Increasing Number of Smart Water Meter Projects is Driving the Asia Pacific Smart Water Metering Market

Several initiatives related to water savings and a clean environment have been witnessed in the past decade during 2011-2020 globally. Different government initiatives and Non-Profit Organizations (NPOs) across the world have been raising awareness for water savings and usage monitoring. This is also leading to the launch of new upgrades to water distribution infrastructure projects by governments of different countries to improve the distribution infrastructure and boost the operational efficiency of the water resources along with better cost savings. The deployment of smart water meters across such old infrastructure is leading to new developments across different regions, which, in turn, is catalyzing the demand for smart water meters. Several local governments have been investing heavily in the modernization of water distribution infrastructure to improve the water savings and operational costs for distributing the water across their respective city’s infrastructure. For instance, in March 2022, the Government of Punjab state in India signed an agreement with three Chinese companies (Wenling Younio Water Meter Co. Ltd, Jiangsu Xinlang Environmental Company (Private) Ltd., and China Energy Engineering Group) for the deployment of 711,265 smart water meters (worth US$ 41.41 million) across Lahore in Pakistan under the alliance of Planning & Development Board of WASA Lahore and Punjab PPP Authority.

Governments of different countries have also been collaboratively working with different smart water metering market vendors across the world to upgrade their respective water meter infrastructure. For instance, in November 2022, Itron Inc announced that Singapore’s national water agency (PUB) was leveraging SP Group’s existing Itron industrial IoT network canopy for smart water metering. The smart water metering rollout will connect around 300,000 Itron residential and commercial/industrial (C&I) smart water meters to the existing network to achieve its water conservation goals. Such factors have been catalyzing the smart water meter deployment and growth of the smart water metering market across different countries.

Asia Pacific remains world’s most vulnerable region to water security and thus needs to address this issue for economic growth of countries. As per research conducted by Asian Development Bank, close to 3.4 billion people by 2050 in Asia Pacific could be living in water stressed areas, while the demand for water is expected to increase by 55%. Asia Pacific is home to around 60% of the world’s population to which it needs to supply clean water for potable uses, as well as for other household purposes. Additionally, the climate change plays another critical role in the water supply crisis in the continent. Some areas of the region remain heavily flooded, whereas a few faces huge water scarcity problems. Therefore, there is a dire need of government intervention in Asian countries to minimize water wastage and maintain water assets for ensuring long-term sustainability of water supply. Supportive digitalization policies and enhanced focus on the development of smart cities in countries such as Japan, China, India, Singapore, Australia, and South Korea will further boost the demands of an intelligent water meter. Countries such as Vietnam, Cambodia, and the Philippines will follow suit in the adoption of smart water meter post the success of smart water meter and IIoT in Asia, increasing overall supply chain efficiency in the region.

Strategic insights for the Asia Pacific Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 532.95 Million |

| Market Size by 2028 | US$ 737.62 Million |

| Global CAGR (2022 - 2028) | 5.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Smart Water Metering Market Segmentation

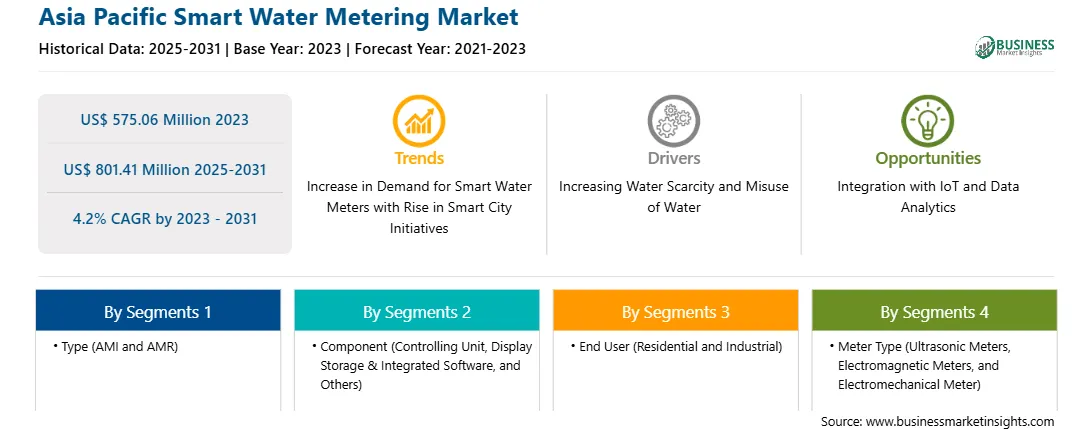

The Asia Pacific smart water metering market is segmented into type, component, application, and meter type, and country.

On the basis of type, the Asia Pacific smart water metering market has been segmented into advanced metering infrastructure and automatic meter reader. The automatic meter reader segment registered the largest market share in 2022.

On the basis of component, the smart water metering market has been segmented into controlling units, display/storage and integrated software, and others. The display/storage and integrated software segment held a larger market share in 2022.

On the basis of application, the Asia Pacific smart water metering market has been segmented into residential and industrial. The residential segment held the largest market share in 2022.

On the basis of meter type, the smart water metering market has been segmented into ultrasonic meters, electromagnetic meters, and electromechanical meters. Ultrasonic meters segment held the largest market share in 2022.

Based on country, the Asia Pacific smart water metering market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the market share in 2022.

Arad Ltd; Badger Meter Inc; Bmeters SRL; Diehl Stiftung & Co KG; Itron Inc; Kamstrup AS; Mueller Water Products Inc; Sensus USA Inc; WAVIoT Integrated Systems LLC are the leading companies operating in the Asia Pacific smart water metering market.

The Asia Pacific Smart Water Metering Market is valued at US$ 532.95 Million in 2022, it is projected to reach US$ 737.62 Million by 2028.

As per our report Asia Pacific Smart Water Metering Market, the market size is valued at US$ 532.95 Million in 2022, projecting it to reach US$ 737.62 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The Asia Pacific Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Smart Water Metering Market report:

The Asia Pacific Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.