Asia-Pacific Unified Endpoint Management Market

No. of Pages: 163 | Report Code: TIPRE00016326 | Category: Technology, Media and Telecommunications

No. of Pages: 163 | Report Code: TIPRE00016326 | Category: Technology, Media and Telecommunications

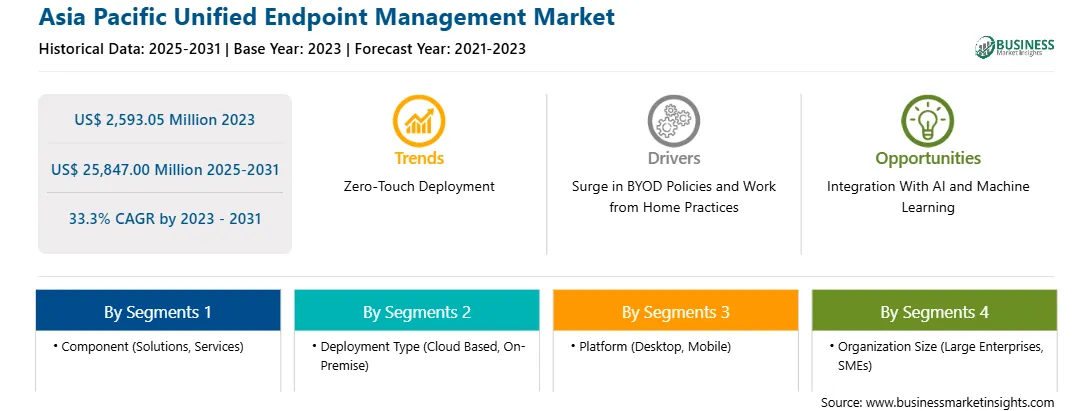

The Asia Pacific unified endpoint management market is expected to grow from US$ 1,949.00 million in 2022 to US$ 11,392.93 million by 2028. It is estimated to grow at a CAGR of 34.2% from 2022 to 2028.

Standardization of Data Protection Rules is Driving the Asia Pacific Unified Endpoint Management Market

Data protection rules and regulations have changed over the decade, owing to the incorporation of smart technologies and rise in the number of endpoint devices among companies. Moreover, international economic organizations such as the Organization for Economic Co-operation and Development (OECD), the Asia-Pacific Economic Cooperation (APEC) Forum developed their privacy policies regarding cross-border transfers of personal data. These policies help create international privacy and data protection standards to facilitate international trade but may be less stringent than the domestic laws of participating countries. Additionally, some new provisions are very similar to their GDPR counterparts. These include the right to be forgotten, the right to data portability, the requirement for periodic Data Protection Impact Assessments (DPIA), and reporting obligations in the event of a breach. Thus, the growing stringent rules pushed organizations toward more unified endpoint management approaches, is driving the Asia Pacific unified endpoint management market.

Asia Pacific Unified Endpoint Management Market Overview

Asian countries are witnessing the rapid development of data protection and cybersecurity laws. With individuals becoming occupied in new digital reality via mobile handsets and IoT, governments are moving toward digital identity programs and taking invasive approaches to electronic surveillance. In this respect, GDPR and data protection rules are gaining attention in the region. The introduction of Cyber Security Law with stringently enforced regulation ensures national data protection. In 2017, India introduced comprehensive data protection law, whereas China introduced a GDPR-inspired nonbinding national standard. The use of data privacy is also receiving importance across South East Asia. Malaysia, the Philippines, and Singapore have an environment of data protection laws and have established a data privacy regulatory authority. In contrast, Thailand has its data protection law.

The ASEAN on Digital Data Governance framework is a structure encompassed with 10 ASEAN member states handling data issues. The current proposals consist of a unified endpoint management framework and ASEAN's cross-border data flow mechanism. These factors and high data protection awareness would propel the installation of unified endpoint management software to secure massive data. Asia Pacific is expected to emerge as the fastest-growing region over the forecast period. The rising BYOD policies and cloud-based solutions and the increasing adoption of mobile devices and IoT applications across enterprises are among the major factors responsible for the regional unified endpoint management market growth. Additionally, the increase in digital workplace trends and modernization in data centers is anticipated to boost the Asia Pacific unified endpoint management market growth during the forecast period.

Large businesses and SMEs in Asia Pacific embrace cloud-based solutions frequently as cloud solutions help save money and resources. According to the 2021 CISCO Cybersecurity Series, Asia Pacific nations often host a bigger percentage of their infrastructures in the cloud rather than on-premises. For instance, compared to just 9% internationally, 16% of APAC companies have between 80 and 100% hosted. Further, 52% of organizations in Asia Pacific countries felt the ease of the use of cloud deployment, and 50% of the organizations in the region felt cloud deployment of endpoint solutions offers better data security. Such factors are contributing to the Asia Pacific unified endpoint management market growth.

Strategic insights for the Asia-Pacific Unified Endpoint Management provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,949.00 Million |

| Market Size by 2028 | US$ 11,392.93 Million |

| Global CAGR (2022 - 2028) | 34.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Unified Endpoint Management refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Unified Endpoint Management Market Segmentation

The Asia Pacific unified endpoint management market is segmented into by component, deployment type, platform, organization size and end-user.

Based on component, the Asia Pacific unified endpoint management market is segmented into solutions and services. The solutions segment held the larger market share in 2022.

Based on deployment type, the Asia Pacific unified endpoint management market is segmented into loud based and on-premise. The cloud based segment held the larger market share in 2022.

Based on platform, the Asia Pacific unified endpoint management market is segmented into desktop and mobile. The desktop segment dominated the market in 2022.

Based on organization size, the Asia Pacific unified endpoint management market is segmented into SMEs and large enterprises. The large enterprises segment dominated the market in 2022.

Based on end-user, the Asia Pacific unified endpoint management market is segmented into BFSI, government and defense, healthcare, IT and telecom, automotive and transportation, retail, manufacturing, and others. The IT and telecom segment dominated the market share in 2022.

Based on country, the Asia Pacific unified endpoint management market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the market share in 2022.

Citrix Systems, Inc.; IBM Corporation; Ivanti; MICROLAND LIMITED; Microsoft Corporation; SCALEFUSION; STEFANINI; TANGOE; and Zoho Corporation Pvt. Ltd. are the leading companies operating in the Asia Pacific unified endpoint management market.

The Asia-Pacific Unified Endpoint Management Market is valued at US$ 1,949.00 Million in 2022, it is projected to reach US$ 11,392.93 Million by 2028.

As per our report Asia-Pacific Unified Endpoint Management Market, the market size is valued at US$ 1,949.00 Million in 2022, projecting it to reach US$ 11,392.93 Million by 2028. This translates to a CAGR of approximately 34.2% during the forecast period.

The Asia-Pacific Unified Endpoint Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Unified Endpoint Management Market report:

The Asia-Pacific Unified Endpoint Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Unified Endpoint Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Unified Endpoint Management Market value chain can benefit from the information contained in a comprehensive market report.