Asia Pacific Trade Credit Insurance Market

No. of Pages: 102 | Report Code: BMIRE00031129 | Category: Banking, Financial Services, and Insurance

No. of Pages: 102 | Report Code: BMIRE00031129 | Category: Banking, Financial Services, and Insurance

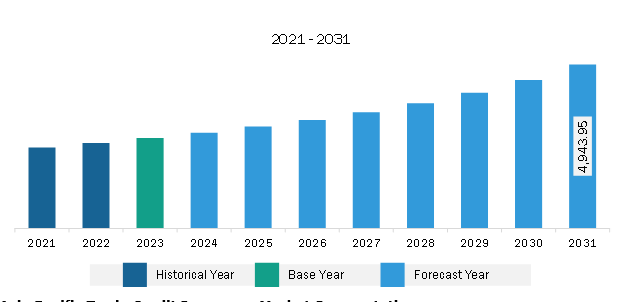

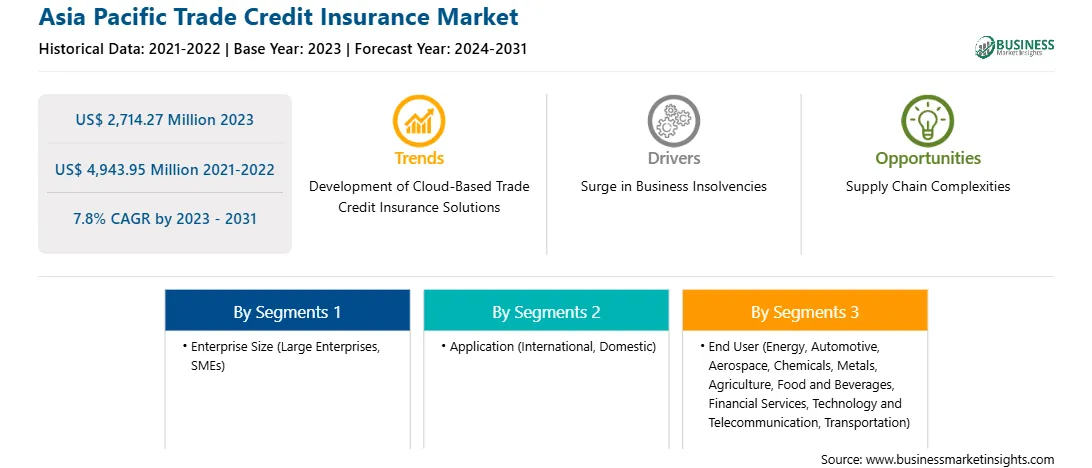

The Asia Pacific trade credit insurance market was valued at US$ 2,714.27 million in 2023 and is expected to reach US$ 4,943.95 million by 2031; it is estimated to register a CAGR of 7.8% from 2023 to 2031.

Insurance coverage is critical for micro, small, and medium enterprises (MSMEs) and small and medium enterprises (SMEs) as it lowers financial risks and absorbs risks such as payment defaults. The growing geopolitical issues, economic downturn, instability in the supply chain, inflation, and other factors have increased the risks with exports worldwide, which boosts the demand for trade credit insurance among MSMEs for making seamless payments. Moreover, historical trends indicate that the majority of MSMEs and SMEs in India are uninsured, as they fail to understand the need for insurance. They only purchase insurance when a buyer or a bank requires it, which makes them vulnerable to financial risks. This also encourages the government to take initiatives to support MSMEs and SMEs in adopting trade credit insurance to secure their business from financial risks and payment defaults. For instance, the Insurance Regulatory and Development Authority of India (IRDAI) trade credit insurance guidelines, 2021, support MSMEs and SMEs to adopt trade credit insurance to protect their businesses from evolving insurance risk. The guidelines include:

• The government and market players promote sustainable and strong development of the trade credit insurance business.

• General insurance companies offer trade credit insurance covers to suppliers, licensed banks, and other financial institutions to help them manage business risk and open access to new markets. Trade credit insurance supports businesses to manage nonpayment risk associated with trade financing portfolios.

• General insurance companies provide customized trade credit insurance covers that improve businesses for SMEs and MSMEs and help protect themselves against evolving insurance risks.

Thus, favorable guidelines and other government initiatives supporting MSMEs and SMEs to adopt trade credit insurance for safeguarding their businesses from financial risks fuel the market growth.

The Asia Pacific trade credit insurance market is segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The market is expected to grow at a significant rate from 2023 to 2031. The rise in the number of businesses adopting strategic approaches for credit management and slow trade rates are a few factors boosting the usage of trade credit insurance among businesses, supporting the trade credit insurance market growth in APAC. For instance, according to an International Monetary Fund report published on April 2024, APAC has been observing slow trade since 2023 due to continuity in the inflation pressures among businesses. The global decrease in commodity and goods prices, monetary tightening, supply-chain disruptions, and high interest rates are a few other factors increasing the demand for trade credit insurance among businesses to protect themselves against financial risks. The growing cases of business insolvencies in APAC are expected to create significant opportunities for trade credit insurance market growth during the forecast period. For instance, according to Atradius N.V. report published on September 2023, the insolvency rate in APAC will continue to increase in 2024 due to the rising cases of bankruptcy faced by firms, less support from the government, and the presence of a financially challenging environment for companies. According to the same source, increasing incidents of business failures in countries, including Hong Kong (68%) and South Korea (45%), and growing cases of business insolvencies in Singapore (49%), India (50%), and Australia (45%) are expected to create new opportunities for the trade credit insurance market growth in the coming years.

Strategic insights for the Asia Pacific Trade Credit Insurance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,714.27 Million |

| Market Size by 2031 | US$ 4,943.95 Million |

| Global CAGR (2023 - 2031) | 7.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Enterprise Size

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Trade Credit Insurance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific trade credit insurance market is categorized into enterprise size, application, end user, and country.

Based on enterprise size, the Asia Pacific trade credit insurance market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

In terms of application, the Asia Pacific trade credit insurance market is bifurcated into international and domestic. The international segment held a larger market share in 2023.

By end user, the Asia Pacific trade credit insurance market is segmented into energy, automotive, aerospace, chemicals, metals, agriculture, food and beverages, financial services, technology and telecommunication, transportation, and others. The automotive segment held the largest market share in 2023.

By country, the Asia Pacific trade credit insurance market is segmented into China, Japan, South Korea, India, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific trade credit insurance market share in 2023.

Allianz Trade, American International Group Inc, Aon Plc, Atradius NV, Chubb Ltd, Credendo, COFACE SA, Great American Insurance Company, QBE Insurance Group Ltd, and Zurich Insurance Group AG are some of the leading companies operating in the trade credit insurance market.

The Asia Pacific Trade Credit Insurance Market is valued at US$ 2,714.27 Million in 2023, it is projected to reach US$ 4,943.95 Million by 2031.

As per our report Asia Pacific Trade Credit Insurance Market, the market size is valued at US$ 2,714.27 Million in 2023, projecting it to reach US$ 4,943.95 Million by 2031. This translates to a CAGR of approximately 7.8% during the forecast period.

The Asia Pacific Trade Credit Insurance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Trade Credit Insurance Market report:

The Asia Pacific Trade Credit Insurance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Trade Credit Insurance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Trade Credit Insurance Market value chain can benefit from the information contained in a comprehensive market report.