The tremendous growth in the patient population worldwide has created a demand for advanced and effective medical devices for better treatments and outcomes, which forces medical device manufacturers to innovate and develop new technologies for the upgrading of existing devices. These innovative and technologically advanced products are also meant to simplify the work of healthcare professionals. The companies are using robotics and automated technologies that accelerate operational efficiency and reduce surgery time. Moreover, a decrease in the need for manual interference reduces complications and chances of tissue damage. For instance, in 2021, Intuitive launched the first surgical stapler with robotic-assisted technology, which helps in automatic adjustments while firing staples. It also provides 120° articulation in all directions. This has also increased the application areas of these surgical stapling devices in various procedures, especially in minimally invasive procedures such as laparoscopy and arthroscopy. Additionally, in 2017, Medtronic launched a smart surgical stapler named Signia stapling system, which detects the tissue thickness and automatically adjusts the stapler’s speed. This will help healthcare professionals to maintain consistency and uniformity in stapling after surgery or during wound closure. Such technological advancement in surgical stapling devices is further expected to reduce manual errors and leakage with improved healing. They would also make it easy to reach complicated sites of a human body.

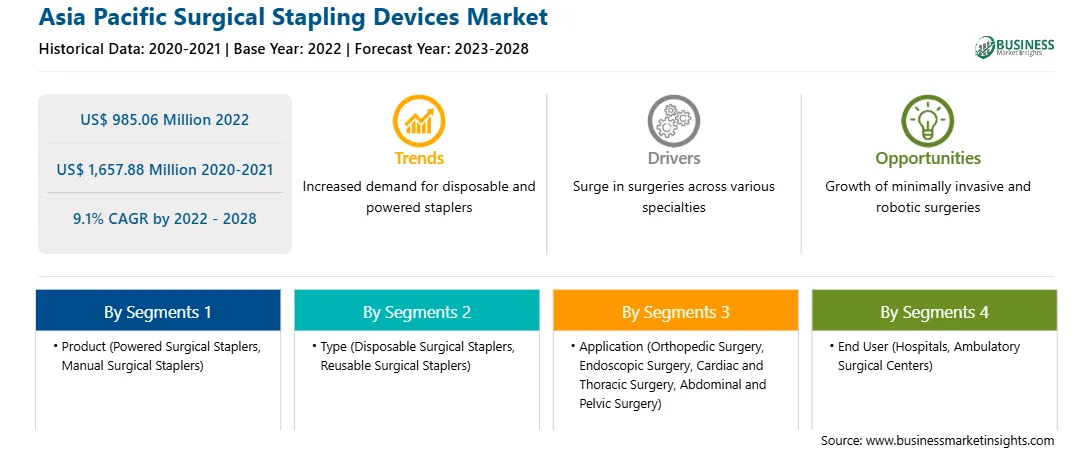

The Asia Pacific surgical stapling devices market is further segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. The market in this region is expected to register the highest CAGR during the forecast period. The market growth in this region is attributed to the rising number of plastic surgeries, and the flourishment of medical tourism in emerging economies such as South Korea and India. Moreover, an increase in the number of product launches and a surge in healthcare expenditure are expected to fuel the market growth during the forecast period. The increasing incidence of cardiovascular disease (CVD) leads to a burden on the healthcare sector in China. The country recorded ~106 million CVD patients in 2019, including 33 million stroke cases. According to the 2022 report by Cardiovascular Diabetology, in China, CVDs contribute to more than 40% of total deaths. Furthermore, ischemic heart disease was the second major cause of death, and the age-standardized mortality rate (ASMR) was 103.16 per 100,000 in 2020. The elevated number of cases of high blood pressure is the leading cause of vast CVD prevalence in the country. Thus, the increasing need for surgeries for treating CVDs, in turn, creates a high demand for surgical stapling devices in China.

Strategic insights for the Asia Pacific Surgical Stapling Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Surgical Stapling Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Surgical Stapling Devices Strategic Insights

Asia Pacific Surgical Stapling Devices Report Scope

Report Attribute

Details

Market size in 2022

US$ 985.06 Million

Market Size by 2028

US$ 1,657.88 Million

Global CAGR (2022 - 2028)

9.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product

By Type

By Application

By End User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Surgical Stapling Devices Regional Insights

Asia Pacific Surgical Stapling Devices Market Segmentation

The Asia Pacific surgical stapling devices market is segmented on the basis of product, type, application, end user, and country.

Based on product, the market is segmented into powered surgical staplers and manual surgical staplers. The powered surgical staplers segment accounted for a larger market share in 2022.

Based on type, the Asia Pacific surgical stapling devices market is segmented into disposable surgical staplers and reusable surgical staplers. The disposable surgical staple segment held a larger market share in 2022.

Based on application, the Asia Pacific surgical stapling devices market is segmented into orthopedic surgery, endoscopic surgery, cardiac and thoracic surgery, abdominal and pelvic surgery, and others. The orthopedic surgery segment registered the largest market share in 2022.

Based on end user, the Asia Pacific surgical stapling devices market is segmented into hospitals and ambulatory surgical centers. The hospitals segment accounted for a larger market share in 2022.

Based on country, the Asia Pacific surgical stapling devices market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the market in this region in 2022.

3M Co, B. Braun SE, Conmed Corp, Ethicon USA LLC, Frankenman International Ltd, Intutive Surgical Inc, Medtronic Plc, and Panther Healthcare Medical Equipment Co Ltd are the leading companies operating in the Asia Pacific surgical stapling devices market.

The Asia Pacific Surgical Stapling Devices Market is valued at US$ 985.06 Million in 2022, it is projected to reach US$ 1,657.88 Million by 2028.

As per our report Asia Pacific Surgical Stapling Devices Market, the market size is valued at US$ 985.06 Million in 2022, projecting it to reach US$ 1,657.88 Million by 2028. This translates to a CAGR of approximately 9.1% during the forecast period.

The Asia Pacific Surgical Stapling Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Surgical Stapling Devices Market report:

The Asia Pacific Surgical Stapling Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Surgical Stapling Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Surgical Stapling Devices Market value chain can benefit from the information contained in a comprehensive market report.