Asia Pacific Well Completion Equipment and Services Market

No. of Pages: 133 | Report Code: TIPRE00026080 | Category: Manufacturing and Construction

No. of Pages: 133 | Report Code: TIPRE00026080 | Category: Manufacturing and Construction

The well completion market in Asia Pacific is dominated by China due to large-scale oil and gas production activities ongoing in the country, high investments in completion equipment and services, and partnerships of foreign companies with government organizations. Large oil companies in China, such as PetroChina and Sinopec, have started research on staged fracturing completion in open hole horizontal wells technology and initially carried out field tests and applications. Emerging technologies are likely to create opportunities for oil & gas companies by lowering the cost of extraction. Factors such as increasing production of conventional and unconventional hydrocarbons and rising demand for oil & gas with crude oil will propel the demand of well completion equipment. Furthermore, players such as CNOOC, ONGC, and Petronas are expected to raise their exploration and production (E&P) expenditure and contribute towards the growth of well completion equipment market as the usage of the drilling & completion fluids depends directly upon the drilling & well completion activities.

The outbreak of the COVID-19 has drastically disrupted the supply chain and manufacturing of industrial equipment. The emergence of COVID-19 virus across Europe which led to lockdown scenarios has led the industry experts to analyze that the industry would face up to a quarter of lag in industrial equipment supply chain. This disruption is expected to create tremors through 2020 till mid-2021. The manufacturing industry is likely to pick up pace sooner as governments across Europe lifted the various containment measure steadily to revive the economy. The production of the industrial equipment is anticipated to gain pace from 2021 which is further foreseen to positively influence the industrial equipment manufacturing including well completion equipment and services. As a result, the European well completion equipment and services market is expected to grow significantly in the coming years.

Strategic insights for the Asia Pacific Well Completion Equipment and Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,386.10 Million |

| Market Size by 2028 | US$ 2,056.02 Million |

| Global CAGR (2021 - 2028) | 5.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Well Completion Equipment and Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

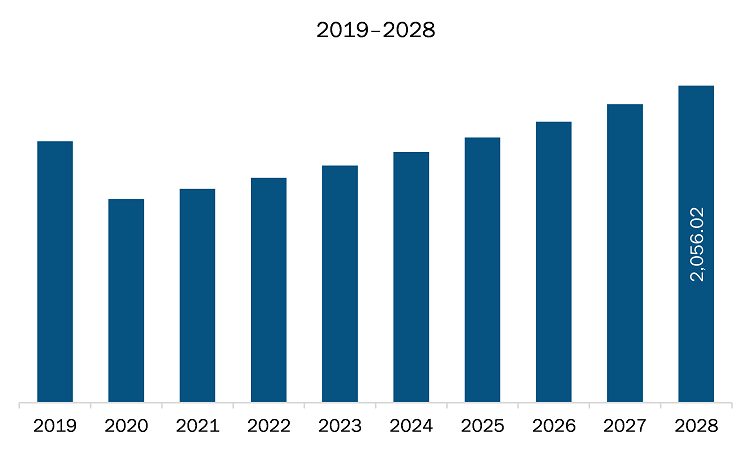

The well completion equipment and services market in Asia Pacific is expected to grow from US$ 1,386.10 million in 2021 to US$ 2,056.02 million by 2028; it is estimated to grow at a CAGR of 5.8% from 2021 to 2028. Resuming of shale gas operations; after a huge industrial crisis, the shale gas industry has resumed its operations and started recovering from the challenges faced during FY 2020. As most of the operations were on hold during FY 2020, the vendors are also focusing on Fracking 2.0. This is due to the increase in demand for natural gas in past few years, owing to rising energy consumption across the region and the surging number of gas rig exploration. This is positively impacting the demand for well completion services & equipment across different gas rig locations, thereby driving the market. This is expected to be one of the major factors aiding the growth of the Asia Pacific well completion equipment & services market. This is bolstering the growth of the well completion equipment and services market.

Based on the offerings, the well completion equipment and services market are segmented into equipment and services. In 2020, the services segment held the largest share Asia Pacific well completion equipment and services market. Based on equipment the market is divided into packers, sand control tools, multistage fracturing tools, liner hangers, smart wells, valves, control devices, and others. In 2020, the packers segment held the largest share Asia Pacific well completion equipment and services market. Based on location, the well completion equipment and services market, is segmented into onshore and offshore. The onshore segment accounts for largest market share in the 2020.

A few major primary and secondary sources referred to for preparing this report on the well completion equipment and services market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Baker Hughes Company; Halliburton Company; Nov Inc.; Royal Dutch Shell PLC; RPC Incorporated; Schlumberger; and Welltec among others.

The Asia Pacific Well Completion Equipment and Services Market is valued at US$ 1,386.10 Million in 2021, it is projected to reach US$ 2,056.02 Million by 2028.

As per our report Asia Pacific Well Completion Equipment and Services Market, the market size is valued at US$ 1,386.10 Million in 2021, projecting it to reach US$ 2,056.02 Million by 2028. This translates to a CAGR of approximately 5.8% during the forecast period.

The Asia Pacific Well Completion Equipment and Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Well Completion Equipment and Services Market report:

The Asia Pacific Well Completion Equipment and Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Well Completion Equipment and Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Well Completion Equipment and Services Market value chain can benefit from the information contained in a comprehensive market report.