Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market

No. of Pages: 118 | Report Code: BMIRE00031055 | Category: Electronics and Semiconductor

No. of Pages: 118 | Report Code: BMIRE00031055 | Category: Electronics and Semiconductor

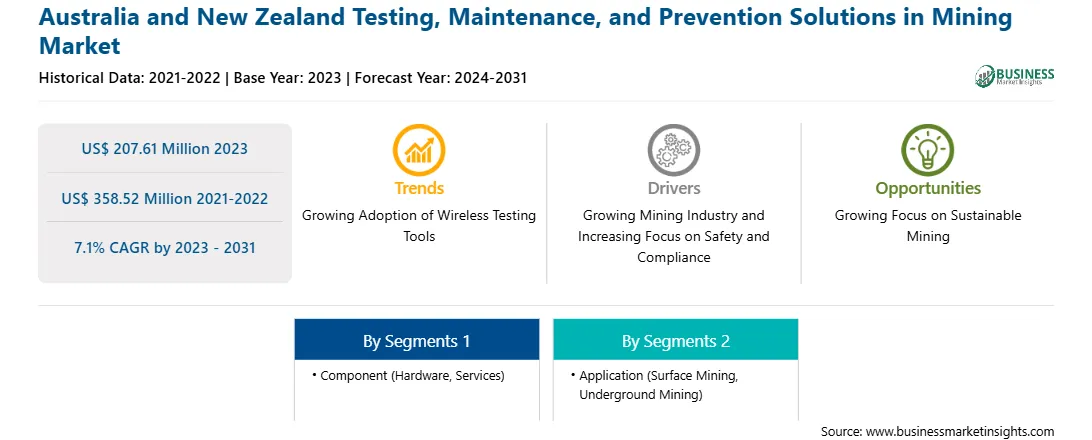

The Australia and New Zealand testing, maintenance, and prevention solutions in mining market size was valued at US$ 207.61 million in 2023 and is expected to reach US$ 358.52 million by 2031; it is estimated to record a CAGR of 7.1% from 2023 to 2031.

The Australia and New Zealand testing, maintenance, and prevention solutions in mining market is segmented into the Australia and New Zealand. The testing, maintenance, and prevention solutions in mining market in Australia's mining industry is driven by the increasing emphasis on quality in mining operations. Australia's mining industry is widely recognized for its historical significance and its position as a world leader in an industry at the forefront of innovations and sustainability. Per the Australian Bureau of Statistics, the mining industry contributed a record US$ 455 billion in export revenue for Australia in the financial year 2022–2023, highlighting that the industry's emphasis on extracting and processing minerals has made it a significant player in meeting the increasing global demand for resources.

The growing government investment in the country is likely to fuel the need for testing, maintenance, and prevention solutions in the mining industry. Australia's mining industry is welcoming the federal government's commitment to support the search for new mineral bodies as the country competes with China and Indonesia in the crucial minerals field. In May 2024, the Australian Prime Minister announced the next federal budget that would have a US$ 566.1 million investment over ten years, beginning in 2024–2025, to deliver data, maps, and other tools to the resource mining industry to aid in discoveries.

The testing, maintenance, and prevention solutions in mining market in New Zealand's mining industry is witnessing significant growth driven by various factors that enhance operational efficiency, safety, and environmental sustainability. The mining sector in New Zealand, though smaller than that of its regional neighbor Australia, continues to be a vital contributor to the national economy. For instance, in August 2023, per the data from economic consulting and forecasting company, Infometrics, New Zealand’s mining industry delivered over US$ 490,000 of GDP per filled job in the March 2023. Currently, as of August 2023, there are just over 2,000 full-time mining jobs in New Zealand. The country's government and companies are investing in state-of-the-art maintenance technologies to support new projects, improve efficiency, and enhance long-term profitability, driving the need for testing, maintenance, and prevention solutions in the mining industry. For instance, in June 2024, per the Minister of Resources, the government plans a new strategy that aims for 10 significant new mining operations by 2045 and doubling of export value to US$ 1.17 billion (NZ$ 2 billion). The strategy also calls for prioritizing economic gain and regional development over environmental protection.

Based on component, the Australia and New Zealand testing, maintenance, and prevention solutions in mining market is segmented into hardware and services. The hardware segment held the largest share in the Australia and New Zealand testing, maintenance, and prevention solutions in mining market in 2023. Hardware is an integral component of testing, maintenance, and prevention solutions within the mining industry that offers effectiveness and efficiency in mining operations. As the demand for sustainable, efficient, and cost-effective mining grows, mining companies are increasingly adopting advanced hardware solutions to enhance their equipment's performance, ensure safety, and minimize downtime. The hardware component comprises a wide range of hardware technologies designed to support the key pillars of testing, maintenance, and preventive actions in the mining industry during operations. Key hardware components include condition monitoring systems, inspection and testing tools, predictive maintenance hardware, safety and environmental monitoring systems, and asset tracking and fleet management hardware. Furthermore, key firms operating in the testing, maintenance, and prevention solutions in mining market are undergoing strategic initiatives such as product launches to enhance their product portfolio and service offerings. For instance, in August 2024, Teledyne FLIR announced its plan to unveil advanced thermal imaging cameras for the mining industry at Electra Mining 2024. The company will demonstrate equipment focused on condition monitoring and early fire detection to improve efficiency and safety in the mining, utilities, and manufacturing industries. Teledyne FLIR's cameras are designed to detect thermal overload in mining operations before issues become critical.

Megger, Fluke, FLIR System, Testo, Yokogawa, Siemens, Honeywell, Ventia, SGS SA, and Metso are among the key Australia and New Zealand testing, maintenance, and prevention solutions in mining market players that are profiled in this market study.

The overall Australia and New Zealand testing, maintenance, and prevention solutions in mining market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Australia and New Zealand testing, maintenance, and prevention solutions in mining market size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Australia and New Zealand testing, maintenance, and prevention solutions in mining market.

Strategic insights for the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 207.61 Million |

| Market Size by 2031 | US$ 358.52 Million |

| Global CAGR (2023 - 2031) | 7.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Australia

|

| Market leaders and key company profiles |

The geographic scope of the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market is valued at US$ 207.61 Million in 2023, it is projected to reach US$ 358.52 Million by 2031.

As per our report Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market, the market size is valued at US$ 207.61 Million in 2023, projecting it to reach US$ 358.52 Million by 2031. This translates to a CAGR of approximately 7.1% during the forecast period.

The Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market report:

The Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Australia and New Zealand Testing, Maintenance, and Prevention Solutions in Mining Market value chain can benefit from the information contained in a comprehensive market report.