US$ 87 billion on new highway construction over the next five years

Growth of Automotive Industry in Emerging Economies

In the last few years, the automotive industry has grown significantly across emerging economies such as Brazil, China, India, Mexico, and South Africa. With the increasing disposable income, the demand for both passenger and commercial vehicles is growing in developing countries. For instance, according to the Federation of Automobile Dealers Associations (FADA), in India, sales of passenger vehicles increased to 2,854,242 units in November 2023, compared with 2,409,535 units in November 2022. Similarly, according to the China Association of Automobile Manufacturers (CAAM), the sales of commercial vehicles accounted for 18.3% year-on-year for September 2023 in China. These stats show the increasing demand for vehicles.

The automotive industry also paved its way in Brazil and South Africa. According to the International Organization of Motor Vehicle Manufacturers (OICA), South Africa's automobile production increased by 24% to 555,889 units in 2022. According to the same source, Brazil was the largest manufacturer and exporter of light and commercial vehicles in 2023 in South & Central America. The country reported production of 2.3 million vehicles in 2022. Thus, the growth of automotive industries in emerging economies is expected to create lucrative opportunities for the automotive composites market growth.

Based on fiber type, the market is segmented into glass fiber composites, carbon fiber composites, and others. The glass fiber composites segment held the largest automotive composites market share in 2024. Glass fiber composites hold a dominant position in the automotive composites market owing to their performance, cost-effectiveness, and versatility. Glass fibers are widely utilized in automotive applications due to their excellent strength-to-weight ratio, high durability, and resistance to environmental factors such as moisture and chemicals.

In terms of application, the market is segmented into structural assembly, powertrain component, and interior. The interior segment held the largest automotive composites market share in 2024. The interior segment of the automotive composites market is witnessing significant innovation as manufacturers seek to improve vehicle aesthetics, comfort, safety, and overall performance. Composites are increasingly used for various interior components, including dashboards, door panels, seat structures, headliners, and center consoles.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 12,474.38 Million |

| Market Size by 2031 | US$ 27,374.53 Million |

| Global CAGR (2025 - 2031) | 12.3% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Automotive Composites Market

|

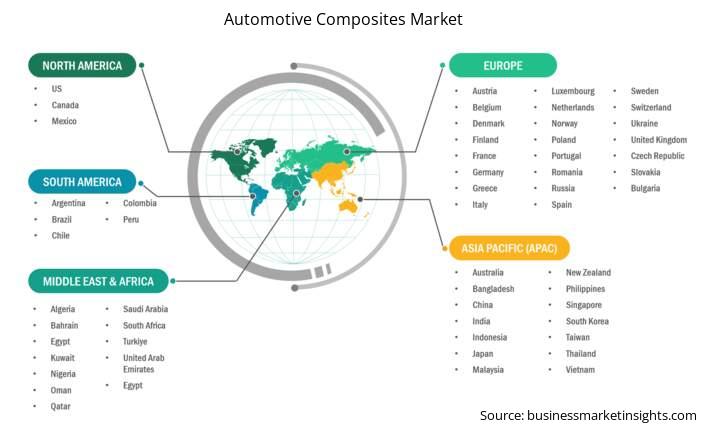

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The "Automotive Composites Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

Automotive Composites Market Country and Regional Insights

The geographical scope of the automotive composites market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The automotive composites market in Asia Pacific is expected to grow significantly during the forecast period.

The automotive composites market in Asia Pacific is experiencing robust growth, owing to the region's significant automotive production and increasing demand for lightweight, durable, and fuel-efficient vehicles. Asia Pacific is a key player in the global automotive industry, with the presence of some of the world's largest automotive manufacturers, such as Toyota, Honda, Hyundai, and Tata Motors. The demand for composites in this region is spurred by the need to reduce vehicle weight, improve fuel efficiency, and meet stringent environmental regulations, which are becoming increasingly important in countries such as China, India, Japan, and South Korea. According to a report published by Fastener World Inc., Asia Pacific experienced a significant increase in production volume from over 46 million units in 2021 to over 50 million units in 2022 and over 55 million units in 2023. The region is growing rapidly in the car market owing to the rising middle-class population and disposable income. It is the largest regional base for automobile production and home to the largest vehicle buyers. The top 5 automobile producing countries are China, with more than 30 million vehicles; Japan, with nearly 9 million vehicles; India, with ~5.9 million vehicles; South Korea, with more than 4 million vehicles; and Thailand, with nearly 1.9 million vehicles.

The automotive composites market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the automotive composites market are:

The Automotive Composites Market is valued at US$ 12,474.38 Million in 2024, it is projected to reach US$ 27,374.53 Million by 2031.

As per our report Automotive Composites Market, the market size is valued at US$ 12,474.38 Million in 2024, projecting it to reach US$ 27,374.53 Million by 2031. This translates to a CAGR of approximately 12.3% during the forecast period.

The Automotive Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Automotive Composites Market report:

The Automotive Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Automotive Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Automotive Composites Market value chain can benefit from the information contained in a comprehensive market report.