Asia Pacific Water Treatment System Market

No. of Pages: 146 | Report Code: BMIRE00030986 | Category: Electronics and Semiconductor

No. of Pages: 146 | Report Code: BMIRE00030986 | Category: Electronics and Semiconductor

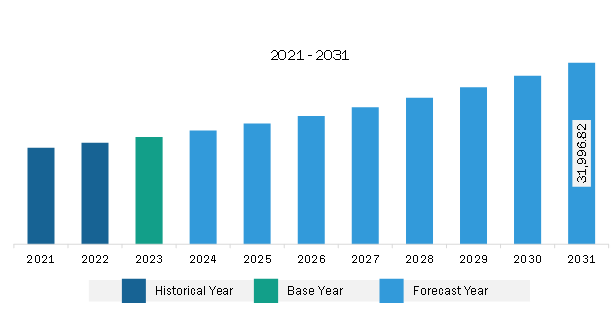

The Asia Pacific water treatment system market was valued at US$ 18,911.67 million in 2023 and is expected to reach US$ 31,996.82 million by 2031; it is estimated to register a CAGR of 6.8% from 2023 to 2031.

Adequate water supply, proper sanitation, including wastewater management, and assured clean drinking water availability are a few of the requirements of a smart city. Developing new infrastructures such as universities, schools, housing, and IT data centers requires a high level of water and wastewater treatment facilities. For instance, in 2023, Kerala Water Authority and the city corporation initiated a project on utilizing Japanese decentralized wastewater treatment plants known as "Johkasou" in the city. Thus, the development of smart cities is anticipated to bring new trends in the water treatment systems market.

China, India, Australia, Japan, and South Korea are among the key countries in the Asia Pacific water treatment systems market. High population growth in China and India, rapid industrialization, rise in awareness regarding water pollution, and government financing are contributing to the growth of the water treatment systems market in Asia Pacific. As per the Asian Water Development Outlook 2020 report by the Asian Development Bank (ADB), ~1.5 billion people in rural areas and ~0.6 billion people in urban areas lacked access to sufficient water supply and hygiene. Additionally, the majority of the ADB members are confronting key water quality concerns. Several governments in Asia Pacific are taking initiatives to develop standards and techniques for deploying water treatment systems. Rapid urbanization and demand for clean water from water-driven industries are among the prime factors propelling the growth of the water treatment systems market in emerging economies in Asia Pacific. In March 2024, Brihanmumbai Municipal Corporation awarded a contract to Welspun Enterprises in Mumbai, India, to develop and operate a water treatment plant with the capacity to process 2,000 million liters daily. Thus, rising infrastructure development and increasing government focus on upgrading the aging water treatment facilities and building new ones are anticipated to propel the growth of the water treatment systems market in Asia Pacific.

Strategic insights for the Asia Pacific Water Treatment System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 18,911.67 Million |

| Market Size by 2031 | US$ 31,996.82 Million |

| Global CAGR (2023 - 2031) | 6.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Filtration Process

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Water Treatment System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific water treatment system market is categorized into filtration process, type, application, end user, and country.

Based on filtration process, the Asia Pacific water treatment system market is segmented distillation, ultra-violet sterilization, reverse osmosis, filtration, ion-exchange, and others. The reverse osmosis segment held the largest market share in 2023.

In terms of type, the Asia Pacific water treatment system market is categorized into drinking water treatment system, industrial water treatment systems, wastewater treatment systems, portable water treatment systems, and well water treatment systems. The drinking water treatment system segment held the largest market share in 2023.

By application, the Asia Pacific water treatment system market is segmented into ground water, brackish and sea water desalination, rainwater harvesting, drinking water, and others. The drinking water segment held the largest market share in 2023.

By end user, the Asia Pacific water treatment system market is segmented into residential, municipal, agriculture, food and beverage, commercial, mining and metal, oil and gas, pharmaceuticals, and others. The municipal segment held the largest market share in 2023.

By country, the Asia Pacific water treatment system market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific water treatment system market share in 2023.

3M Co, Aqua Filsep Inc., Aquatech International LLC., Culligan International Co, DuPont de Nemours Inc, Filtra-Systems Company LLC, Hitachi Zosen Corporation, Pall Corp, Pentair Plc, Rite Water Solutions (India) Pvt. Ltd., Thermax Limited, Thermo Fisher Scientific Inc, Veolia Environnement SA, and Xylem Inc are some of the leading companies operating in the Asia Pacific water treatment system market.

The Asia Pacific Water Treatment System Market is valued at US$ 18,911.67 Million in 2023, it is projected to reach US$ 31,996.82 Million by 2031.

As per our report Asia Pacific Water Treatment System Market, the market size is valued at US$ 18,911.67 Million in 2023, projecting it to reach US$ 31,996.82 Million by 2031. This translates to a CAGR of approximately 6.8% during the forecast period.

The Asia Pacific Water Treatment System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Water Treatment System Market report:

The Asia Pacific Water Treatment System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Water Treatment System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Water Treatment System Market value chain can benefit from the information contained in a comprehensive market report.