Asia Pacific is anticipated to be the second largest market for military ammunition and possesses the highest number of arms producing nations. The region has witnessed considerable growth in arms manufacturing in terms of value, types of systems, and particularly national ambitions for such manufacturing. Resultantly, there has been a substantial investment in national defense technological and industrial bases. Spending in the Asia Pacific region is driven by major procurement programs formulated by large defense spenders such as India, China, Australia, and South Korea. These countries are anticipated to focus on the indigenous development of firearms is anticipated to be a major factor driving the expenditure on military ammunition over the forecast period. An increase in terrorist attacks in the region has surged the procurement of weapons by the regional law enforcement agencies in order to prevent such security lapses and the resultant loss of both lives and property. The demand for new weapons is driving the demand for small caliber ammunition as weapons are configured to work with specific sized caliber. Additionally, the ongoing modernization of the armed forces in the region is anticipated to drive the demand for small caliber ammunition. For instance, Japan has been investing significantly in modernizing its armory to counter the growing influence of China over the South China Sea. Similarly, China has undertaken a massive modernization drive to transform its current capabilities and evolve into a much dominant player in the region. Increasing demand for small arms ammunition and rising adoption of new squad automatic rifle by military forces are the major factor driving the growth of the APAC small caliber ammunition market.

In case of COVID-19, APAC is highly affected specially India. The COVID-19 has had a significant impact on the military and defense sectors of several Asian countries, including India, China, Japan, and others, due to supply chain disruptions. Governments in Asia Pacific countries have announced a lockdown to mitigate the effects, negatively impacting the manufacturing sector. In the APAC, China is the largest manufacturer of ammunition, followed by India and Japan. The dynamics of the military and defense sector in Asia Pacific countries have changed dramatically due to a sharp drop in demand. Ammunition production has slowed because of the lockdowns. India and Thailand, for example, have announced reductions in defense spending as a result of the COVID-19 crisis. Due to COVID-19 pandemic, ammunition, and assembly line manufacturing all over the APAC region have been impacted. Despite the importance of ammunition manufacturing for military applications, supply chain disruptions have temporarily slowed production. Several APAC countries have decided to cut their defense budgets in general. Budgets for research and non-critical sectors are likely to be temporarily cut as defense departments focus more on critical sectors to national security. But APAC countries like china has increased their planned defense spending during this time.

Strategic insights for the Asia Pacific Small Caliber Ammunition provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

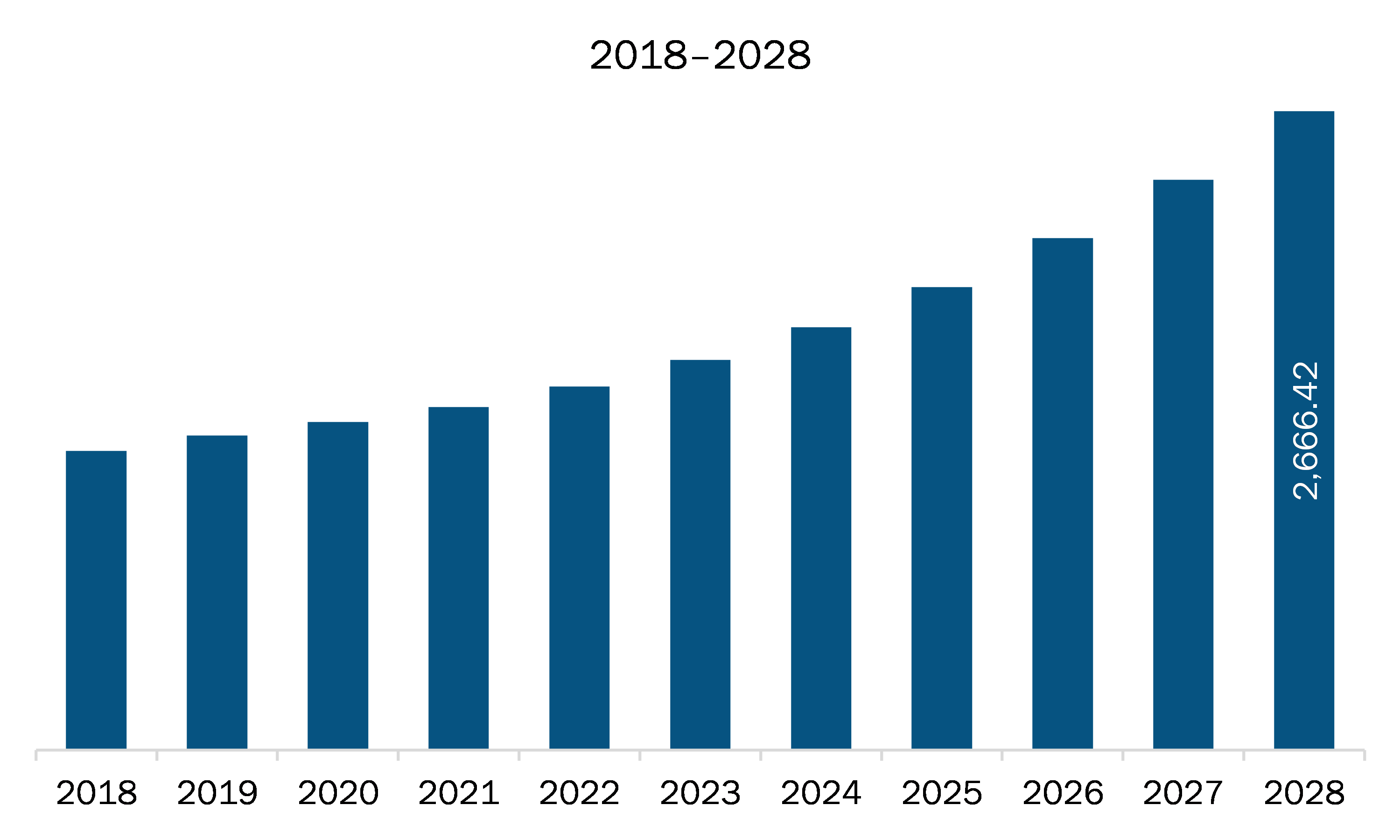

| Market size in 2021 | US$ 1,432.06 Million |

| Market Size by 2028 | US$ 2,666.42 Million |

| Global CAGR (2021 - 2028) | 9.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ammunition Size

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Small Caliber Ammunition refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC small caliber ammunition market is expected to grow from US$ 1,432.06 million in 2021 to US$ 2,666.42 million by 2028; it is estimated to grow at a CAGR of 9.3% from 2021 to 2028. Mounting investments by homeland security and law enforcement departments are expected to escalate the market growth. The law enforcement agencies across APAC region need to perform duties such as executing police response, conducting criminal investigations, and providing building or personnel security to fulfill their law enforcement missions and roles. These agencies also purchase ammunition for conducting training and qualifications as well as to ensure that officers maintain the firearms proficiency of their workforce. Thus, each law enforcement agency independently decides the allocation of ammunition to its firearm-carrying personnel for training and qualification, which results in the increase in the procurement of more ammunition. Moreover, the officers in law enforcement and homeland security departments are engaged in counterterrorism and border security, and thus, require armored vehicles, which are contributing to the rise in demand for small caliber ammunition across APAC region. Rising investments by homeland security and law enforcement departments for the procurement of small caliber ammunition are driving the APAC market growth.

In terms of ammunition size, the 9mm segment accounted for the largest share of the APAC small caliber ammunition market in 2020. In terms of end user, the military segment held a larger market share of the APAC small caliber ammunition market in 2020. Further, the pistols segment held a larger share of the APAC small caliber ammunition market based on gun type in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC small caliber ammunition market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE Systems Plc, CBC Global Ammunition, Elbit Systems Ltd., FN HERSTAL, NAMMO AS, and Northrop Grumman Corporation.

The Asia Pacific Small Caliber Ammunition Market is valued at US$ 1,432.06 Million in 2021, it is projected to reach US$ 2,666.42 Million by 2028.

As per our report Asia Pacific Small Caliber Ammunition Market, the market size is valued at US$ 1,432.06 Million in 2021, projecting it to reach US$ 2,666.42 Million by 2028. This translates to a CAGR of approximately 9.3% during the forecast period.

The Asia Pacific Small Caliber Ammunition Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Small Caliber Ammunition Market report:

The Asia Pacific Small Caliber Ammunition Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Small Caliber Ammunition Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Small Caliber Ammunition Market value chain can benefit from the information contained in a comprehensive market report.