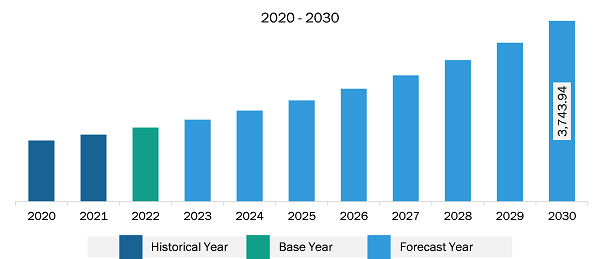

The Asia Pacific voice-based payments market was valued at US$ 1,532.49 million in 2022 and is expected to reach US$ 3,743.94 million by 2030; it is estimated to register a CAGR of 11.8% from 2022 to 2030.

Artificial intelligence (AI), with its ability to perform cognitive functions associated with human minds, offers a range of capabilities that can enhance and optimize voice-based payment systems. AI-powered voice assistants can use algorithms to understand better and interpret user commands, leading to more accurate and seamless voice-based payment experiences. This can enhance user satisfaction and increase the adoption of voice-based payment solutions. AI can also contribute to enhanced security in voice-based payments. By analyzing patterns and behaviors, AI algorithms can detect and prevent fraudulent activities, providing an additional layer of protection for users. This can help build trust in voice-based payment systems, encouraging more individuals to adopt this payment method. Therefore, the adoption of AI is expected to present significant opportunities for the voice-based payments market.

The Asia Pacific voice-based payment market is further segmented into Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific. Governments of various countries in Asia Pacific have played a proactive role in advancing digital payment methods, especially in emerging markets. These efforts are aimed at driving economic growth, reducing cash usage, and enhancing financial inclusion. For instance, the Government of India has introduced pioneering policies and initiatives such as the Bharat Interface for Money (BHIM) and Unified Payments Interface (UPI), making digital payments more accessible and convenient for its citizens. Similarly, the Japanese government is promoting the transition from a cash-dominated society to a digital transactions-driven economy. In September 2022, the Japanese government announced the implementation of a system for companies to digitally pay their salaries without going through bank accounts by 2023. Also, various companies in Asia Pacific are launching voice-based payment methods. For example, in September 2023, the National Payments Corporation of India (NPCI) launched new payment options on UPI, including voice-based transactions. The governor of the Reserve Bank of India (RBI) announced the launch of this product by the NPCI at the Global Fintech Festival. Therefore, government initiatives and the launch of voice-based payment methods are fueling the voice-based payment market growth in Asia Pacific.

Strategic insights for the Asia Pacific Voice-Based Payments provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,532.49 Million |

| Market Size by 2030 | US$ 3,743.94 Million |

| Global CAGR (2022 - 2030) | 11.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Voice-Based Payments refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific voice-based payments market is categorized into component, enterprise size, industry, and country.

Based on component, the Asia Pacific voice-based payments market is segmented into software and hardware. The software segment held a larger market share in 2022.

In terms of enterprise size, the Asia Pacific voice-based payments market is segmented into large enterprises and SMEs. The large enterprises segment held a larger market share in 2022.

Based on industry, the Asia Pacific voice-based payments market is segmented into BFSI, automotive, healthcare, retail, government, and others. The BFSI segment held the largest market share in 2022.

By country, the Asia Pacific voice-based payments market is segmented into China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific voice-based payments market share in 2022.

Amazon.com Inc, Cerence Inc, Google LLC, Huawei Technologies Co Ltd, National Payments Corporation of India (NPCI), NCR VOYIX Corp, PayPal Holdings Inc, and PCI Pal are some of the leading companies operating in the Asia Pacific voice-based payments market.

The Asia Pacific Voice-Based Payments Market is valued at US$ 1,532.49 Million in 2022, it is projected to reach US$ 3,743.94 Million by 2030.

As per our report Asia Pacific Voice-Based Payments Market, the market size is valued at US$ 1,532.49 Million in 2022, projecting it to reach US$ 3,743.94 Million by 2030. This translates to a CAGR of approximately 11.8% during the forecast period.

The Asia Pacific Voice-Based Payments Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Voice-Based Payments Market report:

The Asia Pacific Voice-Based Payments Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Voice-Based Payments Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Voice-Based Payments Market value chain can benefit from the information contained in a comprehensive market report.