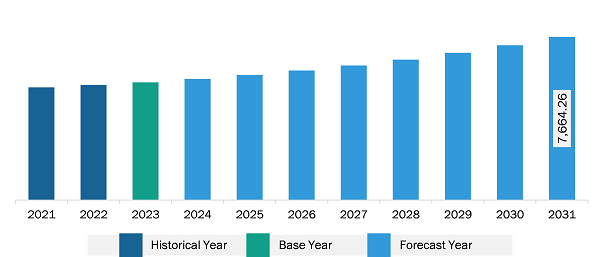

The Asia Pacific sealants market was valued at US$ 5,531.63 million in 2023 and is anticipated to reach US$ 7,664.26 million by 2031; it is estimated to register a CAGR of 4.2% from 2023 to 2031.

Strategic Product Launches in the Sealants Market Boost Asia Pacific Sealants Market

Key manufacturers operating in the sealants market invest significantly in strategic development initiatives such as product innovation, business expansion, and research and development to enhance their market position and attract a wide customer base. In March 2023, Dow expanded its product portfolio with silicone sealant products to offer photovoltaic (PV) module assembly materials, supporting the global movement toward renewable energy. The DOWSIL PV product line contains six silicone-based sealants and adhesives solutions that offer durability and performance for frame sealing, rail bonding, junction box bonding and potting, and building integrated photovoltaics (BIPV) installation materials.

In 2022, Bostik launched a comprehensive range of sealants developed for construction applications. The Bostik Pro Sealants range features high and low modulus formulations, and it offers high performance, made available in post-consumer recycled cartridges, reducing the net effect of plastic on the environment. In 2022, Evonik launched the sustainable liquid polybutadienes with POLYVEST eCO, used as a raw material for the production of adhesives and sealants for application in end-use industries such as automotive, electronics, construction, and others. Thus, rising product innovations are expected to create lucrative opportunities in the Asia Pacific sealants market during the forecast period.

Asia Pacific Sealants Market Overview

China is a major country in the Asia Pacific sealants market. The Chinese government has taken several initiatives to stimulate the annual production capacities of automobile manufacturers to 35 million units by 2025. According to the 2022 report by the International Energy Agency, China recorded electric vehicle sales of 3.3 million in 2021. Further, the country is the world's largest construction market, and it is highly supported by government initiatives. The Government of China invested US$ 1.9 billion in 13 public housing projects in 2019. As mentioned by the State Council of the People's Republic of China, the urbanization rate in the country was the highest globally in 2019; it rose from 60.5% in 2019 to 64.7% in 2021. Under the 14th Five-Year Plan, China aims to increase its urbanization rate to 65% during 2021–2025. Thus, government support for urbanization has the potential to bring developments in the construction and infrastructure sectors, thereby driving the demand for sealants.

China is among the largest producers of electronic products in the world. The country is also a major supplier of intermediate electronics parts. The expansion of the electronics industry in the country contributes to the growth of the sealants market.

Asia Pacific Sealants Market Revenue and Forecast to 2031 (US$ Million)

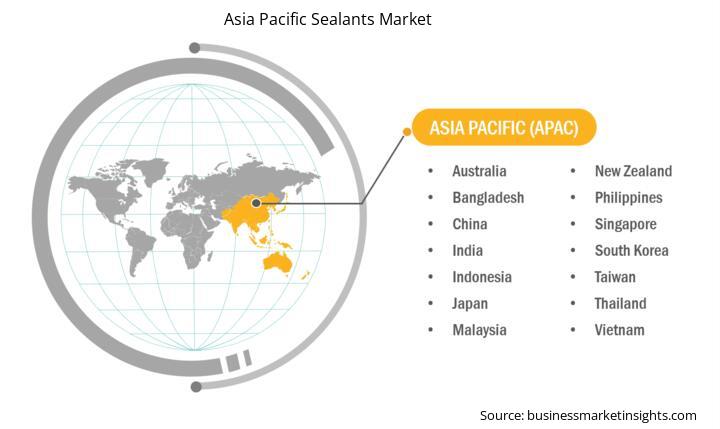

Strategic insights for the Asia Pacific Sealants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Sealants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Sealants Strategic Insights

Asia Pacific Sealants Report Scope

Report Attribute

Details

Market size in 2023

US$ 5,531.63 Million

Market Size by 2031

US$ 7,664.26 Million

Global CAGR (2023 - 2031)

4.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Application

By End-Use Industry

Regions and Countries Covered

Asia Pacific

Market leaders and key company profiles

Asia Pacific Sealants Regional Insights

Asia Pacific Sealants Market Segmentation

The Asia Pacific sealants market is categorized into type, application, end-use industry, and country.

By type, the Asia Pacific sealants market is segmented into silicone sealants, polyurethane sealants, acrylic sealants, polysulfide sealants, butyl sealants, hybrid sealant, and others. The silicone sealants segment held the largest market share in 2023. Furthermore, hybrid sealant is divided into silane modified polymer sealants, polyurethane modified acrylic sealants, and others.

In terms of application, the Asia Pacific sealants market is categorized into waterproofing, insulation, bonding and sealing, soundproofing, and others.

Based on end-use industry, the Asia Pacific sealants market is segmented into building & construction, automotive, electronics, healthcare, aerospace & defense, marine, energy & power, and others.

By country, the Asia Pacific sealants market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific sealants market share in 2023.

3M Co, ACTEGA DS GmbH, Arkema SA, BASF SE, Dow Inc, HB Fuller Co, Henkel AG & Co KGaA, Momentive Performance Materials Inc, RPM International Inc, and Sika AG are some of the leading companies operating in the Asia Pacific sealants market.

The Asia Pacific Sealants Market is valued at US$ 5,531.63 Million in 2023, it is projected to reach US$ 7,664.26 Million by 2031.

As per our report Asia Pacific Sealants Market, the market size is valued at US$ 5,531.63 Million in 2023, projecting it to reach US$ 7,664.26 Million by 2031. This translates to a CAGR of approximately 4.2% during the forecast period.

The Asia Pacific Sealants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Sealants Market report:

The Asia Pacific Sealants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Sealants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Sealants Market value chain can benefit from the information contained in a comprehensive market report.