Asia Pacific comprises of various flourishing and strong economies such as China, Japan, India, Australia, South Korea, and rest of Asia Pacific region. The Asia Pacific xanthan gum market is expected to register a remarkable growth owing to growing number of food and beverage processing plants across various countries such as India, China, Japan, among others, emerging personal care and cosmetics industry in China, and South Korea, and growing utilization in oilfield applications. Moreover, rising consumption of natural and processed food and beverage items, as well as growing consumer health consciousness, are likely to propel the market growth across the region in the upcoming years. Furthermore, increasing demand for bakery and confectionary products in countries like China, India, Australia, Malaysia, and Vietnam also propelling the market growth. Gluten-free bakery products are gaining high popularity across the region due to growing health consciousness amongst the people. Xanthan-gum is used as a partial replacement to wheat flour in gluten-free bakery products. Thus, this factor is further anticipated to fuel the regional market growth over the forecast period.

The outbreak of COVID-19 is wreaking havoc on the economic growth of Asia Pacific. The severity of the consequences and impact is entirely dependent on the transmission of the novel coronavirus. Various governments in Asia Pacific are considering taking actions to limit the spread by imposing lockdowns, which is slowing down the operations of various industries in the region. This factor is anticipated to severely impact the growth of regional market. However, with increasing recovery rates, governments are easing out restrictions imposed on various industrial operations which is expected to create a positive impact for the growth of xanthan gum market across the region.

Strategic insights for the Asia Pacific Xanthan Gum provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

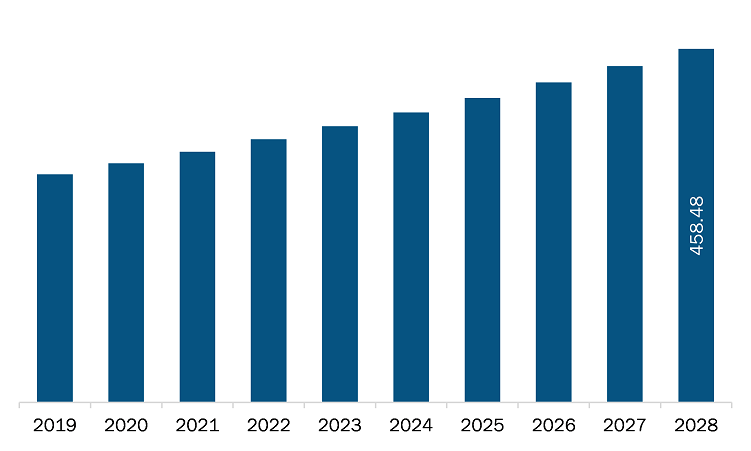

| Market size in 2021 | US$ 325.07 Million |

| Market Size by 2028 | US$ 458.48 Million |

| Global CAGR (2021 - 2028) | 5.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Xanthan Gum refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The xanthan gum market in Asia Pacific is expected to grow from US$ 325.07 million in 2021 to US$ 458.48 million by 2028; it is estimated to grow at a CAGR of 5.0% from 2021 to 2028. Xanthan gum is a common food additive that is used as a gluten alternative. Gluten is the protein that gives wheat flour its structure. Xanthan gum is typically used with non-gluten-containing flour to produce gluten-free goods with good structure and texture. This demand is driven by the growing awareness about health risks associated with gluten consumption, such as celiac disease, as well as FDA and USDA regulatory standards limiting the amount of gluten in food products. For instance, according to the FDA's gluten-free food labeling rule, all products labeled "gluten-free," "no gluten," "free of gluten," or "without gluten" must have fewer than 20 parts per million (ppm) of gluten. Moreover, xanthan gum is a vital gluten-free baking ingredient because it helps baked goods hold together and develop elasticity. Further, xanthan gum is used in gluten-free baking for various products, including cakes and pancakes, cookies, muffins, quick bread, pizza dough, bread, and salad dressings. Among these, xanthan gum is often utilized in the making of pizza dough. The nutritional value of xanthan gum, which includes carbs and fiber, also increases its acceptability. In addition, xanthan gum is used in gluten-free products to improve the texture and shelf life. It works similarly to gluten in terms of keeping baked goods moist and soft. However, gluten, which accounts for around 75% of the protein in wheat, barley, and rye, can cause significant intestine damage and raise the risk of cardiovascular events in celiac disease patients. Hence, consumers facing gluten-intolerance issues and other health-related problems caused due to gluten are demanding gluten-free products, which is further raising the demand for gluten-free food products, thereby boosting the xanthan gum market.

In terms of form, the dry segment held a larger share in 2020. Based on application, food and beverages segment held the largest share in 2020.

A few major primary and secondary sources referred to for preparing this report on the xanthan gum market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADM; Cargill, Incorporated; CP Kelco; Deosen; FUFENG GROUP; HEBEI XINHE BIOCHEMICAL CO. LTD; Ingredion Incorporated; Solvay; and UNIONCHEM among others.

The Asia Pacific Xanthan Gum Market is valued at US$ 325.07 Million in 2021, it is projected to reach US$ 458.48 Million by 2028.

As per our report Asia Pacific Xanthan Gum Market, the market size is valued at US$ 325.07 Million in 2021, projecting it to reach US$ 458.48 Million by 2028. This translates to a CAGR of approximately 5.0% during the forecast period.

The Asia Pacific Xanthan Gum Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Xanthan Gum Market report:

The Asia Pacific Xanthan Gum Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Xanthan Gum Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Xanthan Gum Market value chain can benefit from the information contained in a comprehensive market report.