Tokenization solutions are often used for credit card processing. The payment card industry (PCI) council defines tokenization as a process wherein the primary account number (PAN) is replaced with an alternate/surrogate value known as a token. The key factor attributed to the growth of the Asia-Pacific tokenization market is the growing data security concerns in all the data-sensitive organizations across the world. The tokenization market is anticipated to witness a noteworthy growth owing to a huge number of financial firms choosing for rising security in payment processing systems. Also, with rising incidences of credit card fraudulent activities, there is an increase in the demand for payment security.

Strategic insights for the Asia Pacific Tokenization provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 244.7 Million |

| Market Size by 2027 | US$ 1,798.83 Million |

| Global CAGR (2020 - 2027) | 28.7% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Tokenization refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

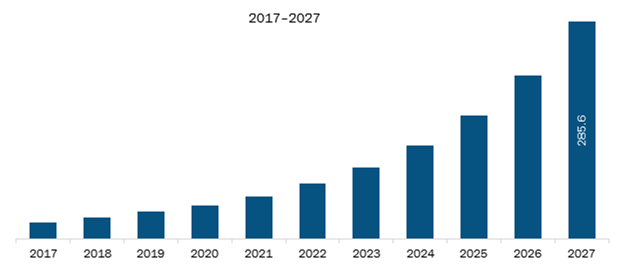

The Asia Pacific tokenization market was valued at US$ 244.7 million in 2019 and is projected to reach US$ 1,798.83 million by 2027; it is expected to grow at a CAGR of 28.7% from 2020 to 2027. Tokenization extensively moderates a retailer or organization’s scope of compliance with these regulations. For example, if an organization/retailer no longer stores its customers’ authentic PANs in its websites, POS terminals, as well as information systems, the number of systems required to be reported to be compliant with the GDPR and PCI DSS requirements are significantly reduced. Thus, to decrease the footprint of sensitive data within an organization, retailers are implementing tokenization solution, which is likely to drive the growth of tokenization market.

In terms of component, the solution segment accounted for a larger share of the Asia Pacific tokenization market in 2019. Based on deployment, the cloud segment held a larger market share in 2019. In terms of enterprise size, the large enterprise segment held a larger share of the market in 2019. In terms of industry vertical, the BFSI segment accounted for the highest market share in 2019.

A few major primary and secondary sources referred to for preparing this report on the tokenization market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Broadcom, Inc.; CipherCloud, Inc.; Fiserv, Inc.; and Micro Focus International plc; are among the major companies listed in the report.

The Asia Pacific Tokenization Market is valued at US$ 244.7 Million in 2019, it is projected to reach US$ 1,798.83 Million by 2027.

As per our report Asia Pacific Tokenization Market, the market size is valued at US$ 244.7 Million in 2019, projecting it to reach US$ 1,798.83 Million by 2027. This translates to a CAGR of approximately 28.7% during the forecast period.

The Asia Pacific Tokenization Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Tokenization Market report:

The Asia Pacific Tokenization Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Tokenization Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Tokenization Market value chain can benefit from the information contained in a comprehensive market report.