Asia Pacific Upstream Bioprocessing Market

No. of Pages: 130 | Report Code: BMIRE00030685 | Category: Life Sciences

No. of Pages: 130 | Report Code: BMIRE00030685 | Category: Life Sciences

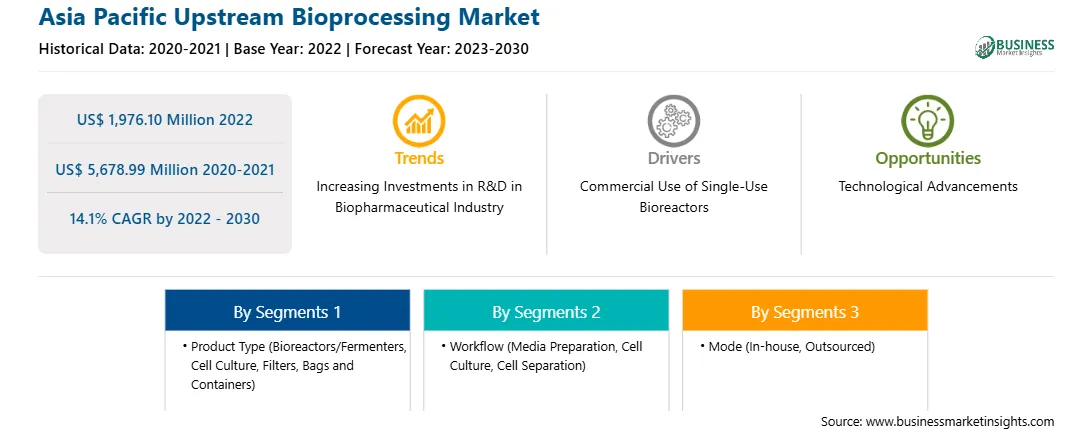

The Asia Pacific upstream bioprocessing market was valued at US$ 1,976.10 million in 2022 and is expected to reach US$ 5,678.99 million by 2030; it is estimated to grow at a CAGR of 14.1% from 2022 to 2030. Technological Advancements Boost Asia Pacific Upstream Bioprocessing Market.

The upstream bioprocessing market is experiencing a wave of technological advancements, presenting considerable industry opportunities. These advancements include innovative developments in cell culture systems, bioreactor design, process monitoring, and control, as well as the integration of automation and digitalization. In September 2023, Repligen Corporation and Sartorius introduced an integrated bioreactor system. Repligen's XCell Alternating Tangential Flow (ATF) upstream intensification technology has been integrated into the Sartorius Biostat stirred-tank reactor (STR). This bioreactor technology is designed to make the application of N perfusion and intensified seed train easier for biopharmaceutical firms. An embedded XCell ATF hardware and software module that combines integrated process analytical technologies with predefined advanced control recipes is incorporated into Biostat STR. This module is intended to simplify the management of cell growth and enhance cell retention in perfusion procedures, eliminating the need for a separate cell retention control tower. Such modern products feature enhanced process efficiency, scalability, and adaptability, which are crucial for meeting the evolving demands of biopharmaceutical production.

Advanced cell culture media formulations and next-generation bioreactor technologies are contributing to the optimization of upstream bioprocessing, in turn, enabling higher product yields, improved product quality, and the efficient production of complex biologics. The ongoing integration of advanced analytics and real-time process monitoring is revolutionizing data-driven decision-making in bioprocessing, driving precision and process optimization opportunities. Progress in biotechnology also fosters the development of flexible and modular manufacturing platforms. Additionally, the convergence of machine learning, artificial intelligence, and predictive analytics is paving the way for predictive bioprocessing, thereby unlocking proactive process control, quality assurance, and cost optimization opportunities. Thus, technological advancements in upstream bioprocessing are reshaping the industry, presenting new avenues for innovation, efficiency, and adaptability.Asia Pacific Upstream Bioprocessing Market Overview

The Asia Pacific upstream bioprocessing market is segmented into China, Japan, Australia, India, South Korea, and the Rest of Asia Pacific. The market in this region is expected to grow at the highest CAGR during 2022-2030. China, India, and Japan are three major contributors to the growth of the market in Asia Pacific, which is mainly driven by rising demand for bioreactors as well as an increase in research centers and government funding. Moreover, many international market players are focusing on countries in Asia Pacific for geographic expansion and other strategies.

Asia Pacific Upstream Bioprocessing Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Upstream Bioprocessing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Upstream Bioprocessing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Upstream Bioprocessing Strategic Insights

Asia Pacific Upstream Bioprocessing Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,976.10 Million

Market Size by 2030

US$ 5,678.99 Million

Global CAGR (2022 - 2030)

14.1%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Workflow

By Mode

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Upstream Bioprocessing Regional Insights

Asia Pacific Upstream Bioprocessing Market Segmentation

The Asia Pacific upstream bioprocessing market is segmented based on product type, workflow, usage type, mode, and country. Based on product type, the Asia Pacific upstream bioprocessing market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. The bioreactors/fermenters services held the largest market share in 2022.

Based on workflow, the Asia Pacific upstream bioprocessing market is categorized into media preparation, cell culture, and cell separation. The cell separation held the largest market share in 2022.

Based on usage type, the Asia Pacific upstream bioprocessing market is bifurcated into single-use and multi-use. The single-use held a larger market share in 2022.

Based on mode, the Asia Pacific upstream bioprocessing market is bifurcated into In-house and outsourced. The In-house held a larger market share in 2022.

Based on country, the Asia Pacific upstream bioprocessing market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific upstream bioprocessing market share in 2022.

Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, and Entegris Inc are some of the leading companies operating in the Asia Pacific upstream bioprocessing market.

1. Thermo Fisher Scientific Inc

2. Esco Micro Pte Ltd

3. Sartorius AG

4. Danaher Corp

5. Getinge AB

6. Merck KGaA

7. Corning Inc

8. Entegris Inc

The Asia Pacific Upstream Bioprocessing Market is valued at US$ 1,976.10 Million in 2022, it is projected to reach US$ 5,678.99 Million by 2030.

As per our report Asia Pacific Upstream Bioprocessing Market, the market size is valued at US$ 1,976.10 Million in 2022, projecting it to reach US$ 5,678.99 Million by 2030. This translates to a CAGR of approximately 14.1% during the forecast period.

The Asia Pacific Upstream Bioprocessing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Upstream Bioprocessing Market report:

The Asia Pacific Upstream Bioprocessing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Upstream Bioprocessing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Upstream Bioprocessing Market value chain can benefit from the information contained in a comprehensive market report.