Asia Pacific Type-C Tanks Market

No. of Pages: 196 | Report Code: BMIRE00030626 | Category: Manufacturing and Construction

No. of Pages: 196 | Report Code: BMIRE00030626 | Category: Manufacturing and Construction

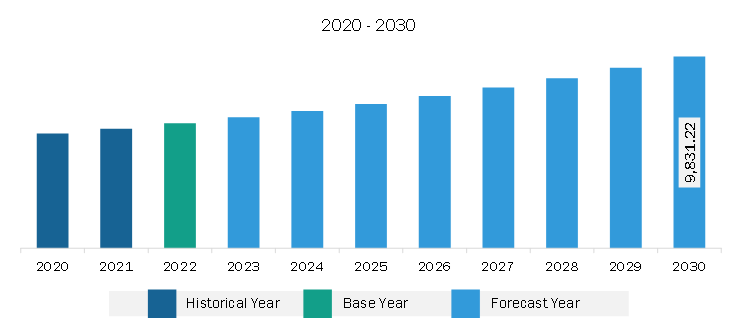

The Asia Pacific Type-C tanks market was valued at US$ 6,412.39 million in 2022 and is expected to reach US$ 9,831.22 million by 2030; it is estimated to register at a CAGR of 5.5% from 2022 to 2030.

Structural Efficiency to Support Pressure Vessel Requirement Boosts Asia Pacific Type-C Tanks Market

Type-C tanks are primarily designed and developed as cryogenic pressure vessels, leveraging conventional pressure vessel codes, and the prevalent design norm is vapor pressure. The design pressure for Type-C tanks ranges above 2,000 mbar (millibar). The most generic shapes for Type-C tanks are bi-lobe and cylindrical. Type-C tanks are used in the LNG carriers. Type-C tanks can stock LNG at a higher pressure than any Type A or Type B tanks; however, space optimization in these tanks is less. Type-C tanks do not need a secondary barrier, as it demonstrates limited risk of structural failure or leakage. Sensors are placed in the hold space to detect the leakage of cargo from the tanks. They can detect the variation in the composition of the dry air or inert gas to fuel vapor and leakages. Hence, leakage can be detected and prevented. Type-C tanks, which are primarily designed to withstand cryogenic temperatures, are often considered a feasible choice for LNG storage on marine vessels. Type-C tanks, usually 300–1000 m3 (cubic meter), -162°C below 10 bar, and less than 20 meters in height are appropriate to be applied for LNG. Thus, the structural advancement and advantages of leveraging Type-C tanks as LNG and LPG carriers drive the market.

Asia Pacific Type-C tanks Market Overview

‘The type-C tank market growth in Asia Pacific (APAC) is attributed by dynamic growth and strategic significance across diverse industries. Countries in APAC are experiencing a surge in energy demand due to rapid industrialization, necessitating the development of efficient energy infrastructure. With a robust energy demand, industrial expansion, and increased focus on sustainability, type-C tanks have become pivotal components in oil and gas transportation and storage. With a growing emphasis on sustainability, several APAC countries are investing substantially in renewable energy projects green hydrogen, highlighting the shift towards clean energy. Type-C tanks also find applications in renewable energy projects in APAC for transporting and storing renewable energy sources such as green hydrogen. Moreover, the demand for type-C tanks is gaining traction in petroleum plants and liquified gas facilities with the growing industrial sector in APAC, notably in countries such as China and India. Due to the convergence of energy demands, industrial expansion, and sustainability initiatives, type-C tanks are gaining high importance across this region's energy and petroleum landscape.

Asia Pacific Type-C Tanks Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Type-C Tanks provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Type-C Tanks refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Type-C Tanks Strategic Insights

Asia Pacific Type-C Tanks Report Scope

Report Attribute

Details

Market size in 2022

US$ 6,412.39 Million

Market Size by 2030

US$ 9,831.22 Million

Global CAGR (2022 - 2030)

5.5%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Tank Type

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Type-C Tanks Regional Insights

Asia Pacific Type-C Tanks Market Segmentation

The Asia Pacific Type-C tanks market is segmented based on tank type, application, end user, and country.

Based on tank type, the Asia Pacific Type-C tanks market is segmented into cylindrical, bi-lobe, and tri-lobe. The cylindrical segment held the largest share in 2022.

In terms of application, the Asia Pacific Type-C tanks market is bifurcated into cargo tanks and fuel tanks. The fuel tanks segment held a larger share in 2022.

By end user, the Asia Pacific Type-C tanks market is segmented into LNG, LPG, LH2, and ethanol. The LNG segment held the largest share in 2022.

Based on country, the Asia Pacific Type-C tanks market is categorized into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific Type-C tanks market in 2022.

Cryogas Equipment Pvt Ltd, Linde Plc, IHI Corp, McDermott International Ltd, China Intonational Marine Containers (Group) Co Ltd, Dongsung Finetec Co Ltd, Tianjin Sinogas Repower Energy Co Ltd, Shandong Zhongjie Special Equipment Co Ltd, Hebei Runfeng Cryogenic Equipment Co Ltd, Qixing Group Co Ltd, Corban Energy Group Corp, Furuise Europe Co SL, Suzhou Shenghui Equipment Co Ltd, INOX India Pvt Ltd, Chongqing Endurance Energy Equipment Integration Co Ltd, WOBO Industrial Group Corp, China Shipbuilding Trading Co Ltd, Jiangsu Watts Energy & Engineering Co Ltd, Henan Jian Shen Metal Material Co Ltd, MAN Energy Solutions SE, Gas and Heat SpA, Mitsubishi Heavy Industries Ltd, Broadview Energy Solutions BV, Transworld Equipment Corp, Bharat Tanks and Vessels LLP, ISISAN AS, Wartsila Corp, Chart Industries Inc, Guangzhou Minwen Cryogenic Equipment Co Ltd, Wuxi Triumph Gases Equipment Co Ltd, Nantong CIMC SinoPacific Offshore & Engineering Co Ltd, Beijing Tianhai Cryogenic Equipment Co Ltd, C-LNG Solutions Pte Ltd, Gloryholder Liquefied Gas Machinery Co Ltd, and TaylorWharton America Inc are some of the leading companies operating in the Asia Pacific Type-C tanks market.

1. Cryogas Equipment Pvt Ltd

2. Linde Plc

3. IHI Corp

4. McDermott International Ltd

5. China Intonational Marine Containers (Group) Co Ltd

6. Dongsung Finetec Co Ltd

7. Tianjin Sinogas Repower Energy Co Ltd

8. Shandong Zhongjie Special Equipment Co Ltd

9. Hebei Runfeng Cryogenic Equipment Co Ltd

10. Qixing Group Co Ltd

11. Corban Energy Group Corp

12. Furuise Europe Co SL

13. Suzhou Shenghui Equipment Co Ltd

14. INOX India Pvt Ltd

15. Chongqing Endurance Energy Equipment Integration Co Ltd

16. WOBO Industrial Group Corp

17. China Shipbuilding Trading Co Ltd

18. Jiangsu Watts Energy & Engineering Co Ltd

19. Henan Jian Shen Metal Material Co Ltd

20. MAN Energy Solutions SE

21. Gas and Heat SpA

22. Mitsubishi Heavy Industries Ltd

23. Broadview Energy Solutions BV

24. Transworld Equipment Corp

25. Bharat Tanks and Vessels LLP

26. ISISAN AS

27. Wartsila Corp

28. Chart Industries Inc

29. Guangzhou Minwen Cryogenic Equipment Co Ltd

30. Wuxi Triumph Gases Equipment Co Ltd

31. Nantong CIMC SinoPacific Offshore & Engineering Co Ltd

32. Beijing Tianhai Cryogenic Equipment Co Ltd

33. C-LNG Solutions Pte Ltd

34. Gloryholder Liquefied Gas Machinery Co Ltd

35. TaylorWharton America Inc

The Asia Pacific Type-C Tanks Market is valued at US$ 6,412.39 Million in 2022, it is projected to reach US$ 9,831.22 Million by 2030.

As per our report Asia Pacific Type-C Tanks Market, the market size is valued at US$ 6,412.39 Million in 2022, projecting it to reach US$ 9,831.22 Million by 2030. This translates to a CAGR of approximately 5.5% during the forecast period.

The Asia Pacific Type-C Tanks Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Type-C Tanks Market report:

The Asia Pacific Type-C Tanks Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Type-C Tanks Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Type-C Tanks Market value chain can benefit from the information contained in a comprehensive market report.