The slewing bearing market in APAC is sub segmented into China, India, Japan, Australia, South Korea, and the rest of APAC. Vast industrialization, favorable economies policies, low labor cost, positive economic development, and increasing foreign direct investments (FDIs) and foreign institutional investments (FIIs), among others, make APAC a significant contributor to the slewing bearing market. Further, governments of developing countries have been launching Make in India and Made in China 2025 to promote the establishment of manufacturing plants, to make the respective countries self-sufficient as well as to make them capable of exporting surplus goods. Owing to increase in awareness about elevating carbon emission levels, governments of APAC countries are taking various initiatives to emphasize the adoption of clean energy. Recently, China announced to increase the share of non-fossil energy by 20% by 2030; the country aims to be a carbon neutral economy by 2050. In 2020, Indian government announced its ambitious target of being able to procure 60% of its energy needs from renewables by 2030. The South Korean government aims to procure 42% of its energy from renewables and to be a carbon neutral country by 2050. Further, territorial disputes between India and China, China and Russia, India and Pakistan, South Korea and North Korea as well as the rising tension over South China are leading the respective governments to increase their military spending. In 2020, China, India, Japan, South Korea, and Australia were among the countries with the largest military spending in APAC, with the military expenditure of US$ 252 billion, US$ 65.86 billion, US$ 55 billion, US$ 44 billion, and US$ 27 billion, respectively. Further, a significant amount of these defense budgets is allocated for procuring advanced combat systems, communication systems, and military aircraft. The civil aviation industry is also growing at significant rate. According to Boeing, APAC countries are expected to receive ~17,390 deliveries in total during 2019–2038. The total fleet is expected to increase to ~19,420 aircraft by 2038. Also, the opening of Boeing and Airbus manufacturing/assembly plants, and upcoming indigenous commercial and regional aircraft such as COMAC C919 and Mitsubishi MRJ will continue to boost the Asia-Pacific market in the coming years. Local manufacturers such as Hindustan Aeronautics Limited, Aviation Corporation of China, Rostec State Corporation, and Kawasaki Heavy Industries are investing significantly to strengthen their position in the growing aviation industry. Meanwhile, steady growth of mining industry and rapid advancements in healthcare infrastructure in emerging economies in APAC are among other factors fueling the adoption of slewing bearing in the region.

APAC is characterized by the presence of several developing countries, positive economic outlook, and huge industrial sector, in addition to the largest share of global population. These factors make APAC a major region for the growth of the slewing bearings market. The shutdown of various plants and factories in many countries in APAC has affected the supply chains and negatively impacted the manufacturing processes, delivery schedules, and product and service sales. APAC is a global manufacturing hub with countries such as China, Japan, and South Korea leading the global manufacturing sector. Disruptions in supply chains and manufacturing activities have led to the discontinuation of the production of new slewing bearings, which is hindering the market growth. Meanwhile, the initiation of vaccination drive coupled with the reopening of economies is expected to drive the slewing bearing market and help it register positive growth from the Q1 of 2021.

Strategic insights for the Asia-Pacific Slewing Bearing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

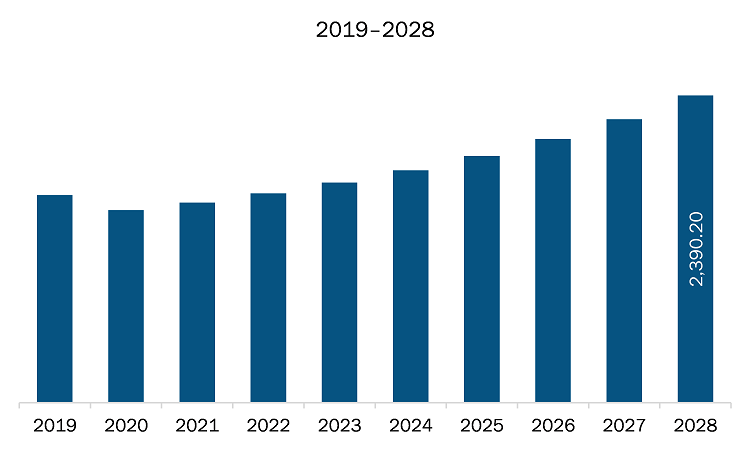

| Market size in 2021 | US$ 1,556.89 Million |

| Market Size by 2028 | US$ 2,390.20 Million |

| Global CAGR (2021 - 2028) | 6.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Rolling Element

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Slewing Bearing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The slewing bearing market in APAC is expected to grow from US$ 1,556.89 million in 2021 to US$ 2,390.20 million by 2028; it is estimated to grow at a CAGR of 6.3% from 2021 to 2028. Increasing mining industry; minerals are the backbone of human civilization as their use has accelerated the development of human society. They are widely used across the industries such as manufacturing, power generation, chemicals and petrochemicals, healthcare and pharmaceuticals, and construction. Currently, copper, coal, iron ore, gold, and aluminum are among the most mined minerals. The aggregate revenue of Top 40 mining companies has grown steadily from 2016 to 2019. In 2020, they witnessed a fall in revenue due to the COVID-19 pandemic. Heavy mining machinery such as excavator, shovels, reclaimers, and stackers are widely used for extraction of mineral at mining sites plays a crucial role, and slewing bearings are among the major component used in this machinery. With growing rate of industrialization and urbanization, the demand for minerals is projected to surge further during the forecast period, thereby propelling the mining activities. Thus, the growth of mining industry is subsequently contributing to the growth of the slewing bearing market.

Based on gear type, the market is segmented into external, internal, and ungeared. The internal gear segment held the largest share of APAC slewing bearing market throughout the forecast period. Based on rolling element, the slewing bearing market is segmented into ball and roller. The ball segment held a larger market share throughout the forecast period. Based on application, the slewing bearing market is segmented into wind and solar energy, aerospace & defense, medical, industrial machinery, oil & gas, mining, and others. The industrial machinery segment accounted for a major share of the APAC slewing bearing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the slewing bearing market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Antex corp.

The Asia-Pacific Slewing Bearing Market is valued at US$ 1,556.89 Million in 2021, it is projected to reach US$ 2,390.20 Million by 2028.

As per our report Asia-Pacific Slewing Bearing Market, the market size is valued at US$ 1,556.89 Million in 2021, projecting it to reach US$ 2,390.20 Million by 2028. This translates to a CAGR of approximately 6.3% during the forecast period.

The Asia-Pacific Slewing Bearing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Slewing Bearing Market report:

The Asia-Pacific Slewing Bearing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Slewing Bearing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Slewing Bearing Market value chain can benefit from the information contained in a comprehensive market report.