Asia-Pacific Subscriber Data Management Market

No. of Pages: 142 | Report Code: TIPRE00025214 | Category: Technology, Media and Telecommunications

No. of Pages: 142 | Report Code: TIPRE00025214 | Category: Technology, Media and Telecommunications

APAC is one of the most important markets for subscriber data management providers, owing to the region's 2.8 billion mobile service users. The area is one of the fastest expanding markets worldwide, with almost 500 million new customers acquired since 2014, accounting for roughly half of all worldwide subscribers. While top-line growth is slowing, APAC will still account for almost half of all new subscribers globally by 2025. Studies claim that 266 million new customers are anticipated to be linked throughout the region by 2025, bringing the total to just over 3 billion (approximately 70%) of the population. Furthermore, in APAC, 5G is gaining traction. Nine markets, including Japan, have launched commercial mobile 5G services, and another 12 have stated intentions to do so. As a result, the area is home to some of the world's most advanced 5G marketplaces, with nations including Australia, China, Japan, Malaysia, Singapore, and South Korea all vying to be global 5G leaders. These economies will experience fast 5G adoption, with 5G accounting for slightly under half of all mobile connections in developed Asia by 2025. Mobile operators in APAC are anticipated to invest over US$ 400 billion in their networks between 2020 and 2025 to enable this generational transition and boost consumer participation in the digital era, with US$ 331 billion going toward 5G installations. Hence, the rising number of mobile service customers, coupled with the increasing availability of 5G services, is expected to boost the subscriber data management market in the region.

In case of COVID-19, APAC is highly affected especially India. Many global brands and technological companies are headquartered in the region. According to the Organization for Economic Co-operation and Development (OECD), the pandemic has affected major economies such as China, India, Australia, and Japan, which are experiencing inflation. The rapid outbreak of the COVID-19 pandemic has led to strict lockdowns across the region since the starting of 2020. China is the manufacturing hub of hardware and servers, also it is the leading exporter for raw material to manufacture the same across the globe. The sudden travel restriction imposed by local government bodies led to supply chain disruption, thereby negatively impacting the manufacturing of hardware for the market. The outbreak of the pandemic has positively impacted the subscriptions across the region as more and more people were forced to stay at home. For instance, Netflix Australia has benefited directly from the coronavirus pandemic-related streaming boom, with the video giant increasing its local revenue by 17 percent in 2020. OTT providers are attempting to accommodate the growing entertainment thirst of viewers despite the nationwide ban. According to a recent study conducted by mobile marketing platform InMobi, 46% of viewers watch more material online. Various OTT service providers like Amazon Prime Video and Zee5 offered free shows to watch to attract more consumers in the platform. As a result of this, Zee5 experienced a 80% increase in subscription in the year 2020. Thus, the rise in subscription across the channels are accumulating more data to be managed thereby contributing to the high adoption of subscriber data management solutions over the years.

Strategic insights for the Asia-Pacific Subscriber Data Management provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

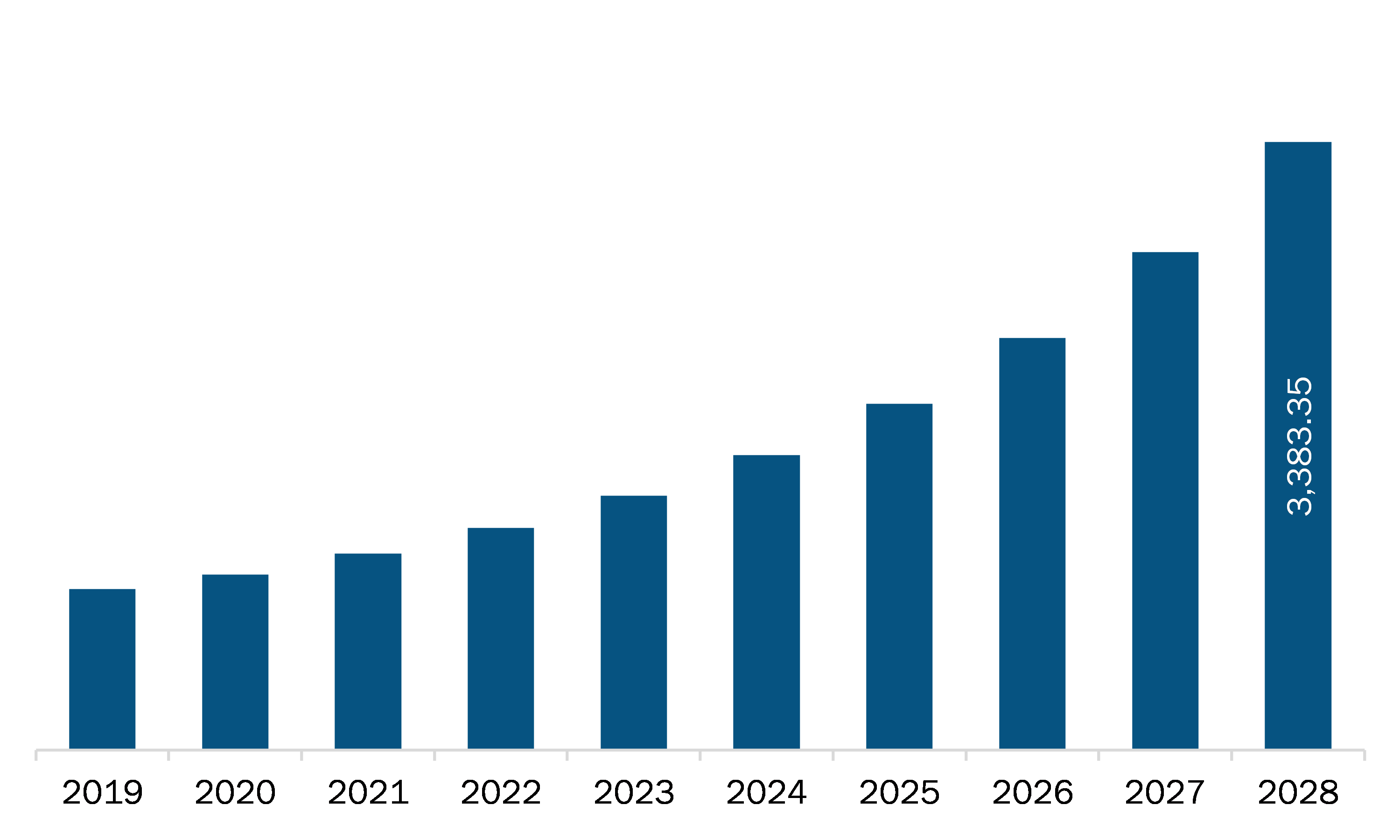

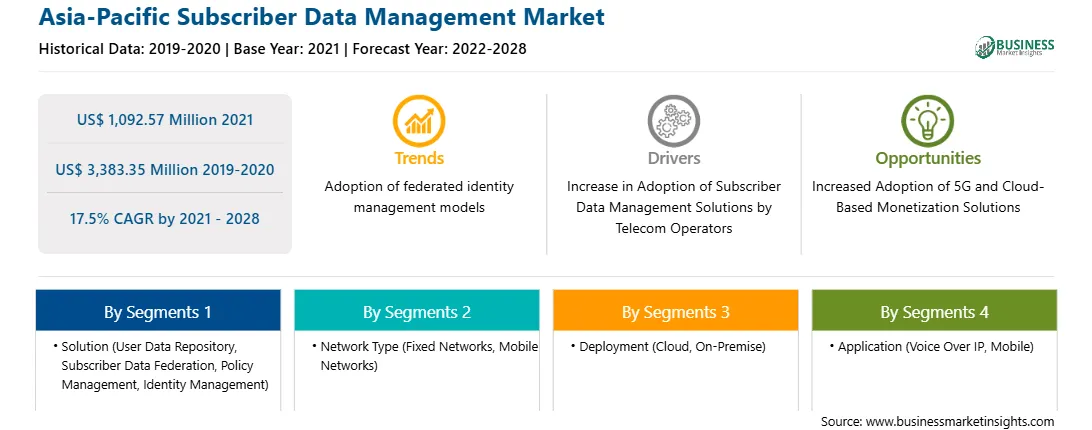

| Market size in 2021 | US$ 1,092.57 Million |

| Market Size by 2028 | US$ 3,383.35 Million |

| Global CAGR (2021 - 2028) | 17.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Subscriber Data Management refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC subscriber data management market is expected to grow from US$ 1,092.57 million in 2021 to US$ 3,383.35 million by 2028; it is estimated to grow at a CAGR of 17.5% from 2021 to 2028. Surging adoption of subscriber data management solutions by telecom operators is expected to fuel the market growth. Subscriber data management (SDM) solution converges the management of subscriber data across different network domains. The SDM solution unifies and manages the subscriber data of network carriers, including access preferences, services, locations, authentication, identities, and presence, into unified data repositories. Furthermore, it improves the carrier networks by lowering their operating costs while maintaining consistent service to users. It also allows operators to examine subscriber data in a centralized manner, allowing them to monetize their subscriber data more effectively. SDM also assists telecom operators in lowering network complexity, the total cost of ownership, and time to market for new services. The need to lower operating expenses and facilitate cross-network convergence, as well as rise in subscriber demand for LTE and VoLTE, IMS implementation, and telcos' shift to NFV technologies, will boost the subscriber data management market growth among the telecom enterprises. Moreover, third parties can help telecom carriers supply new and improved services by providing new value chains that are slowly but steadily recognized. Telecom companies are looking into the possibility of providing similar degrees of personalization and activity tracking to their customers. Third parties may find subscriber data to be particularly appealing to enhance the services they may provide by leveraging the telecom operators' infrastructure. Thus, the rising adoption of SDM solutions by telecom operators is significantly fueling the growth of the APAC market.

In terms of solution, the user data repository segment accounted for the largest share of the APAC subscriber data management market in 2020. In terms of network type, the fixed networks segment held a larger market share of the APAC subscriber data management market in 2020. In terms of deployment, the cloud segment held a larger market share of the APAC subscriber data management market in 2020. Further, the voice over IP segment held a larger share of the APAC subscriber data management market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC subscriber data management market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cisco Systems, Inc.; Enea AB; Hewlett Packard Enterprise Development LP (HPE); Huawei Technologies Co., Ltd.; Nokia Corporation; Oracle Corporation; R Systems International Limited; Sandvine; Telefonaktiebolaget LM Ericsson; and ZTE Corporation.

The Asia-Pacific Subscriber Data Management Market is valued at US$ 1,092.57 Million in 2021, it is projected to reach US$ 3,383.35 Million by 2028.

As per our report Asia-Pacific Subscriber Data Management Market, the market size is valued at US$ 1,092.57 Million in 2021, projecting it to reach US$ 3,383.35 Million by 2028. This translates to a CAGR of approximately 17.5% during the forecast period.

The Asia-Pacific Subscriber Data Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Subscriber Data Management Market report:

The Asia-Pacific Subscriber Data Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Subscriber Data Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Subscriber Data Management Market value chain can benefit from the information contained in a comprehensive market report.