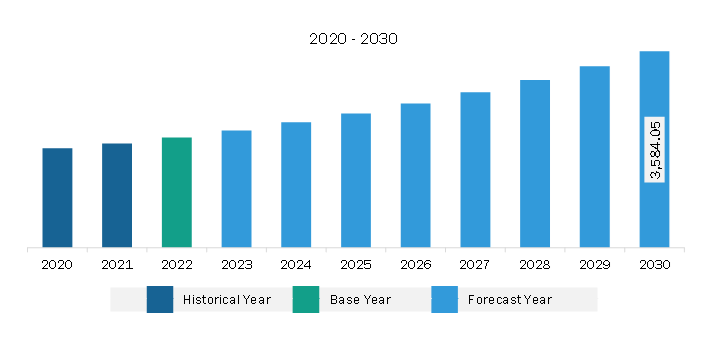

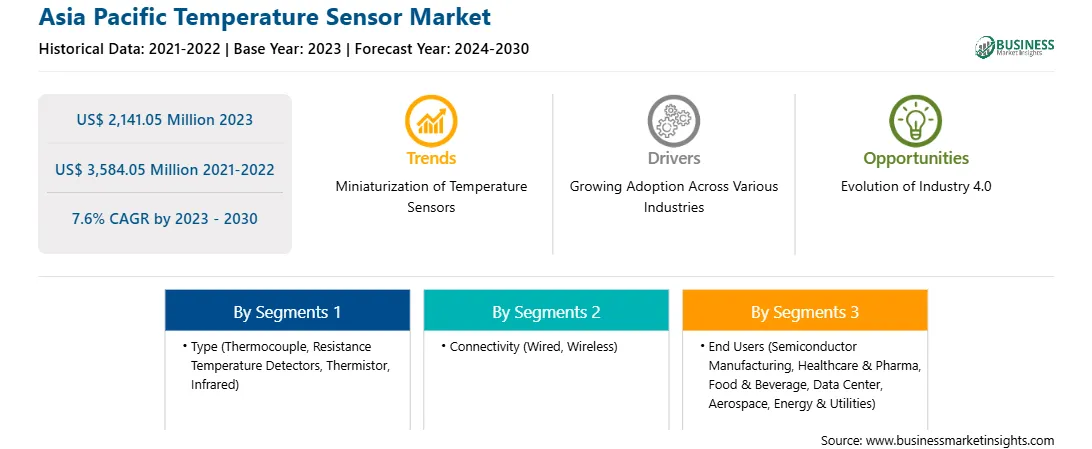

The Asia Pacific temperature sensor market was valued at US$ 2,141.05 million in 2023 and is expected to reach US$ 3,584.05 million by 2030; it is estimated to register a CAGR of 7.6% from 2023 to 2030.

Increasing number of Data Centers Boosts Asia Pacific Temperature Sensor Market

A growing number of data center construction activities worldwide is accelerating the market. For instance, in February 2023, the government of Maharashtra signed a memorandum of understanding (MoU) with UK-based Ark Data Centers and Japan's Nippon Telegraph and Telephone (NTT) for the construction of two new data centers in Pune. The MoU with NTT covers an investment of US$ 2.5 billion for the development of data centers in Pune, Mumbai, Thane, and Nagpur. This project generated the demand for temperature sensors for monitoring temperature ranges in the data center. Below mentioned are a few of the largest data center projects:

Data centers are increasingly using temperature sensors to monitor key environments. A change in the data center’s temperature results in overheating and can cause downtime. The replacement of damaged equipment may incur huge expenses for the data center during downtime. For instance, according to the ASHRAE report of 2021, a data center requires a minimum of six temperature sensors per rack for monitoring the air inflow and exhaust temperatures. Similarly, high-density data centers most commonly use more than six temperature sensors per rack to measure more accurate temperature ranges, especially ambient temperature of 80°F. Thus, the growing number of data center construction activities has surged the demand for temperature sensors for measuring temperate ranges and overheating equipment.

Asia Pacific Temperature Sensor Market Overview

Several Asian industries, especially semiconductor manufacturing, automotive, consumer electronics, data centers, and energy, have created a rapid demand for temperature sensors over the years. According to the Asia Pacific Foundation, China and Taiwan have significantly boosted investments in chip manufacturing, with South Korea and Japan also looking to benefit. To make any chip, numerous processes such as deposition, photoresist, lithography, ionization, silicon wafer, and packaging plays an important role. Temperature sensors are used in these processes to measure and monitor the temperature, which is further boosting the market growth. Also, the Taiwan Semiconductor Manufacturing Company planned to set up its first factory in Japan, which aligned with the Japanese Prime Minister's agenda of prioritizing semiconductor manufacturing to expand domestic supply chains. Meanwhile, the South Korean government incentivized competition across several companies to invest in its semiconductor industry by providing tax benefits. As a result, in 2021, companies in Korea planned to invest around US$ 609 billion into their semiconductor industry. Temperature sensors are used widely in semiconductor manufacturing to maintain the optimal temperature at each stage of the process. Thus, the adoption of temperature sensors is increasing in the semiconductor manufacturing. Additionally, the expansion of the data center industry is driving the demand for temperature sensors in APAC. Various companies are launching new data centers in the region. For example, the flagship 20 MW greenfield data center, MAA10, was launched in January 2024 in Chennai, India, on a potential 100 MW campus. Additionally, Digital Connexion acquired another 2.15 acres of land in Mumbai, India, to expand its footprint with the planned construction of a 40 MW data center. Similarly, in December 2023, China started assembling the world's first underwater commercial data center off the coast of Sanya on Hainan Island. Also, Equinix announced that it is launching a new hyperscale data center site in Korea in Q1 2024. Temperature sensors are vital for maintaining a stable and controlled thermal environment, optimizing energy usage, preventing equipment failures, and ensuring overall reliability and efficiency in data centers. Thus, such an increasing number of data centers in the region will flourish the temperature sensor market growth in Asia Pacific. Furthermore, Asia Pacific is emerging as a key region in healthcare and pharma, attracting significant investments. According to MJH Life Sciences, China, Japan, and India are the largest healthcare and pharma markets in the region. China's healthcare industry is experiencing rapid growth, driven by rising incomes, increasing health awareness, and an aging population. It is also a priority sector for the Chinese government to address healthcare gaps and meet rising demand. Chinese firms are taking several initiatives to adopt temperature sensors for the healthcare industry. For instance, In January 2020, the Shanghai Public Health Clinical Center (SPHCC) used VivaLNK's continuous temperature sensor to monitor COVID-19 patients. Moreover, China's healthcare sector generated 10 trillion yuan in 2021. Moreover, the Healthy China 2030 initiative has precipitated an increase in demand for new technology to optimize healthcare delivery systems, including digitalization. Such growth in the healthcare and pharma sector in major markets of Asia Pacific will drive the temperature sensor market growth in the region.

Asia Pacific Temperature Sensor Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Temperature Sensor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Temperature Sensor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Temperature Sensor Strategic Insights

Asia Pacific Temperature Sensor Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,141.05 Million

Market Size by 2030

US$ 3,584.05 Million

Global CAGR (2023 - 2030)

7.6%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Type

By Connectivity

By End Users

Regions and Countries Covered

Asia Pacific

Market leaders and key company profiles

Asia Pacific Temperature Sensor Regional Insights

Asia Pacific Temperature Sensor Market Segmentation

The Asia Pacific temperature sensor market is categorized into type, connectivity, end user, and country.

Based on type, the Asia Pacific temperature sensor market is segmented into thermocouple, resistance temperature detectors (RTD), thermistor, infrared, and others. The thermocouple segment held the largest share of Asia Pacific temperature sensor market share in 2023.

In terms of connectivity, the Asia Pacific temperature sensor market is bifurcated into wired and wireless. The wired segment held a larger share of Asia Pacific temperature sensor market in 2023.

By end users, the Asia Pacific temperature sensor market is segmented into semiconductor manufacturing, healthcare & pharma, food and beverage, data center, aerospace, energy & utilities, and others. The semiconductor manufacturing segment held the largest share of Asia Pacific temperature sensor market in 2023.

By country, the Asia Pacific temperature sensor market is segmented into China, Japan, South Korea, India, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific temperature sensor market share in 2023.

Texas Instruments Inc.; Siemens Ltd.; TE Connectivity Ltd.; Amphenol LTW Ltd.; Analog Devices Inc.; Emerson Electric Co.; Microchip Technology Inc.; Panasonic Corporation; Honeywell International, Inc.; and NXP Semiconductors N.V are some of the leading companies operating in the Asia Pacific temperature sensor market.

The Asia Pacific Temperature Sensor Market is valued at US$ 2,141.05 Million in 2023, it is projected to reach US$ 3,584.05 Million by 2030.

As per our report Asia Pacific Temperature Sensor Market, the market size is valued at US$ 2,141.05 Million in 2023, projecting it to reach US$ 3,584.05 Million by 2030. This translates to a CAGR of approximately 7.6% during the forecast period.

The Asia Pacific Temperature Sensor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Temperature Sensor Market report:

The Asia Pacific Temperature Sensor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Temperature Sensor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Temperature Sensor Market value chain can benefit from the information contained in a comprehensive market report.