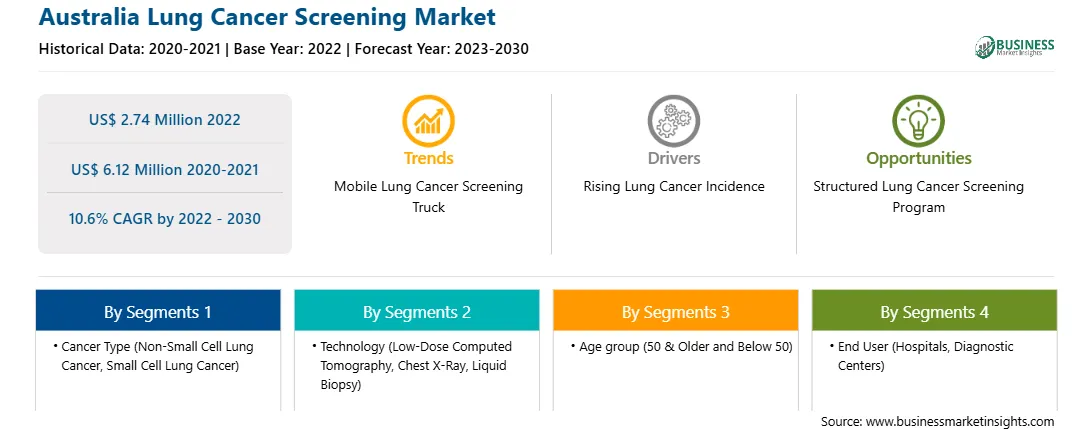

The Australia lung cancer screening market growth is attributed to the increasing Incidence of lung cancer and rising government support. However, uncertainties related to lung cancer screening trial with LDCT is hampering the growth of the Australia lung cancer screening market.

Lung cancer screening is a process used to detect lung cancer in otherwise healthy people with a high risk of lung cancer. Lung cancer screening is recommended for older adults who are long time smokers and who don't have any signs or symptoms of lung cancer. Doctors use a LDCT scan of the lungs to look for lung cancer. If lung cancer is detected early, it's more likely to be cured with treatment.

Australia faces unique challenges with lung cancer screening programs. A few examples of population-based Australian screening programs are "BreastScreen," the "National Bowel Cancer Screening Program," and the "National Cervical Screening Program." Therefore, there is a crucial requirement for a well-structured program such as a community-based program or a shared, informed decision-making program between clinicians and potential participants; accredited reporting centers; and a central data registry for quality control, monitoring, and outcome reporting. Additionally, integrated smoking cessation intervention, international data supporting cost-effectiveness, additional mortality benefits, and a high sustainability rate are a few factors that must be studied for lung cancer screening. Further, the International Association for the Study of Lung Cancer (IASLC) recommends implementing feasibility screening programs in the country without participating in lung cancer screening studies. These programs involve smoking cessation initiatives, standardized algorithms for selecting and managing screening participants, and specialist multidisciplinary teams to manage participants with positive screening results. Therefore, the implementation of structured lung cancer screening programs in the country is expected to be a lucrative opportunity in the Australia lung cancer screening market during the forecast period.

Based on cancer type, the Australia lung cancer screening market is bifurcated into NSCLC and small cell lung cancer. The NSCLC segment accounted for the largest market share in 2022 and is expected to grow at a CAGR of 10.3% during the forecast period. The market position of this segment is due to the rising cases of NSCLC in Australia. NSCLC develops more slowly than small cell lung cancer. It usually spreads to other parts of the patient's body by the time it is diagnosed. Therefore, early diagnosis and treatment are crucial. According to National Foundation for Cancer Research, NSCLC accounts for nearly 9 out of every 10 diagnoses. As per the same source, large-cell undifferentiated carcinoma lung cancer accounts for approximately 10–15% of all NSCLC diagnoses.

Based on technology, the Australia lung cancer screening market is segmented into LDCT, chest X-ray, liquid biopsy, and others. The chest X-ray segment accounted for the largest market share in 2022, however, the LDCT is expected to grow at a CAGR of 11.9% during the forecast period.

Based on age group, the Australia lung cancer screening market is bifurcated into 50 & older and below 50. The 50 & older segment accounted for the largest market share in 2022, however, the below 50 is expected to grow at a CAGR of 11.3% during the forecast period.

Based on end user, the Australia lung cancer screening market is segmented into hospitals, diagnostic centers, and others. The hospitals segment accounted for the largest market share in 2022, however, the others is expected to grow at a CAGR of 11.1% during the forecast period.

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Australia lung cancer screening market. A few recent key market developments are listed below:

In June 2022, Royal Philips teamed up with Biodesix, Inc. to incorporate the results of Biodesix’s Nodify Lung blood-based lung nodule risk assessment testing into Philips Lung Cancer Orchestrator lung cancer patient management system. The incorporation of proteomics data along with the radiologic and patient history data currently used to determine treatment decisions can help create diagnostic efficiency for cancer care centers in the management of a growing number of lung nodule cases via the contextual launch of Biodesix Nodify Lung application within Lung Cancer Orchestrator.

In August 2022, Intelerad Medical Systems acquired of PenRad Technologies, Inc., a software provider for enhancing breast imaging and lung screening productivity. The acquisition has expanded Intelerad’s product offerings for mammography and lung analytics, optimizing workflow for radiologists and boosting patient health outcomes.

Strategic insights for the Australia Lung Cancer Screening provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.74 Million |

| Market Size by 2030 | US$ 6.12 Million |

| Global CAGR (2022 - 2030) | 10.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Cancer Type

|

| Regions and Countries Covered | Australia

|

| Market leaders and key company profiles |

The geographic scope of the Australia Lung Cancer Screening refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Australia Lung Cancer Screening Market is valued at US$ 2.74 Million in 2022, it is projected to reach US$ 6.12 Million by 2030.

As per our report Australia Lung Cancer Screening Market, the market size is valued at US$ 2.74 Million in 2022, projecting it to reach US$ 6.12 Million by 2030. This translates to a CAGR of approximately 10.6% during the forecast period.

The Australia Lung Cancer Screening Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Australia Lung Cancer Screening Market report:

The Australia Lung Cancer Screening Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Australia Lung Cancer Screening Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Australia Lung Cancer Screening Market value chain can benefit from the information contained in a comprehensive market report.