Asia Pacific Soldering in Electronics Assembly Market

No. of Pages: 145 | Report Code: BMIRE00028606 | Category: Electronics and Semiconductor

No. of Pages: 145 | Report Code: BMIRE00028606 | Category: Electronics and Semiconductor

With the introduction of Industry 4.0 in manufacturing, the adoption of automation for mass customizations plays a crucial role in large-scale production in a shorter time. Robots provide precision in soldering products in electronic assembly and improve overall productivity. Market players provide such soldering robots and machinery to reduce the downtime of the production process and provide accurate results. The adoption of robotics for automation in soldering in electronics assembly contributes to the soldering process's production output, propelling the market's growth. Robotic soldering also plays an important role in optimizing printed circuit board (PCB) assembly to reduce and eliminate human error. The controlled and repeatable process increases the productivity and profitability of the PCB assembly process. Thus, there is a rise in the adoption of soldering robots by companies. For instance, Indium Corporation manufactures flux-cored solder wire with the help of soldering robots. In July 2022, Indium Corporation partnered with SAFI-Tech to develop no-heat and low-heat solder and metallic joining products, where the Indium Corporation can use its soldering robots to manufacture the newly developed products. Thus, the adoption of robotics in soldering is expected to be a trend in the Asia Pacific soldering in electronics assembly market during the forecast period.

The Asia Pacific soldering in electronics assembly market, based on country, is segmented into Australia, China, India, Japan, South Korea, and the rest of APAC. Over the years, China, India, and Taiwan have become major electronics manufacturing countries across the globe. The wide presence of electronics manufacturers across the region is driving the market growth. A few electronics manufacturers in the region are Samsung Electronics; Integrated Micro-Electronics, Inc.; Venture Corporation Limited; and Fabrinet Company Limited. The constant innovation by these companies coupled with expansion plans to increase their market share boost the demand for soldering, thereby contributing to the APAC soldering in electronics assembly market growth. The automotive industry across APAC is experiencing a significant growth over the years. Countries such as India, China, Indonesia, South Korea, and Thailand have experienced a significant rise in vehicle production volume in 2022, according to the International Organization of Motor Vehicle Manufacturers. Additionally, regional and global automotive manufacturers are investing in establishing new vehicle production plants across the region.

Strategic insights for the Asia Pacific Soldering in Electronics Assembly provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Soldering in Electronics Assembly refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Soldering in Electronics Assembly Strategic Insights

Asia Pacific Soldering in Electronics Assembly Report Scope

Report Attribute

Details

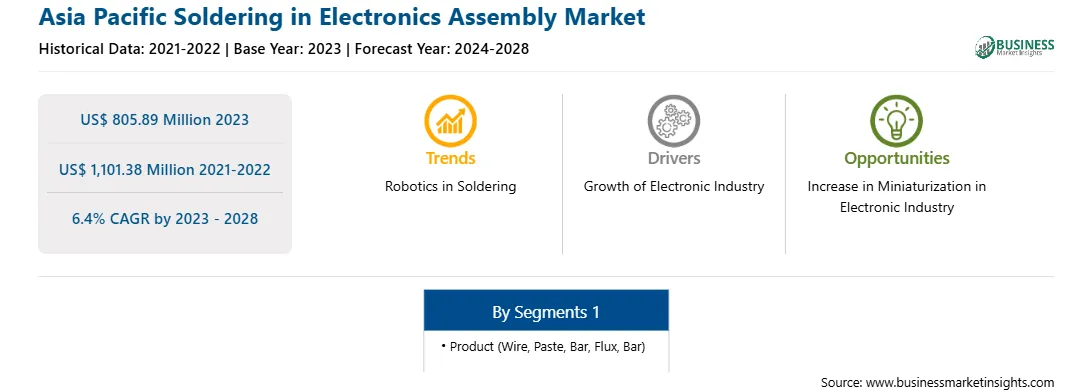

Market size in 2023

US$ 805.89 Million

Market Size by 2028

US$ 1,101.38 Million

Global CAGR (2023 - 2028)

6.4%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Product

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Soldering in Electronics Assembly Regional Insights

Asia Pacific Soldering in Electronics Assembly Market Segmentation

The Asia Pacific soldering in electronics assembly market is bifurcated into product and country.

Based on the product, the Asia Pacific soldering in electronics assembly market is segmented into wire, paste, bar, flux, and others. The wire segment held the largest share of the Asia Pacific soldering in electronics assembly market in 2023.

Based on country, the Asia Pacific soldering in electronics assembly market has been categorized into China, India, Japan, South Korea, Taiwan, and the Rest of Asia Pacific. Our regional analysis states that China dominated the Asia Pacific soldering in electronics assembly market in 2023.

AIM Metals & Alloys LP, Fusion Inc, Indium Corp, KOKI Co Ltd, Lucas-Milhaupt Inc, MacDermid Alpha Electronics Solutions, and Superior Flux & Manufacturing Co are the leading companies operating in the Asia Pacific soldering in electronics assembly market.

The Asia Pacific Soldering in Electronics Assembly Market is valued at US$ 805.89 Million in 2023, it is projected to reach US$ 1,101.38 Million by 2028.

As per our report Asia Pacific Soldering in Electronics Assembly Market, the market size is valued at US$ 805.89 Million in 2023, projecting it to reach US$ 1,101.38 Million by 2028. This translates to a CAGR of approximately 6.4% during the forecast period.

The Asia Pacific Soldering in Electronics Assembly Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Soldering in Electronics Assembly Market report:

The Asia Pacific Soldering in Electronics Assembly Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Soldering in Electronics Assembly Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Soldering in Electronics Assembly Market value chain can benefit from the information contained in a comprehensive market report.