The vessel monitoring system (VMS) is a satellite-based monitoring system providing data to end-user (operators of fishing vessels, cargo vessels) related to location, speed, and course of vessels. The VMS is heavily used for fisheries management. This system also finds its application in service vessels, passenger ships, and ferries. The fisheries managers have begun using VMS decades ago to track exact locations and monitor the fishing vessels' activity to strengthen the effectiveness of fisheries management measures. The VMS gathers vessel positions with help from satellite signals and transmits data to the communication server, which is further communicated to the land-based station/room. By using VMS, the task of tracking vessel becomes easy and fast, and assist in preventing wrongdoing activities at sea. Countries such as Thailand and South Korea in APAC have started using VMS technology to monitor their vessels, ensuring that fisheries are carrying marine products legally. Factor such as increase in fisheries applications is expected to create significant demand for VMS which will drive the APAC vessel monitoring system market.

Furthermore, in case of COVID-19, APAC is highly affected specially China and India. The governments in APAC countries are taking possible steps to reduce its effects by announcing lockdown, which is negatively affecting the manufacturing sector hence affecting the APAC vessel monitoring system market. China, Japan, South Korea, India, Vietnam, Thailand, Indonesia are some major countries having well-established business of fisheries. However, disruption in supply chain has reduced the number of fishing vessels during the pandemic situation, which will negatively impact the installation of VMS in existing fishing vessels thereby affecting the vessel monitoring system market. Also, temporary shutdown of manufacturing units has decreased the procurement of fishing, cargo, and other vessels. This further impacted the APAC vessel monitoring system market. In respect to cargo vessels, China, Hong Kong, South Korea, and Japan are the top APAC export countries which have observed negative impact in their cargo shipment. Because of low demand and movement ban, the number of cargo vessels has fallen down drastically that further decreases installation of VMS.

Strategic insights for the Asia Pacific Vessel Monitoring System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

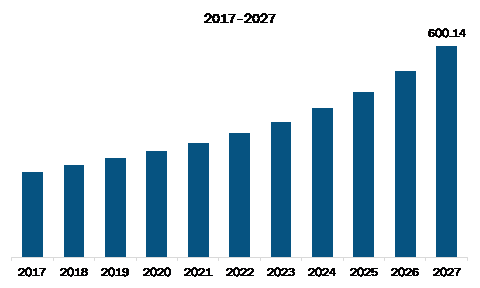

| Market size in 2019 | US$ 282.46 Million |

| Market Size by 2027 | US$ 600.14 Million |

| Global CAGR (2020 - 2027) | 10.3 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Vessel Monitoring System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC vessel monitoring system market is expected to grow from US$ 282.46 million in 2019 to US$ 600.14 million by 2027; it is estimated to grow at a CAGR of 10.3 % from 2020 to 2027. Merging advanced technologies with vessel monitoring system is expected to boost up the APAC vessel monitoring system market. Advancements in automatic identification system (AIS)-based tools for vessel tracking are expected to deliver new capabilities related to on-demand and actionable business intelligence. The upcoming advancements in tools will give the waterway users real-time solutions to various critical business process optimization challenges associated with each mile-marker, berth, terminal, anchorage and buoy. Each terminal has unique set of mandates, and all the relevant ship characteristics need to be compared with the present terminal condition & restrictions. This industry is now moving to enterprise terminal management tools that help in streamlining the dock scheduling process while making it simpler to match the existing ship & cargo characteristics with the restrictions of terminal dock. As automatic identification system and other relevant asset tracking solutions become a crucial part of the incident response plans, the industry is projected to see a significant return on investment. Advantages such as optimize and streamline operations while merging technologies with VMS will drive the APAC vessel monitoring system market.

In terms of application, the fisheries management segment accounted for the largest share of the APAC vessel monitoring system market in 2019. In terms of vessel type, the fishing vessels segment held a larger market share of APAC vessel monitoring system market in 2019.

A few major primary and secondary sources referred to for preparing this report on the APAC vessel monitoring system market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Addvalue Technologies; Applied Satellite Technology Ltd; Beijing Highlander Digital Technology Co., Ltd.; CLS Fisheries; ORBCOMM Inc.

The Asia Pacific Vessel Monitoring System Market is valued at US$ 282.46 Million in 2019, it is projected to reach US$ 600.14 Million by 2027.

As per our report Asia Pacific Vessel Monitoring System Market, the market size is valued at US$ 282.46 Million in 2019, projecting it to reach US$ 600.14 Million by 2027. This translates to a CAGR of approximately 10.3 % during the forecast period.

The Asia Pacific Vessel Monitoring System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Vessel Monitoring System Market report:

The Asia Pacific Vessel Monitoring System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Vessel Monitoring System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Vessel Monitoring System Market value chain can benefit from the information contained in a comprehensive market report.