In the 21st century, the upcoming electronic technologies are paving the way for automation to be introduced heavily in the manufacturing sector. Over the past two decades, automation in manufacturing has been a constant factor leading to transformation in the factory floor operations, manufacturing employment, and the dynamics of the manufacturing sector. Current trends in the manufacturing sector, such as robotics, machine learning, and artificial intelligence, have enabled the machines to match or outpace humans in various activities, including the cognitive activities required at multiple levels of manufacturing. Increased productivity ranges between 10% and 20% when automation is integrated on any lean assembly line. Further, Industry 4.0 is an emerging trend that is anticipated to take up the manufacturing sector in the coming years. The advent of Industry 4.0 or the Industrial Internet of Things (IIoT) will utilize the powers of collaborative robots and automated guided vehicles, which is further anticipated to boost productivity in the manufacturing sector. As a result, the demand for rotary indexers is expected to rise. Increasing uptake of rotary indexers has resulted in the rising levels of automation in the manufacturing sector. However, the onset of the COVID-19 outbreak in 2020 hampered the business dynamics due to the shutdown of manufacturing industries. The pandemic is poised for a remarkable rebound in 2022 due to growing manufacturing industry investments. With the ongoing pace of IoT emergence and deployments, rotary indexers are used with programmable systems in many applications in various industries. Programmable rotary tables are used to position parts for welding, machining, assembly, inspection, or operations in manufacturing industries.

The manufacturing sector is witnessing error-free and streamlined procedures using Robotic Process Automation (RPA). Manufacturing companies are replacing human sources with industrial robots in production units for assembling, quality checking, and packaging products. The RPA has been integrated into the manufacturing sector for activities such as preparing material bills, administration & reporting, customer support and service desk, data migration, logistics data automation, ERP automation, and Web integrated RPA. Manufacturing industries have been incorporating higher automation levels wherein rotary indexers are used in packaging, labeling, pressing, trimming, bottling, automatic assembly machines, and other applications. Moreover, the manufacturing of consumer electronics, healthcare-related products, automobiles, and aerospace industries are a few of the major industry verticals that have been prolific in the automation integrations into manufacturing assembly lines. Thus, the rise in the Asia-Pacific rotary indexer market is attributed to growth prospects in the manufacturing industry.

In India, as per the data published by Trading Economics, manufacturing sector accounts for 78% of total industrial output. Further, government initiatives for propelling the automotive industry are driving the market for rotary indexers. For instance, as per the data published by India Brand Equity Foundation, in September 2021, the Indian government had approved PLI scheme with an investment of US$ 3.53 billion. Also, in November 2021, had initiated the Uttar Pradesh Defense Industrial Corridor Project worth US$ 53.73 million in Jhansi. Thus, such booming investment prospects in industrial sector is anticipated to hold potential demand for rotary indexers in the manufacturing industries, which helps drive the market growth.

Strategic insights for the Asia Pacific Rotary Indexer provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

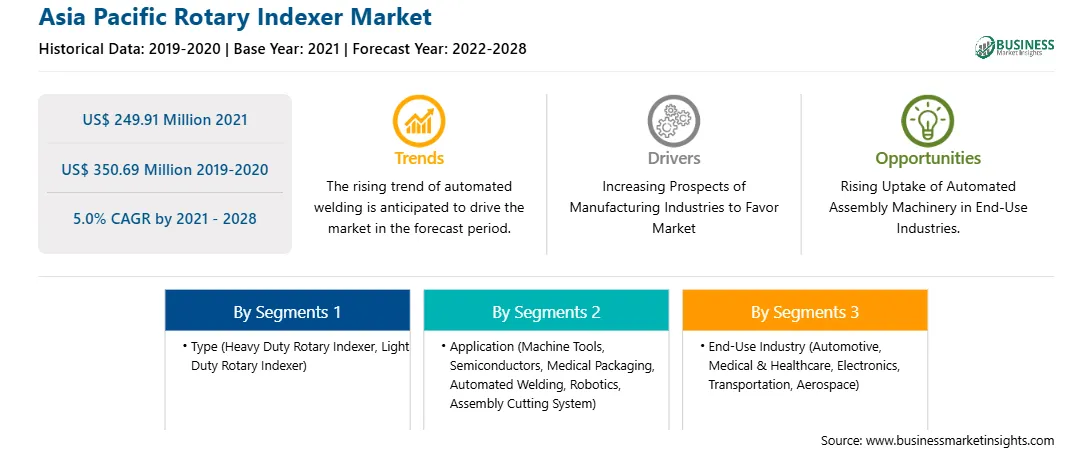

| Market size in 2021 | US$ 249.91 Million |

| Market Size by 2028 | US$ 350.69 Million |

| Global CAGR (2021 - 2028) | 5.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Rotary Indexer refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia-Pacific Rotary Indexer Market Segmentation

The Asia-Pacific rotary indexer market is segmented into type, application, end-use industry, and country. Based on type, the market is bifurcated into heavy duty rotary indexer and light duty rotary indexer. Further, the heavy duty rotary indexer segment accounted for a larger market share in 2020. Based on application, the market is categorized into machine tools, semiconductors, medical packaging, automated welding, robotics, and assembly cutting system. Further, the machine tools segment accounted for the largest market share in 2020. Based on end-use industry, the market is segmented into automotive, electronics, medical & healthcare, transportation, and aerospace. Further, the automotive segment accounted for the largest market share in 2020. Based on country, the Asia-Pacific rotary indexer market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia-Pacific. Further, China contributed a substantial share in 2020.

Bettinelli F.lli S.p.A; Camfield Engineers; CKD Corporation; Colombo Filippetti S.p.A; DESTACO; Festo; FIBRO India; Goizper Group; Guangdong Saini Intelligent Equipment Technology Co., Ltd.; Haas Automation, Inc; HepcoMotion; Nabtesco Corporation; Nexen Group, Inc.; Packam Controls; Sankyo Automation; Square Automation; TAKTOMAT; TUNKERS Maschinenbau GmbH; and WEISS GmbH are among the leading companies operating in the Asia-Pacific rotary indexer market.

The Asia Pacific Rotary Indexer Market is valued at US$ 249.91 Million in 2021, it is projected to reach US$ 350.69 Million by 2028.

As per our report Asia Pacific Rotary Indexer Market, the market size is valued at US$ 249.91 Million in 2021, projecting it to reach US$ 350.69 Million by 2028. This translates to a CAGR of approximately 5.0% during the forecast period.

The Asia Pacific Rotary Indexer Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Rotary Indexer Market report:

The Asia Pacific Rotary Indexer Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Rotary Indexer Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Rotary Indexer Market value chain can benefit from the information contained in a comprehensive market report.