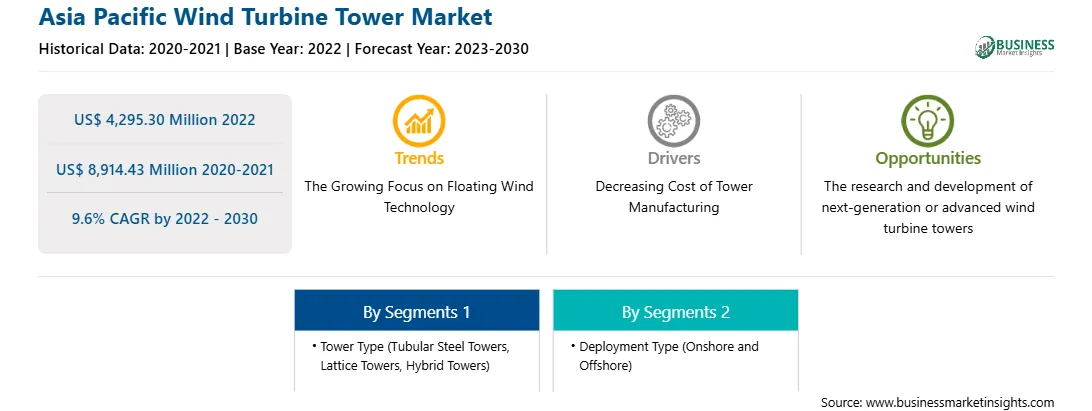

The Asia Pacific wind turbine tower market was valued at US$ 4,295.30 million in 2022 and is expected to reach US$ 8,914.43 million by 2030; it is estimated to grow at a CAGR of 9.6% from 2022 to 2030.

The demand for offshore wind turbine towers is growing, which allows the turbine to generate electricity in deep water. The floating wind technology is substantially competent in extreme conditions and, thus, capable of producing high power. This technology is being implemented globally across various countries, such as China, Japan, Germany, the UK, Belgium, Denmark, and France. Additionally, the growing demand for floating wind technology is due to the development in technological advancements and advantages linked with floating wind technology. Also, the mounting awareness regarding renewable energy in several countries is driving the demand for floating offshore wind energy, boosting the growth of the wind turbine tower market.

Moreover, governments of different countries have invested in several floating wind projects.

In 2023, Japan and Denmark collaborated to develop floating offshore wind turbine mass production technology. The goal is to combine their respective areas of competence to establish de facto global standards for the sector. The government, business, and academic institutions from both nations will work together on cost-cutting research projects under the new strategy. Universities, shipbuilders, and power firms in Japan are anticipated to participate. Further, in order to construct the 16.8 MW Goto floating offshore wind farm in Nagasaki prefecture, the Japan government chose a group of six businesses led by Toda Corp in 2021. It was the only bidder at the modest project's auction. Toda and its collaborators announced in September 2023 that flaws in a floating structure would cause the Goto project's launch to be delayed by two years, to January 2026. Before the end of March 2024, Japan is working on a new offshore wind power plan. Additionally, in 2023, Shanghai Electric Wind Power Group announced that China has completed the world's first offshore renewable energy project, which integrates deep-sea aquaculture with floating wind power.

In addition, in June 2022, Equinor collaborated with Technip Energies to develop floating wind steel SEMI substructures that accelerate technology development for floating offshore wind. Thus, as the demand for floating offshore wind farms strengthens globally, the necessity for wind turbine towers will also increase, fueling the wind turbine tower market growth in the coming years

Asia Pacific is one of the major regions in the wind turbine towers market owing to favorable government mandates and policies, growing investment in wind energy projects, and lowered cost of wind energy. China, India, Australia, South Korea, and Japan are some of the major markets in Asia Pacific for wind turbine towers. China, India, and Japan are the dominating countries holding a large share of the market, which is further estimated to increase during the forecast period. In Asia Pacific, China leads the wind turbine tower market, as it has the largest onshore market with 32,579 MW of new capacity additions in 2022. India aims at wind capacity additions of over 60 GW onshore and ~40 GW offshore by 2030. The country also focuses on the supply chain to strengthen the foothold of Indian wind manufacturers. Several global developers have manufacturing facilities in Asia Pacific, where they develop various components. In September 2022, Siemens Gamesa announced the expansion of their offshore Nacelle facility in Taichung, Taiwan. This facility will be tripled in size to ~90,000 sq.m., where the manufacturing of SG 14-222 DD offshore wind turbines will take place. In 2023, the China Three Gorges Corporation launched an offshore wind farm utilizing 16 MW turbines in China's Fujian province. As per the Clean Energy Council, in Australia, there were 14 onshore wind projects with over 1,200 turbines projected or under construction in 2023. A Marubeni-led consortium introduced large-scale commercial offshore wind operations at Noshiro Port and Akita Port in late 2022 and early 2023 in Japan. Thus, such expansions by the global players in Asia Pacific will further increase the growth of the wind turbine tower market during the forecast period.

Strategic insights for the Asia Pacific Wind Turbine Tower provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,295.30 Million |

| Market Size by 2030 | US$ 8,914.43 Million |

| Global CAGR (2022 - 2030) | 9.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Tower Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Wind Turbine Tower refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific wind turbine tower market is segmented based on tower type, deployment type, and country. Based on tower type, the Asia Pacific wind turbine tower market is segmented into tubular steel towers, lattice towers, and hybrid towers. The tubular steel towers segment held the largest market share in 2022.

In terms of deployment type, the Asia Pacific wind turbine tower market is bifurcated into onshore services and offshore services. The onshore services held a larger market share in 2022.

Based on country, the Asia Pacific wind turbine tower market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific wind turbine tower market share in 2022.

Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, Valmont Industries Inc, Nordex SE, Dongkuk Structures & Construction Co Ltd, and Cs Wind Corp, are some of the leading companies operating in the Asia Pacific wind turbine tower market.

1. Vestas Wind Systems AS

2. Siemens Gamesa Renewable Energy SA

3. Valmont Industries Inc

4. Nordex SE

5. Dongkuk Structures & Construction Co Ltd

6. Cs Wind Corp

The Asia Pacific Wind Turbine Tower Market is valued at US$ 4,295.30 Million in 2022, it is projected to reach US$ 8,914.43 Million by 2030.

As per our report Asia Pacific Wind Turbine Tower Market, the market size is valued at US$ 4,295.30 Million in 2022, projecting it to reach US$ 8,914.43 Million by 2030. This translates to a CAGR of approximately 9.6% during the forecast period.

The Asia Pacific Wind Turbine Tower Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Wind Turbine Tower Market report:

The Asia Pacific Wind Turbine Tower Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Wind Turbine Tower Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Wind Turbine Tower Market value chain can benefit from the information contained in a comprehensive market report.