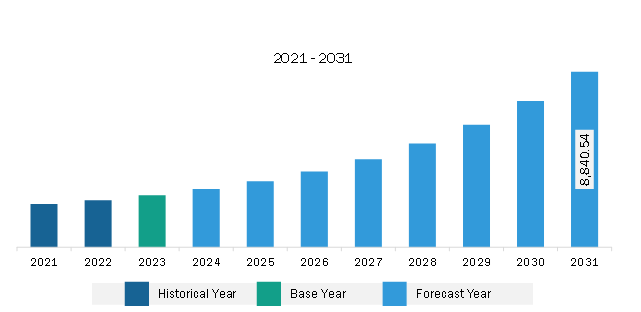

The Asia Pacific satellite propulsion market was valued at US$ 2,621.67 million in 2023 and is expected to reach US$ 8,840.54 million by 2031; it is estimated to register a CAGR of 16.4% from 2023 to 2031.

The substantial upsurge in satellite constellations has propelled the requirement for a competent satellite constellation management plan. To address this emerging need, companies and agencies operating in the space industry are analyzing the potential strategies for constellation launches, set-ups, alternatives for failed satellites, and end-of-life policies. In 2023, OneWeb announced the deployment and contact of 36 satellites launched by NewSpace India Limited from the Satish Dhawan Space Centre in Sriharikota, India. OneWeb's 18th satellite launch brings the number of constellations to 618 satellites in orbit. SpaceX, Iridium constellation, and Globalstar constellation project are operating space constellation programs globally. In 2024, China announced plans to start building its own network of LEO satellite internet constellations utilizing low Earth orbit. The country aims to become a major space competitor to the US, and part of the plan calls for the deployment of over 26,000 satellites to give global coverage, according to a report published in Japan's Nikkei. Beijing established the China Satellite Network Group, or SatNet, a state-owned company, in 2021. This action came after China notified the International Telecommunication Union of its intention to launch over 13,000 satellites in order to establish a network of high-speed internet access. According to Chinese media sources, this project's first phase will witness the launch of over 1,300 satellites between the first half of 2024 and 2029-or 10% of the total number planned. Thus, the growing deployment of satellite constellations is anticipated to provide lucrative opportunities for the satellite propulsion market during the forecast period.

The Asia Pacific satellite propulsion market growth is attributed to product innovation and strategic collaborations. With a strong focus on satellite launches, countries in Asia Pacific, including China, India, Australia, and Japan, have emerged as key players in advancing satellite propulsion technologies. Major industry contributors include leading aerospace and space companies such as Neumann; Space Machines Company; Beijing Spacecraft Manufacturing Co., Ltd; China Aerospace Science; Technology Corporation; and Kongtian Dongli. The companies are renowned for their initiatives in the space technology sector.

The Asia Pacific satellite propulsion market benefits from combined initiatives facilitated by organizations such as the Indian Space Research Organization (ISRO), SmartSat Cooperative Research Centre, and the South Korean Ministry of Science and ICT. The partnerships between government agencies and research organizations accelerate research and development and other activities supporting the space-related projects of member states. The region's commitment to space exploration is apparent in projects such as the Space Industry Responsive Intelligent Thermal (SpIRIT) satellite launch project, the Apstar 6-E satellite launch project, and the LOTUSat-1 project, which emphasizes Earth observation and environmental monitoring. As demand for small satellites and satellite consortiums is rising, the Asia Pacific satellite propulsion market is witnessing strong growth.

Strategic insights for the Asia Pacific Satellite Propulsion provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,621.67 Million |

| Market Size by 2031 | US$ 8,840.54 Million |

| Global CAGR (2023 - 2031) | 16.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Propulsion Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Satellite Propulsion refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic insights for the Asia Pacific Satellite Propulsion provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Satellite Propulsion refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Satellite Propulsion Strategic Insights

Asia Pacific Satellite Propulsion Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,621.67 Million

Market Size by 2031

US$ 8,840.54 Million

Global CAGR (2023 - 2031)

16.4%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Propulsion Type

By System Type

By Orbit Type

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Satellite Propulsion Regional Insights

The Asia Pacific satellite propulsion market is categorized into propulsion type, system type, application, satellites, orbit type, and country.

Based on propulsion type, the Asia Pacific satellite propulsion market is segmented solid propulsion, cold gas propulsion, green propulsion, electric propulsion, and ambipolar propulsion. The electric propulsion segment held the largest market share in 2023.

In terms of system type, the Asia Pacific satellite propulsion market is categorized into monopropellant, bipropellant, and electric ion propulsion. The electric ion propulsion segment held the largest market share in 2023.

By application, the Asia Pacific satellite propulsion market is segmented into launchers, spacecraft, satellites, space tugs, and landers. The private segment held the largest market share in 2023. The satellites is further sub segmented into Below 500 Kg, 500-1000 Kg, and Above 1000 Kg.

In terms of orbit type, the Asia Pacific satellite propulsion market is categorized into LEO, MEO and GEO, and beyond GEO. The LEO segment held the largest market share in 2023.

B By country, the Asia Pacific satellite propulsion market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific satellite propulsion market share in 2023.

Moog Inc, Thales SA, Safran SA, Northrop Grumman Corp, Airbus SE, IHI Corp, ArianeGroup, and Bellatrix Aerospace Pvt. Ltd are some of the leading companies operating in the Asia Pacific satellite propulsion market.

The Asia Pacific Satellite Propulsion Market is valued at US$ 2,621.67 Million in 2023, it is projected to reach US$ 8,840.54 Million by 2031.

As per our report Asia Pacific Satellite Propulsion Market, the market size is valued at US$ 2,621.67 Million in 2023, projecting it to reach US$ 8,840.54 Million by 2031. This translates to a CAGR of approximately 16.4% during the forecast period.

The Asia Pacific Satellite Propulsion Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Satellite Propulsion Market report:

The Asia Pacific Satellite Propulsion Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Satellite Propulsion Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Satellite Propulsion Market value chain can benefit from the information contained in a comprehensive market report.